What Are Cash Equivalents Types Features Examples

Contents

- 1 Cash Equivalents: Types, Features, Examples

- 1.1 What Are Cash Equivalents?

- 1.2 Understanding Cash Equivalents

- 1.3 Types of Cash Equivalents

- 1.4 Features of Cash Equivalents

- 1.5 Uses of Cash Equivalents

- 1.6 Advantages and Disadvantages of Cash Equivalents

- 1.7 Example of Cash Equivalents

- 1.8 How Are Cash Equivalents Used?

- 1.9 Why Are Cash Equivalents Important?

- 1.10 What Is the Difference Between Cash and Cash Equivalents?

- 1.11 The Bottom Line

Cash Equivalents: Types, Features, Examples

What Are Cash Equivalents?

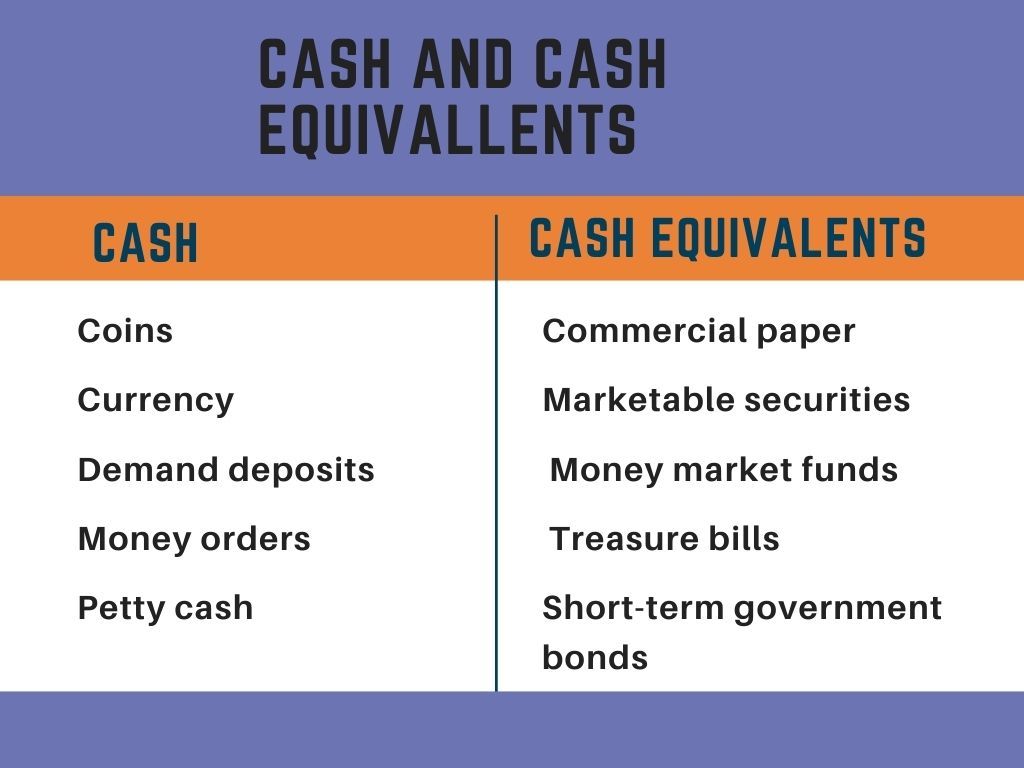

Cash equivalents are short-term securities with solid credit quality and high liquidity. They can be quickly converted to cash, hence the name. These securities are commonly listed as "cash and cash equivalents" in the current assets section of balance sheets. Cash equivalents are one of the three main asset classes, along with stocks and bonds.

These securities have a low-risk, low-return profile.

Key Takeaways

- Cash equivalents are highly liquid securities that are equivalent to cash.

- The amount of cash and cash equivalents reflects a company’s financial health and its ability to meet short-term obligations.

- Stocks, bonds, and cash equivalents are the three main asset classes.

- Cash equivalents include U.S. government T-bills, bank CDs, corporate commercial paper, and other money market instruments.

Understanding Cash Equivalents

Cash equivalents are financial instruments with short maturities, high liquidity, and low risk. They include U.S. government Treasury bills, bank certificates of deposit, corporate commercial paper, and other money market instruments. Analysts use cash equivalents to assess a company’s financial well-being and liquidity. Companies with large amounts of cash equivalents may be attractive targets for acquisition.

Financial statements often combine investments in cash equivalents with cash, representing the company’s total holding of money and liquid investments.

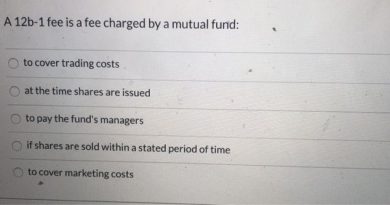

Types of Cash Equivalents

Treasury Bills

Treasury bills, also known as "T-bills," are short-term securities issued by the United States Department of the Treasury. They mature in one year or less and are sold at a discount. T-bills are highly liquid and have low risk.

Commercial Paper

Commercial paper is unsecured debt used by companies to raise short-term funds. These notes have maturities ranging from one to 270 days and are issued at a discount.

Marketable Securities

Marketable securities are highly liquid financial assets that can be easily converted into cash. These include T-bills, CDs, commercial paper, stocks, bonds, and ETFs.

Money Market Funds

Money market funds are mutual funds that invest in cash and cash equivalents. They offer liquidity and stability, making them popular for managing cash.

Short-Term Government Bonds

Short-term government bonds are liquid securities issued by governments to fund projects. They carry low risk and are actively traded.

Certificate of Deposit (CD)

A certificate of deposit is a fixed-term savings account with a financial institution. It offers a fixed rate of interest and is considered a safe investment.

Banker’s Acceptance

A banker’s acceptance is a short-term payment guarantee issued by a bank. It’s considered cash due to the bank’s backing.

What’s Not a Cash Equivalent

Not all short-term assets are considered cash equivalents. Examples include credit collateral, inventory, CDs with unbreakable contracts, prepaid assets, and accounts receivable.

Features of Cash Equivalents

Cash equivalents share several characteristics:

- Liquidity: Cash equivalents are highly liquid, easily converted to cash.

- Short-Term Investment: They have short maturities and are quickly convertible to cash.

- Low-Risk/Volatility: Cash equivalents are low-risk investments.

- Unrestricted Access: Conversion to cash must be unrestricted.

Uses of Cash Equivalents

Companies use cash equivalents for various purposes:

To Meet Short-Term Obligations

Cash equivalents are part of a company’s net working capital and are used to pay expenses and cover short-term liabilities.

To Build an Emergency Fund

Companies maintain cash equivalents for unexpected costs during slowdowns or economic downturns. It provides security and earns interest.

To Be Ready for Future Projects

Companies keep cash equivalents to quickly access funds for business opportunities instead of locking capital long-term.

As Required by Debt Agreements

Lenders may require companies to maintain liquid cash equivalents, protecting their interests and offering better loan terms.

Advantages and Disadvantages of Cash Equivalents

Advantages

- Cash equivalents offer higher interest rates compared to basic bank accounts.

- They are highly accessible and reliable.

- Some products offer fixed rates of interest and income security.

Disadvantages

- Cash equivalents earn less than longer-term, less liquid investments.

- They are subject to issuer default risk.

- Early redemption may incur fees or fines.

Cash Equivalent Quick Reference Comparison

- Earns higher rate compared to cash in many savings accounts

- Highly liquid

- May offer fixed rates of interest

- Generally considered safe investments

- Earns lower rate compared to longer-term, less liquid investments

- Subject to issuer default risk

- May not be federally insured

Example of Cash Equivalents

In 2021, Microsoft invested in and held cash equivalents throughout the year.

How Are Cash Equivalents Used?

Companies invest excess cash in money market funds, which offer higher yields than traditional bank accounts. Cash equivalents can be sold when cash is needed.

Why Are Cash Equivalents Important?

Cash equivalents provide quick access to cash and allow a company to earn some return on its funds while planning for the long term.

What Is the Difference Between Cash and Cash Equivalents?

Cash refers to actual currency, while cash equivalents are interest-earning financial instruments that can be easily converted to cash. Cash equivalents have low risk and high liquidity, making them almost as accessible as cash.

The Bottom Line

Investing in cash equivalents allows companies to earn a return on their funds while maintaining liquidity. These short-term, low-risk investments provide more interest than basic bank accounts and can be quickly converted into cash.