Understanding American Depositary Receipts ADRs Types Pricing Fees Taxes

Contents

- 1 Understanding American Depositary Receipts (ADRs): Types, Pricing, Fees, Taxes

- 1.1 What Is an American Depositary Receipt (ADR)?

- 1.2 How ADRs Work

- 1.3 Types of ADRs

- 1.4 ADR Pricing and Costs

- 1.5 ADRs and Taxes

- 1.6 Advantages and Disadvantages of ADRs

- 1.7 History of ADRs

- 1.8 Real-World Example of ADRs

- 1.9 If I Own an ADR, Is It the Same As Owning Shares in the Company?

- 1.10 Why Do Foreign Companies List ADRs?

- 1.11 What Is a Sponsored vs. an Unsponsored ADR?

- 1.12 What Is the Difference Between an ADR and a GDR?

- 1.13 Is an ADR the Same As an American Depositary Share (ADS)?

- 1.14 The Bottom Line

Understanding American Depositary Receipts (ADRs): Types, Pricing, Fees, Taxes

Cierra Murry is an experienced writer who specializes in banking, credit cards, investing, loans, mortgages, and real estate. With over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management, she offers expert insights and guidance.

What Is an American Depositary Receipt (ADR)?

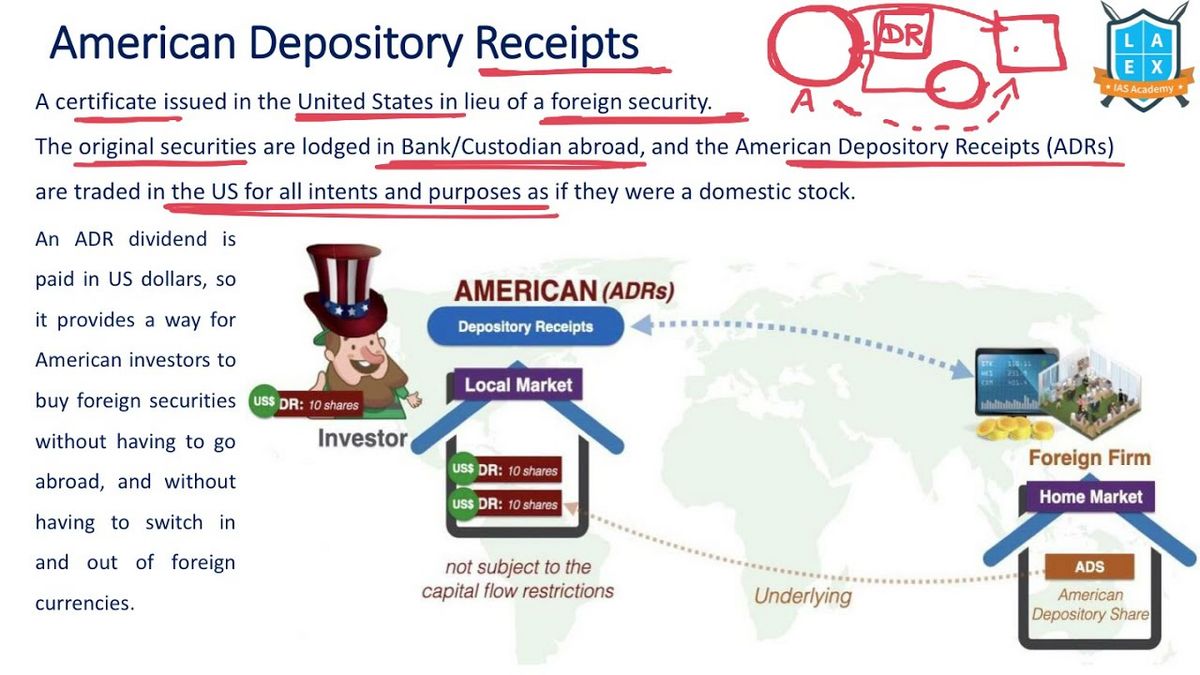

American depositary receipts (ADRs) are certificates issued by a U.S. depositary bank that represent a specific number of shares—usually one share—of a foreign company’s stock. ADRs can be traded on U.S. stock markets like domestic shares.

ADRs give U.S. investors the opportunity to invest in overseas companies that might not otherwise be available. They also benefit foreign companies by allowing them to attract American investors and capital without the complexities and expenses of listing on U.S. stock exchanges.

Key Takeaways

- An ADR is a certificate representing shares in a foreign stock issued by a U.S. bank.

- ADRs trade on American stock exchanges.

- ADRs and their dividends are priced in U.S. dollars.

- ADRs offer an easy, liquid way for U.S. investors to own foreign stocks.

- These investments may be subject to double taxation, and options may be limited.

How ADRs Work

ADRs are denominated in U.S. dollars and held by U.S. financial institutions, often through overseas branches. They are priced and traded in dollars and cleared through U.S. settlement systems.

To offer ADRs, a U.S. bank must purchase shares on a foreign exchange, hold them as inventory, and issue ADRs for domestic trading. ADRs can be listed on the New York Stock Exchange (NYSE), Nasdaq, and over-the-counter (OTC) markets.

U.S. banks require detailed financial information from foreign companies, making it easier for American investors to assess a company’s financial health.

Types of ADRs

ADRs come in two categories:

Sponsored ADRs

A sponsored ADR is issued by a bank on behalf of a foreign company. The bank and the company have a legal arrangement, with the company typically covering the costs of issuing the ADR. The bank handles transactions with investors, and sponsored ADRs comply with SEC regulations and American accounting procedures to varying degrees.

Unsponsored ADRs

An unsponsored ADR is issued by a bank without direct involvement or permission from the foreign company. Multiple unsponsored ADRs for the same company can be issued by different U.S. banks, and they may offer varying dividends. Unsponsored ADRs trade only over the counter and lack voting rights.

The difference between sponsored and unsponsored ADRs is where they trade. Most sponsored ADRs register with the SEC and trade on major U.S. stock exchanges, while unsponsored ADRs trade only over the counter.

2,000+

The number of available ADRs representing companies from over 70 countries.

ADR Levels

ADRs are categorized into three levels based on the extent of the foreign company’s access to U.S. markets.

Level I

This basic type of ADR allows foreign companies to establish a trading presence in the U.S. but not raise capital. Level I ADRs trade only on the over-the-counter market and have fewer SEC requirements, making them speculative investments.

Level II

Level II ADRs also establish a trading presence on a stock exchange but cannot be used to raise capital. They have more SEC requirements than Level I ADRs and offer higher visibility and trading volume.

Level III

Level III ADRs are the most prestigious. They allow foreign companies to float a public offering of ADRs on a U.S. exchange, establishing a substantial trading presence and raising capital. Issuers must fully report to the SEC.

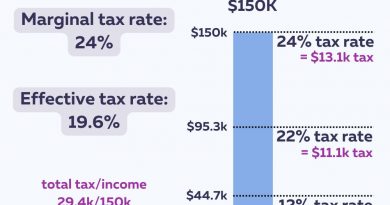

ADR Pricing and Costs

An ADR may represent the underlying shares on a one-for-one basis, a fraction of a share, or multiple shares. The depositary bank sets the ratio of U.S. ADRs per home-country share to appeal to investors. The price should not be too high to deter investors or too low to be seen as risky.

ADRs closely track the price of the company’s stock on its home exchange due to arbitrage opportunities. Arbitrage allows traders to profit from price differences in different markets.

ADR Fees

Investing in an ADR may incur additional fees not charged for domestic stocks. The depositary bank may charge a custody fee, listed in the ADR prospectus, to cover the costs of creating and issuing the ADR. This fee ranges from one to three cents per share and is either deducted from dividends or passed on to the investor’s brokerage firm.

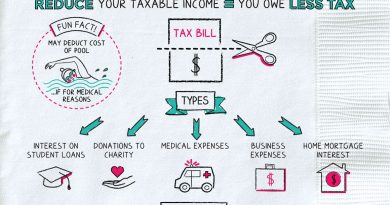

ADRs and Taxes

ADRs pay dividends and recognize capital gains in U.S. dollars. However, dividend payments are net of currency conversion expenses and foreign taxes, which may be automatically withheld by the bank. American investors may need to seek credits or refunds to avoid double taxation.

If you’re interested in learning more about ADRs, there are many investing courses available to get you started.

Advantages and Disadvantages of ADRs

ADRs have distinct advantages and disadvantages:

Advantages

ADRs trade like stocks on U.S. exchanges, making them easily accessible and trackable. They can be purchased directly through U.S. brokers, denominated in dollars, and offer portfolio diversification.

ADRs and Exchange Rate Risk

ADRs still have currency risk due to their structure. Movements in the exchange rate between the home country and the ADR price must be reflected in U.S. dollars to maintain the conversion rate.

One of the benefits of investing in ADRs is the potential for greater rewards and risks by diversifying international investments.

Disadvantages

ADRs may involve double taxation and have a limited selection of listed companies compared to domestic investments. Unsponsored ADRs may not comply with SEC regulations, and investors may incur currency conversion fees.

- Easy to track and trade

- Available through U.S. brokers

- Denominated in dollars

- Offer portfolio diversification

- May face double taxation

- Limited selection of companies

- Unsponsored ADRs may not be SEC-compliant

- Investors may incur currency conversion fees

History of ADRs

ADRs were created in the 1920s to simplify purchasing shares of non-U.S. listed companies for American investors. J.P. Morgan’s predecessor, Guaranty Trust, introduced the first ADR in 1927. They enabled U.S. investors to buy shares of Selfridges, a famous British retailer, and helped the company tap into global markets. A sponsored ADR for the British music company Electrical & Musical Industries was introduced in 1931. Today, J.P. Morgan and BNY Mellon remain active in the ADR markets.

Real-World Example of ADRs

Volkswagen AG, a German car manufacturer, traded as a sponsored ADR under the ticker VLKAY from 1988 to 2018. After terminating the ADR program, Volkswagen established an unsponsored ADR with J.P. Morgan trading under the ticker VWAGY.

Investors holding VLKAY ADRs had options to cash out, exchange for Volkswagen stock on German exchanges, or exchange for the new VWAGY ADRs.

ADRs track the price of a foreign company’s shares but do not grant ownership rights like common stock does.

Why Do Foreign Companies List ADRs?

Foreign companies list ADRs to gain international visibility, access a larger pool of investors, and receive coverage from more equity analysts. ADRs also make it easier to raise capital in international markets.

What Is a Sponsored vs. an Unsponsored ADR?

A sponsored ADR is issued by a depositary bank in partnership with a foreign company. An unsponsored ADR is issued without involvement or permission from the foreign company and is usually traded over the counter.

What Is the Difference Between an ADR and a GDR?

ADRs provide a listing for foreign shares in one market, while Global Depositary Receipts (GDRs) give access to two or more markets with one fungible security. GDRs are commonly used when an issuer raises capital in local and international markets through private placement or public offerings.

An American depositary share (ADS) is the actual share that the ADR represents. The ADR itself represents a bundle of ADSs issued.

The Bottom Line

ADRs allow Americans to invest in foreign companies easily. They provide a way to trade these stocks on U.S. markets and allow foreign firms to raise capital from the U.S. market.