Wash Sale Definition How It Works and Purpose

Contents

Wash Sale: Definition, How It Works, and Purpose

What Is a Wash Sale?

A wash sale occurs when an investor sells or trades a security at a loss and purchases a similar one within 30 days of the sale. This rule, enacted by the Internal Revenue Service (IRS), prevents investors from using capital losses as a tax advantage.

The wash sale rule applies to all types of securities and trading.

Key Takeaways

- A wash sale happens when an investor buys a security within 30 days of selling an identical or similar security.

- The IRS created the wash sale rule to prevent taxpayers from reducing their tax liability.

- An investor cannot claim a loss if they purchased the same or a similar security within 30 days (before or after) the sale.

Understanding a Wash Sale

Many countries’ tax laws allow investors to deduct a specific amount of capital losses from their taxes. In the U.S., the deduction is up to $3,000 or the total net loss, whichever is less. Any excess losses can be carried forward to future years.

However, investors started exploiting this deduction by selling a losing security and buying it again shortly after to claim a capital loss and reduce their tax liability.

To prevent this abuse, the IRS instituted the Wash Sale Rule in the U.S. (similar to the bed-and-breakfasting practice in the U.K.). The rule states that if an investor buys a security within 30 days of selling it, any losses from that sale cannot be counted as income. This eliminates the incentive to do a short-term wash sale.

How It Works

A wash sale typically involves three steps:

- An investor realizes they are in a losing position and closes it by selling the stock or exiting a trading position.

- The sale allows them to claim a loss on their tax returns, reducing their total tax liability for the year.

- The investor intends to repurchase the security at or below the sale price. If the repurchase occurs within 30 days of the sale, it is considered a wash sale, and the loss cannot be claimed.

Day traders, especially pattern day traders, may frequently encounter wash sales. It is essential for day traders to consult a tax professional to understand the complex tax implications.

Wash Sale Example

Suppose an investor has a $15,000 capital gain from selling ABC stock. They fall in the highest tax bracket and owe a 20% capital gains tax of $3,000. However, they also sold XYZ security at a loss of $7,000. The net capital gain for tax purposes becomes $15,000 – $7,000 = $8,000, reducing their capital gains tax to $1,600. The loss on XYZ reduces the gain on ABC, resulting in a lower tax bill.

However, if the investor repurchases XYZ stock, or a substantially similar one, within 30 days of the sale, the transaction is considered a wash sale, and the loss cannot offset any gains.

Special Considerations

Bonds and preferred stock are generally not considered "substantially identical" to a company’s common stock. However, in certain circumstances, preferred stock may be treated as substantially identical if it meets specific criteria.

According to Revenue Ruling 2008-5, IRA transactions can trigger the wash-sale rule. If an investor sells shares in a non-retirement account and purchases substantially identical shares in an IRA within 30 days, they cannot claim tax losses for the sale, nor does the basis in the individual’s IRA increase.

Reporting a Wash Sale Loss

A loss from a wash sale can be applied to the cost basis of the most recently purchased substantially identical security. This increases the new security’s cost basis and reduces potential taxable gains in the future.

Moreover, the holding period of the wash sale securities is added to the holding period of the repurchased securities. This increases the chance of qualifying for the 15% favorable tax rate on long-term capital gains.

Tax-Loss Harvesting and Wash Sales

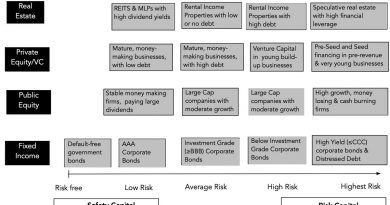

Tax-loss harvesting, where securities are sold at a loss to offset capital gains elsewhere, can inadvertently trigger wash sales. To avoid this, investors often look for alternative investments that are similar but not "substantially identical."

Are Wash Sales Illegal?

Wash sales are not illegal. The rule prevents claiming a loss on the sale in the same year’s tax filing, but there are no restrictions on selling and repurchasing similar securities within 30 days.

Is a Wash Sale Window 30 or 60 Days?

A wash sale window encompasses a total of 60 days—starting from 30 days before the sale to 30 days after the sale.

How Do I Avoid a Wash Sale?

To avoid triggering the wash sale rule, you can purchase a similar security 31 days or more before or after selling a security at a loss.

The Bottom Line

A wash sale occurs when an investor sells a security at a loss and repurchases the same or a substantially similar security within 30 days. This rule prevents claiming capital losses as tax deductions if re-entering a similar position too quickly. While not illegal, wash sales have negative tax implications—they cannot offset gains in the same tax year. However, these losses can be added to the cost basis of the newly purchased security, affecting future gains. Understanding and navigating the wash sale rule is crucial for effective tax planning and investment strategy.