Value Averaging What it Means Examples

Ariel Courage, an experienced editor, researcher, and former fact-checker, has performed editing and fact-checking work for leading finance publications such as The Motley Fool and Passport to Wall Street.

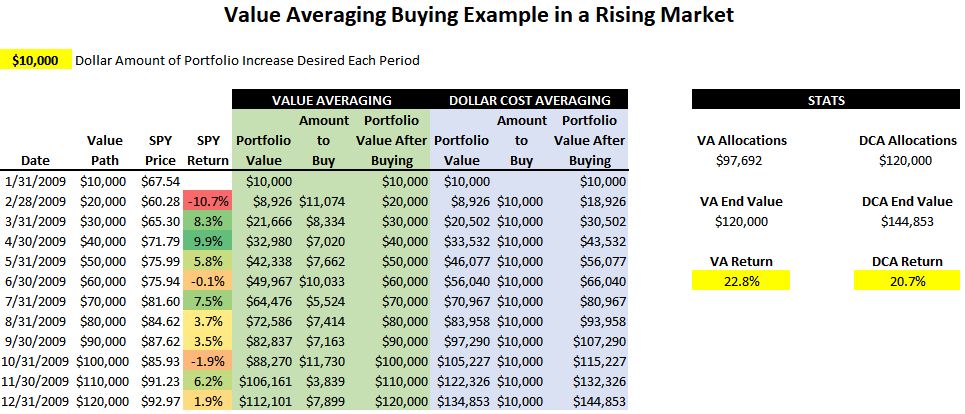

Value averaging (VA) is an investing strategy similar to dollar-cost averaging (DCA) in terms of making steady monthly contributions. However, it differs in the approach to the amount of each monthly contribution. With value averaging, the investor sets a target growth rate or amount for their portfolio each month and adjusts the next month’s contribution based on the relative gain or shortfall made on the original portfolio.

Instead of investing a set amount each period, a value averaging strategy makes investments based on the total size of the portfolio at each interval.

Key Takeaways:

– Value averaging involves making regular contributions to a portfolio over time.

– When the price or the portfolio value falls, more investment is made, and when it rises, less investment is made.

– Value averaging calculates predetermined amounts for future periods and matches the investment size to these amounts.

The main goal of value averaging is to acquire more shares when prices are falling and fewer shares when prices are rising. This is similar to dollar-cost averaging, but with a slightly different effect. Independent studies have shown that value averaging can produce slightly superior returns to dollar-cost averaging over multiyear periods.

In dollar-cost averaging, investors always make the same periodic investment and buy more shares when prices are lower because the shares cost less. On the other hand, value averaging allows investors to buy more shares because prices are lower, ensuring that most investments are spent on acquiring shares at lower prices.

Value averaging may be more attractive to investors since it protects against overpayment for stocks when the market is hot. By avoiding overpayment, long-term returns can be stronger compared to those who invest set amounts regardless of market conditions.

For example, suppose the goal is for the portfolio to increase by $1,000 every quarter. If the assets grow to $1,250 in a quarter’s time, the investor will fund the account with $750 worth of assets. This will buy an additional 60 shares, bringing the total to 160 shares. This pattern continues in the following quarter.

While there are performance differences between value averaging, dollar-cost averaging, and set investment contributions, each is a good strategy for disciplined long-term investment, especially for retirement.

The biggest challenge with value averaging is that as an investor’s asset base grows, funding shortfalls can become too large to keep up with. This is particularly noteworthy in retirement plans, where an investor may not have the potential to fund a shortfall due to limits on annual contributions.

One way to address this problem is by allocating a portion of assets to a fixed-income fund or funds and rotating money in and out of equity holdings based on the monthly targeted return. This allows raising cash in the fixed income portion and allocating it in higher amounts to equity holdings as needed.

Another potential problem with the VA strategy is that in a down market, an investor might run out of money, making the larger required investments impossible before things turn around. This problem becomes more significant as the portfolio grows larger when drawdown in the account could require substantially larger amounts of capital to stick with the VA strategy.