Risk Capital What it is How it Works Uses

Contents

Risk Capital: What it is, How it Works, Uses

What Is Risk Capital?

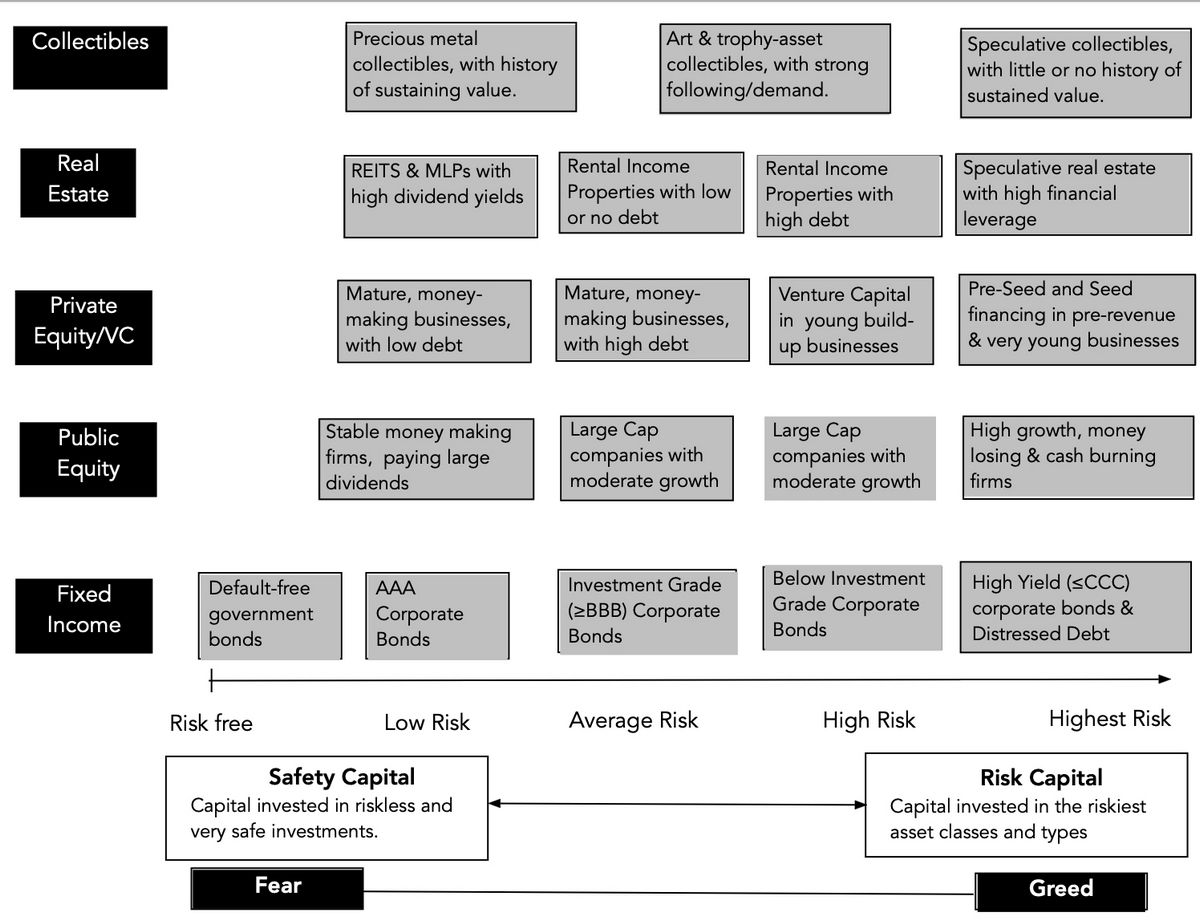

Risk capital refers to funds allocated to speculative activity and used for high-risk, high-reward investments. Any money or assets exposed to possible loss in value is considered risk capital, but the term is often reserved for funds earmarked for highly speculative investments. Diversification is key for successful investment of risk capital as the prospects of each investment tend to be uncertain by nature, although the returns can be far above average when an investment succeeds. Additionally, an investor needs to ensure that only a portion of total capital is considered risk capital.

In the context of venture capital, risk capital may also refer to funds invested in a promising, but still unproven, startup.

Risk capital should not be confused with capital at risk (CaR), which refers to funds set aside to cover risks (such as via insurance or hedging activities).

Key Takeaways

- Risk capital refers to money or other assets exposed to high risk of a loss in value.

- Capital, by definition, is put to work as an investment, and the risk it is exposed to is compensated in the form of a positive expected return that increases with its relative riskiness.

- Risk capital can be made more efficient through diversification.

- Some investors define risk capital as funds they are willing to lose, and so can be used to speculate on highly risky bets.

Understanding Risk Capital

Risk capital is the funds that are expendable in exchange for the opportunity to generate outsized gains. Investors must be willing to lose all risk capital, which is why it should only account for 10% or less of a typical investor’s portfolio equity. Experienced investors with high risk tolerance may allocate a quarter or more of their portfolio to higher-risk investments. Any investments made with risk capital should be offset with stable diversified investments to avoid the possibility of losing the entire portfolio.

The more risk averse the investor, the lower the proportion of risk capital allocated in the total portfolio should be. While young investors, because of their lengthy investment horizons, can have a significant proportion of risk capital in their portfolios, retirees are not usually comfortable with a high proportion of risk capital—nor should they be, as their time to make back losses is limited. Speculative investing should be segmented to the early years of investing and cordoned off as retirement age approaches.

Uses of Risk Capital

Risk capital is typically used for speculative investments in penny stocks, angel investing, private lending, futures and options trading, private equity, day trading, and swing trading of stocks and commodities. Many of these markets indirectly influence those who can put risk capital in them. Classifications like sophisticated investor and accredited investor are used to limit the highest risk, highest reward investments to investors with a certain threshold of net worth and income. The idea is that these individuals were able to amass wealth by understanding their risks and mitigating them intelligently, so they are given access to markets with complex engineered financial instruments commonly used by institutional investors.

Day trading, one of the most common uses for risk capital, also has safety features to indirectly control the amount of risk capital a trader can put in. The pattern day trading (PDT) rule requires a brokerage account to have a minimum account equity of $25,000. This allows for day trading buying power up to a 4:1 intraday margin. Accounts that fall under the $25,000 minimum are not allowed to make more than three roundtrip trades within a rolling five-day period. Failing to abide by the PDT rule can result in account restrictions and suspensions. It is important to check with the specific brokerage regarding policies for day trading accounts.