What Is a Circuit Breaker in Trading How Is It Triggered

Circuit Breaker in Trading: How Is It Triggered?

Circuit breakers are emergency-use regulatory measures that temporarily halt trading on an exchange. They aim to curb panic-selling and can be triggered on the way up with manic-buying. Circuit breakers are used for individual securities and broad market indexes like the S&P 500. They automatically stop trading when prices reach predefined levels in exchanges worldwide.

Key Takeaways:

– Circuit breakers halt trading to curb panic-selling.

– U.S. regulations have three levels of circuit breakers for the S&P 500 Index.

– Circuit breakers for individual securities are triggered by price movements.

– The system of circuit breakers has been revised based on feedback from past crises.

– The first circuit breaker was implemented after a significant drop in the Dow Jones Industrial Average in 1987.

How Circuit Breakers Work:

Circuit breakers function similarly to electrical circuits in homes. They shut down trading temporarily or for the rest of the trading day when market prices drop significantly. This applies to both individual securities and market indexes.

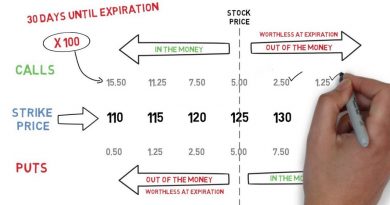

Since February 2013, market-wide circuit breakers respond to declines in the S&P 500 index. Level 1 refers to a 7% decline, Level 2 to a 13% decline, and Level 3 to a 20% decline. Level 1 or 2 circuit breakers halt trading for 15 minutes unless triggered after 3:25 PM. Level 3 circuit breakers halt trading for the rest of the day.

Circuit breakers for individual securities are triggered regardless of price movement. Exchange-traded funds (ETFs) are considered individual securities under this system.

Special Considerations:

There are acceptable trading ranges for individual securities within the circuit breaker system. If trading occurs outside of these ranges, activity is halted for a specific period. The Securities and Exchange Commission (SEC) determines these ranges using a limit-up limit-down (LULD) mechanism based on the security’s price and listing.

History of Circuit Breakers:

Circuit breakers were implemented after the market crash in 1987 and were updated after the flash crash of 2010.

Criticism of Circuit Breakers:

Some analysts argue that circuit breakers disrupt the market and create artificial volatility.

Real-World Example of a Circuit Breaker:

Four circuit breaker halts occurred in March 2020 due to market volatility caused by the global coronavirus pandemic.

When Is a Market-Wide Circuit Breaker Triggered?

Market-wide circuit breakers are triggered when the S&P 500 falls by specific amounts within a single trading day. They are activated at Level 1 (7%), Level 2 (13%), and Level 3 (20%) to stem excess volatility.

What Happens at Each Breaker Level Threshold?

When a Level 1 or Level 2 circuit breaker is triggered, trading halts for at least 15 minutes. A Level 3 breach halts trading for the rest of the day.

Are the Rules the Same for Single-Stock Circuit Breakers?

No, single-stock circuit breakers have different rules based on the stock price and listing.

Are Options Markets Also Halted When a Circuit Breaker Is Triggered?

Yes, if the equities market triggers a circuit breaker, trading in the affected listed options markets is also halted, and any subsequent trades are nullified.