Understanding Nonmonetary Assets vs Monetary Assets

Understanding Nonmonetary Assets vs. Monetary Assets

What Are Nonmonetary Assets?

Nonmonetary assets are items a company holds for which it is not possible to precisely determine a dollar value. These assets may fluctuate in value over time. Examples of nonmonetary assets include factory equipment and vehicles. Nonmonetary assets appear on the balance sheet but are not easily convertible into cash or cash equivalents.

Key Takeaways

-A nonmonetary asset refers to an asset that a company holds that does not have a precise dollar value and is not easily convertible to cash or cash equivalents.

-Companies categorize nonmonetary assets as tangible assets or intangible assets.

-Examples of tangible nonmonetary assets are a company’s property, plant, equipment, and inventory.

-Examples of intangible nonmonetary assets are a company’s intellectual property, such as patents, copyrights, and trademarks.

-In contrast, monetary assets can easily be converted to cash or cash equivalents.

Understanding Nonmonetary Assets

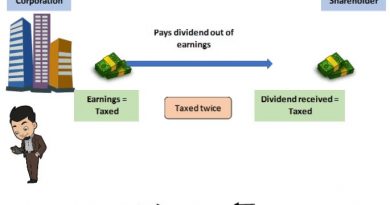

Nonmonetary assets are distinct from monetary assets. Monetary assets include cash, cash equivalents, and other assets that can be easily converted into a fixed amount of money.

Nonmonetary assets do not have a fixed conversion rate into cash. They can be tangible or intangible. Tangible assets have a physical form and include inventory and property, plant, and equipment. Intangible assets, on the other hand, are not physical and include copyrights, patents, trademarks, brand recognition, and goodwill.

Special Considerations

Determining whether an asset is monetary or nonmonetary is not always clear. The deciding factor is whether the asset can be easily converted into cash within a short period of time. If it can be converted easily, it is considered a monetary asset. If it cannot be readily converted, it is considered a nonmonetary asset.

Nonmonetary Assets vs. Nonmonetary Liabilities

In addition to nonmonetary assets, companies also have nonmonetary liabilities. Nonmonetary liabilities include obligations that cannot be met in the form of cash payments, such as warranty services. Nonmonetary liabilities represent service obligations rather than financial obligations.

Differences Between Monetary and Nonmonetary Assets

Dollar values are used to quantify a company’s assets and liabilities in financial statements. Nonmonetary assets and liabilities that cannot be readily converted to cash are included in the balance sheet. Examples of nonmonetary assets include real estate, proprietary technology, and other intellectual property.

The value of nonmonetary assets changes over time due to economic and market conditions. Factors such as marketplace competition, inflation, and deflation impact the value of nonmonetary assets.

Companies use monetary assets to fund capital improvements and operational expenses. Nonmonetary assets are used to generate revenue. For example, a company can use factory equipment to produce products for sale.

Overall, understanding the difference between nonmonetary assets and monetary assets is crucial for accurate financial reporting and decision-making.