Valuation Clause What It Means How It Works Types

Contents

- 1 Valuation Clause: Definition, Types, and Importance

- 1.1 What Is a Valuation Clause?

- 1.2 Understanding Valuation Clauses

- 1.3 Special Considerations

- 1.4 Types of Valuation Clauses

- 1.5 Example of Valuation Clauses

- 1.6 Why Are Valuation Clauses Important?

- 1.7 Do Valuation Clauses Apply Only to Insurance?

- 1.8 Effects of Valuation Clauses on Insurance Claims

- 1.9 The Bottom Line

Valuation Clause: Definition, Types, and Importance

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He has earned several designations, including Chartered Financial Consultant® and Chartered Life Underwriter®. He is also an Accredited Financial Counselor® and holds certifications in Retirement Income and Retirement Counseling.

What Is a Valuation Clause?

A valuation clause is a provision in insurance policies that specifies the amount of money the policyholder will receive in the event of a covered hazard. It determines the fixed amount to be paid for a loss on insured property. There are various types of valuation clauses, such as actual cash value and replacement cost.

Key Takeaways

- A valuation clause determines the fixed amount a policyholder may receive in a claim.

- Methods used in valuation clauses include agreed value, replacement cost, and stated amount.

- Actual cash value is the most commonly used method, paying the insured’s pre-loss value.

Understanding Valuation Clauses

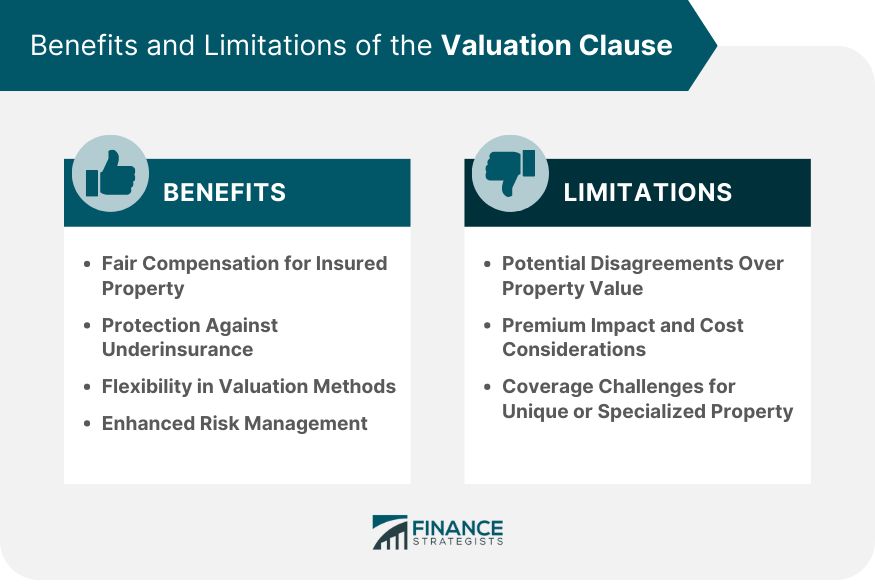

Valuation clauses are provisions in insurance contracts that state the amount the insurer will reimburse the insured party for property loss. These clauses consider various factors about the property and the individual’s budget requirements.

Determining the cost of insured articles is important for obtaining proper insurance coverage. By understanding the value of an item, the policyholder can determine the level of coverage needed and account for maximum foreseeable loss.

In some cases, insurance providers may require an appraisal to determine the value of unique or historic properties before underwriting coverage. An appraisal may also be required if the policyholder seeks coverage exceeding the assessed value of a property.

Policyholders should be aware of important factors related to valuation clauses:

- Review insurance policies with valuation clauses to understand benefit payment circumstances.

- Regularly review the listed dollar value for the insured property.

Policies that do not keep up with the cost of living, inflation, or changes to local building code cost increases may not provide adequate protection.

In some cases, insurance providers may require policyholders to update the value of covered items periodically using a full reporting clause.

Special Considerations

Valuation clauses are not limited to the insurance industry. They are also used in various business contracts to determine asset value. For example, they may be included in mergers and acquisitions, distribution agreements, or licensing agreements.

Types of Valuation Clauses

The two most common types of valuation clauses are actual cash value and replacement cost. Other types include:

- Stated Valuation Clause: This clause, often used for automobile coverage, defines the maximum value of the property as determined by the policyholder. However, the insurer may pay either the stated value or actual cash value in the event of a loss.

- Agreed Valuation Clause: This clause stipulates the value of the insured property as agreed upon by the insurer and insured party. It is important to define the actions in the case of a total loss.

- Market Valuation Clause: Also known as a market value clause, it determines the value of the covered property based on the market rate, rather than actual or replacement cost.

Example of Valuation Clauses

Here’s an example of how valuation clauses work in an insurance policy. If a driver purchases a policy for their car, the insurance company includes a provision stating the amount they will reimburse if the car is totaled in a no-fault accident. The reimbursement may be based on the actual cash value, which considers depreciation.

Why Are Valuation Clauses Important?

Valuation clauses inform the insured party about the amount they will receive in the event of a claim. These clauses are crucial in insurance contracts, but they can also be applied in other business contracts to determine asset value.

Do Valuation Clauses Apply Only to Insurance?

No, valuation clauses are also used in different types of business contracts. They can be found in mergers and acquisitions, distributions, and licensing agreements. Valuation clauses help determine the value of assets between parties.

Effects of Valuation Clauses on Insurance Claims

Valuation clauses have a significant impact on insurance claims. Different valuation methods, such as actual cash value, replacement cost, stated value, agreed value, and market value, determine the reimbursement amount. It is important for policyholders to understand the amount they can expect to receive for covered losses.

The Bottom Line

Insurance can be complex, and it is crucial for consumers to understand their policies. Valuation clauses are provisions written into contracts that determine the value of property in the event of a loss. Policyholders should be aware of these clauses and their implications when filing a claim.