What Are Social Security Benefits Definition Types and History

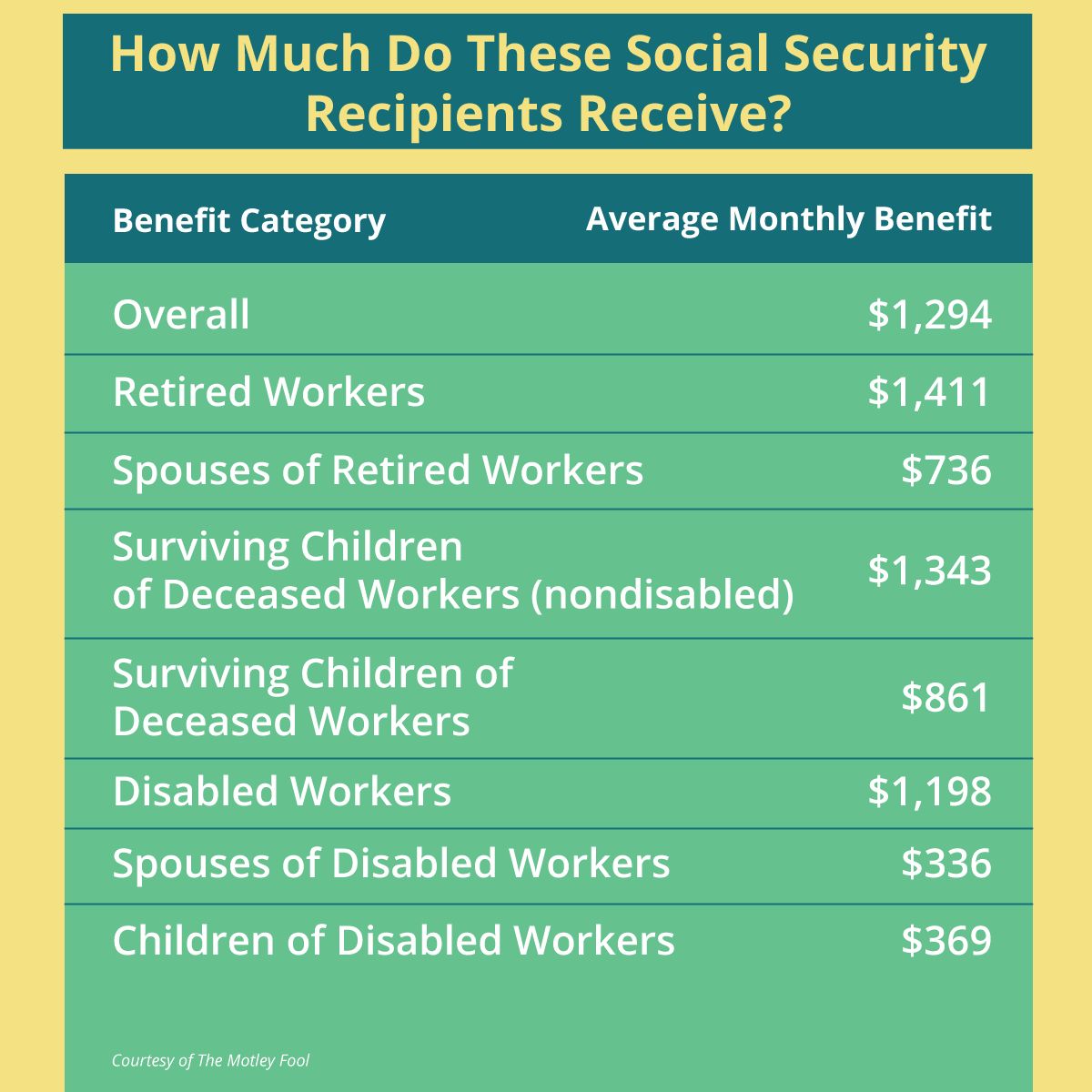

Social Security benefits are payments made to qualified retired adults, people with disabilities, and their spouses, children, and survivors. The program, officially known as the Old-Age, Survivors, and Disability Insurance (OASDI) program, is a comprehensive federal benefits program designed to provide partial replacement income. It also supports the children of beneficiaries.

Here are the key takeaways:

– Social Security benefits provide partial replacement income for qualified retired adults, individuals with disabilities, and their spouses, children, and survivors.

– To qualify for benefits, you must pay into the Social Security program during your working years and accrue 40 credits.

– The benefit amount you receive is based on your earnings history, birth year, and age when you start claiming Social Security.

– Spouses who haven’t earned enough credits can receive benefits based on their spouse’s work record.

– Benefits may be taxed depending on your income and tax filing status.

How Social Security Benefits Work

President Franklin Roosevelt signed the Social Security Act into law in 1935. The current law includes several social insurance and welfare programs, including Social Security benefits. The benefits are determined by specific criteria issued by the Social Security Administration (SSA). Payroll taxes fund Social Security and its benefits.

Qualifying for Social Security Benefits

You qualify for Social Security retirement benefits by paying into the program during your working years. Full insurance requires accumulating 40 quarters or "credits" from covered wages. You can earn up to four credits per year. The SSA keeps track of your earnings throughout your career and uses the 35 highest-earning years to determine your average indexed monthly earnings (AIME). Your AIME is used to calculate your primary insurance amount (PIA), the monthly amount you can collect when you reach full retirement age.

The full retirement age gradually increases from 65 to 67 for individuals born in 1938 or later. You can collect Social Security retirement benefits at age 62, but the amount will be reduced based on claiming it earlier. Waiting until age 70 increases your benefits by 8% per year.

The maximum monthly Social Security payment for retired workers is $3,345 in 2022, rising to $3,627 in 2023.

Types of Social Security Benefits

Spousal Benefits:

Spouses who didn’t work or didn’t earn enough credits to qualify for Social Security on their own can receive benefits starting at age 62 based on their spouse’s work record. The highest spousal benefit is half of the spouse’s benefit at full retirement age.

Survivor Benefits:

When a spouse dies, the surviving spouse is entitled to file for a survivor’s benefit as early as age 60. The benefit can be switched to the surviving spouse’s own benefit if it’s higher.

Cost-of-living adjustments (COLAs) are made annually to Social Security benefits to counteract inflation.

Special Considerations

Taxes may be applicable if an individual’s income exceeds certain thresholds. 85% of Social Security benefits are taxable for most individuals.

Unused Social Security benefits are kept in the Social Security trust funds and used to pay current beneficiaries.

Several states tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, and West Virginia.

Widows can receive up to 100% of the deceased spouse’s primary insurance amount (PIA). Divorced spouses married for at least 10 years can also collect up to 100% of their former spouse’s PIA.

Social Security benefits are evaluated each year based on the previous year’s income. If you had high-earning years, your benefit will be recalculated retroactively.

Certain types of income, such as wages and net earnings from self-employment, can reduce your Social Security benefits if you’re younger than full retirement age. Other types of income, such as interest, annuities, capital gains, and pensions, don’t affect your benefits.