Unissued Stock What it is How it Works

Contents

Unissued Stock: What it is, How it Works

What Is Unissued Stock?

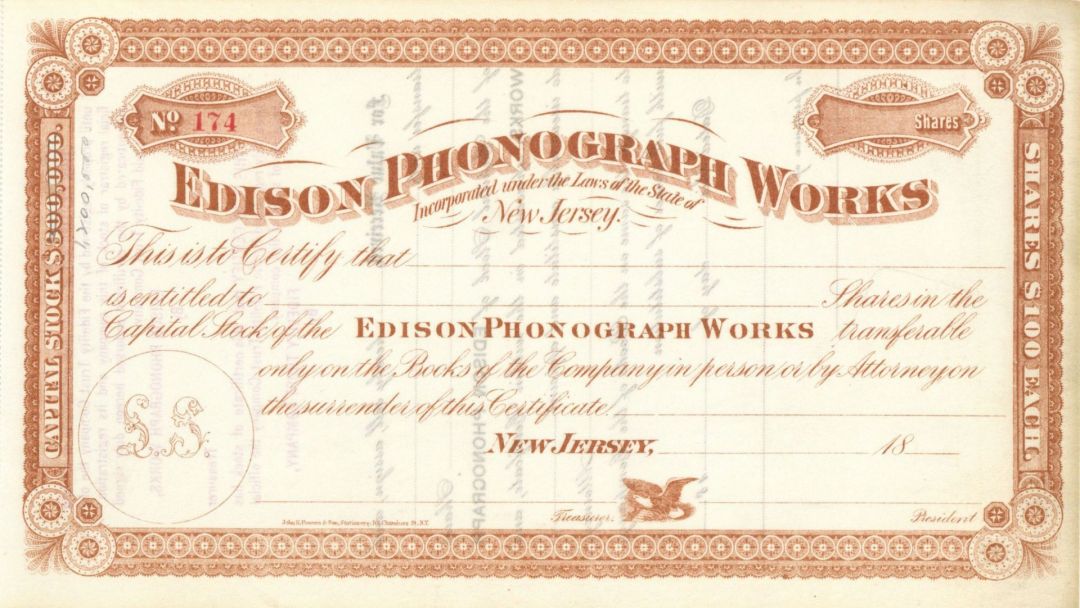

Unissued stock are shares that do not circulate or go up for sale to employees or the public. Companies do not print stock certificates for unissued shares. Unissued shares are held in a company’s treasury and do not affect shareholders.

Key Takeaways

- Unissued stock are company shares not circulating or for sale.

- Unissued shares can be calculated by subtracting outstanding and treasury stock shares from authorized shares.

- Unissued shares do not grant voting rights or dividends.

- Unissued stock may affect a company’s earnings per share.

Understanding Unissued Stock

When a company goes public, it authorizes a certain number of shares in its charter or articles of incorporation. These authorized shares include shares for sale to investors, issued to employees, and unissued shares. Unissued shares are held in the company’s treasury and do not have stock certificates. The number of unissued shares is determined by deducting authorized shares from outstanding and treasury shares.

Unissued shares do not provide stockholders with voting rights or dividends. However, they can potentially dilute existing shareholder ownership and share value if the company decides to issue more stock in the future.

Analysts and investors monitor a company’s plans for issuing unissued shares as it may affect the company’s earnings per share (EPS).

Unissued shares are not included in fully diluted earnings per share calculations, but convertible securities and unexercised stock options are taken into account.

Unissued stock is generally different from treasury stock. Treasury stock refers to shares that were issued and sold but bought back by the company. However, some companies may classify treasury shares as unissued stock.

Companies may list treasury shares as unissued stock to maintain flexibility for future stock sales. Although authorized to issue a large number of shares, only a fraction may be issued and outstanding.

A real example is Dollar Tree (DLTR) stating in a 2016 8-K filing with the SEC: "Shares purchased under the share repurchase authorizations are generally held in treasury or returned to authorized but unissued status."