Marketable Securities

Marketable Securities

Marketable securities are highly liquid financial instruments that can be easily converted to cash at a reasonable price. The short maturities and limited impact on prices when bought or sold contribute to their liquidity.

Key Takeaways

– Marketable securities are assets that can quickly be converted to cash.

– They can be bought or sold on public stock or bond exchanges.

– These securities typically mature in a year or less and can be either debt or equity.

– Examples of marketable securities include common stock, Treasury bills, and money market instruments.

Understanding Marketable Securities

Businesses hold cash in reserves to be prepared for quick actions, such as acquiring or making contingent payments. Instead of leaving cash idle, a business invests a portion in short-term liquid securities to earn returns. If cash is needed, these securities can be easily liquidated. Marketable securities encompass unrestricted financial instruments that can be bought or sold on public exchanges. They have strong secondary markets that facilitate quick buy and sell transactions, and they are considered safe investments due to their liquidity.

Examples of marketable securities include common stock, commercial paper, banker’s acceptances, Treasury bills, and other money market instruments.

Special Considerations

Analysts evaluate marketable securities when assessing liquidity ratio analysis. Liquidity ratios measure a company’s ability to meet short-term financial obligations. Creditors prefer a cash ratio above 1, indicating the firm can cover short-term debt. However, most companies have a low cash ratio since holding excess cash or heavily investing in marketable securities is not highly profitable.

Liquidity ratios include:

1. Cash Ratio: Calculated by dividing the market value of cash and marketable securities by current liabilities.

2. Current Ratio: Measures a company’s ability to pay off short-term debt using current assets, including marketable securities.

3. Quick Ratio: Considers only quick assets, such as marketable securities, when evaluating a company’s liquidity. Calculated by dividing quick assets by current liabilities.

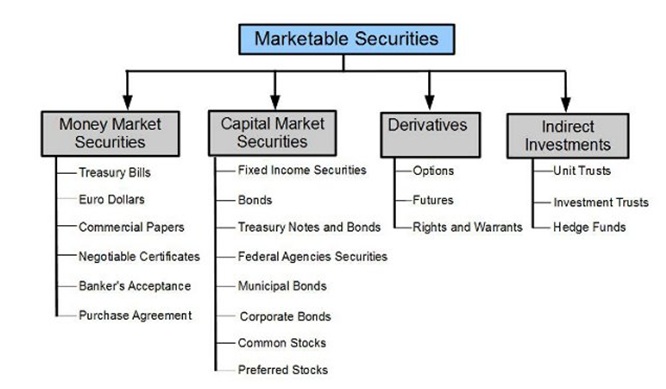

Types of Marketable Securities

Equity Securities

Marketable equity securities include common and preferred stock. They are equity securities held by one corporation in a public company and listed on the balance sheet of the holding company. If liquidation or trading is expected within a year, they are listed as current assets. Otherwise, they are listed as non-current assets. All marketable equity securities, whether current or non-current, are listed at the lower of cost or market value.

However, if a company invests in another company’s equity for control, these securities are not considered marketable equity securities. Instead, they are listed as long-term investments.

Debt Securities

Marketable debt securities are short-term bonds issued by a public company and held by another company. Since they serve as substitutes for cash, an established secondary market is crucial. Marketable debt securities are classified as current assets on a company’s balance sheet, held at cost until a gain or loss is realized upon their sale.

These securities are considered short-term investments and are expected to be sold within a year. If held for longer, they should be classified as long-term investments.