Mean Return Overview Calculations Benefits

Contents

Mean Return: Overview, Calculations, Benefits

Cierra Murry is a banking consultant, loan signing agent, and arbitrator with over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management.

What Is Mean Return?

Mean return in securities analysis is the expected value, or mean, of investments in a portfolio. It is also known as an expected return and can refer to monthly stock returns or the mean value of the probability distribution of possible returns. In capital budgeting, mean return is the mean value of the probability distribution of possible returns.

Key Takeaways

- Mean return (expected return) is the estimated profit or loss an investor expects from a portfolio of investments.

- It can refer to monthly stock returns or the mean value of the probability distribution of possible returns.

- An investor can calculate the mean return given historical returns or probable rates of return under different scenarios.

- Calculating mean return helps quantify the risk-return relationship in a portfolio.

- However, mean return does not guarantee future returns and should be considered alongside other factors when evaluating an investment.

Understanding Mean Return

Stock analysis involves projecting a stock’s future worth and estimating revenue and growth to assess the risk involved. Calculating the mean or expected return of a portfolio helps investors understand how specific securities impact the overall portfolio. This analysis enables investors to evaluate the pros and cons of each investment and create a portfolio aligned with their risk tolerance.

Calculating mean return also aids in asset allocation and comparing securities within an industry for inclusion in a portfolio.

Calculating Mean Return

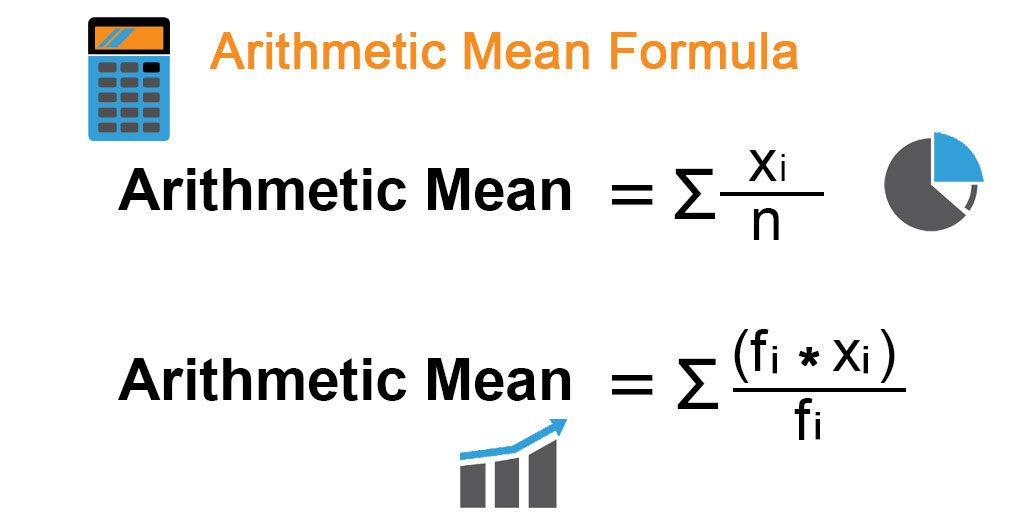

Mean returns are calculated by multiplying return probabilities with returns and finding the weighted average sum. It is often referred to as a geometric mean return due to its similarity to geometric formulas. The geometric mean return formula is primarily used for compounded investments. For simple interest accounts, the average mean is found by adding rates and dividing by time periods.

Capital budgeting mean returns use maximum risk-tolerance weighted returns instead of probabilities. Mean return is a broad term that doesn’t equate to average monthly returns.

Benefits of Mean Return

Mean returns quantify the risk-return relationship in a portfolio. Rational investors seek to maximize the expected return for every acceptable level of risk. Mean returns help visualize changes in wealth over time and support analysis of potential future rate of return. However, mean returns are based on historical data and don’t guarantee future performance.

Prudent investors use mean returns as one tool in the decision-making process. They also review financial statements and evaluate management strategies for future growth.