USD JPY U S Dollar Japanese Yen Explaining the Currency Pair

Ariel Courage, an experienced editor, researcher, and former fact-checker, has provided editorial and fact-checking services for top finance publications such as The Motley Fool and Passport to Wall Street.

USD/JPY is the symbol used to represent the currency exchange rate between the U.S. dollar and the Japanese yen. It shows the number of Japanese yen (quote currency) required to buy one U.S. dollar (base currency). The Japanese yen is denoted by the symbol ¥.

Key Takeaways:

1. USD/JPY is the ticker used to indicate the currency exchange rate between the U.S. dollar and the Japanese yen.

2. USD/JPY is one of the most traded and liquid currency pairs globally.

3. USD/JPY usually correlates positively with USD/CHF because both the yen and the Swiss franc are considered safe haven currencies by investors.

Understanding the USD/JPY Pair:

The value of the USD/JPY pair is quoted in Japanese yen per U.S. dollar. For instance, if the pair is trading at 150, it means one U.S. dollar can be exchanged for 150 yen. The USD/JPY is highly traded due to Japan’s position as the world’s third-largest national economy and major exporter.

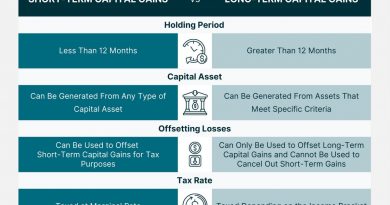

The USD/JPY exchange rate is influenced by various factors that affect the value of the U.S. dollar and the Japanese yen relative to each other and other currencies. The difference in interest rates between the Federal Reserve and the Bank of Japan plays a significant role in USD/JPY. Higher interest rates make a currency more appealing as they provide higher yields to investors holding assets in that currency.

For instance, if the federal funds rate increases from near-zero to 2% while the Bank of Japan’s policy rate remains low, the U.S. dollar would strengthen against the yen. This is because investors can now earn a significantly higher yield in dollar-denominated money markets. In fact, the yen reached a 24-year low against the dollar in mid-2022 when the Bank of Japan declined to raise interest rates, viewing deflation as a greater threat than near-term inflation.

Japan’s domestic interest rates, coupled with deflation, have led the yen to be considered a safe haven currency. During periods of market turmoil, the yen tends to appreciate as Japanese investment funds flow back from higher-yielding foreign currencies like the U.S. dollar. This was evident during the Great Recession, where the USD/JPY rate dropped from 120 in 2007 to below 90 in 2009.

Conversely, the yen weakens when there is increased risk appetite in financial markets. Following the Great Recession, as the global economy recovered, the yen slowly depreciated against the U.S. dollar. This depreciation accelerated in 2013 when the Bank of Japan implemented large-scale quantitative easing.

The USD/JPY shows a positive correlation with USD/CHF as both currency pairs have the U.S. dollar as the base currency. Additionally, the Swiss franc is considered a safe haven currency by investors. Conversely, the price of gold has a negative correlation with USD/JPY. During the Great Recession, as USD/JPY fell, gold prices rose.

The USD/JPY pair typically exhibits a close and positive correlation with U.S. Treasury yields.