Void Transaction How It Works Examples vs Refund

Contents

- 1 Void Transaction: How It Works, Examples, vs. Refund

- 1.1 What Is a Void Transaction?

- 1.2 How Void Transactions Work

- 1.3 Examples of Void Transactions

- 1.4 Void Transactions vs. Refunds

- 1.5 What Is a Chargeback or Reverse Transaction?

- 1.6 What Does "Posting" Mean With a Credit or Debit Card?

- 1.7 Why Are Credit or Debit Card Transactions Declined?

- 1.8 The Bottom Line

Void Transaction: How It Works, Examples, vs. Refund

What Is a Void Transaction?

A void transaction is a canceled debit or credit card transaction. It is canceled by the merchant before the cardholder’s bank settles the payment. Void transactions occur when errors or fraud are suspected.

Key Takeaways

- A void transaction is a canceled credit or debit card purchase.

- After a transaction is voided, it may still appear as a pending transaction on the customer’s account statement for a short time.

- Void transactions are different from refunds, which are issued after a transaction has cleared and the merchant has been paid.

- Mistaken charges, returns, and suspected fraud are common reasons for voiding a transaction.

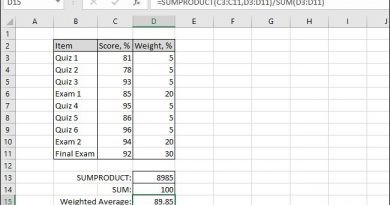

How Void Transactions Work

During a credit or debit card transaction, the merchant’s point-of-sale (POS) terminal sends the transaction information through a card network. If the card is valid and there are enough funds or credit in the customer’s account, the authorization process takes place. This process usually happens in a matter of seconds.

However, the transaction is not complete until the settlement step. Settlement occurs when payment is released from the customer’s account and sent to the merchant’s bank. If there is an issue with the transaction, it can be voided before this point, preventing the money from being transferred.

Transactions may be voided for various reasons. For instance, a customer might change their mind about a purchase and request a void. Alternatively, the merchant may notice a mistake and void the transaction proactively. Once voided, the transaction temporarily appears as pending on the customer’s account before disappearing after a specific length of time.

Pending transactions can hold the customer’s money for a certain period, causing inconvenience if they need to use their card during that time.

Note

A void transaction usually occurs on the same day as the initial transaction.

Examples of Void Transactions

Problems With Purchases

Mistakes in transactions can be swiftly corrected by voiding them, especially when identified immediately. For example, a shopper who pays for items at a grocery store may later discover that the cashier included items from the next customer. The cashier can void the transaction, rescan the correct items, and charge the customer the accurate amount.

Some merchants offer buyers a limited window to cancel purchases if they change their minds. This is particularly common in e-commerce, where customers may have the chance to cancel an online purchase within 24 hours. If they cancel, the seller voids the transaction, and the buyer is not charged, and the goods are not shipped.

Fraudulent Transactions

Potentially fraudulent charges can also be voided. Card issuers have fraud detection procedures that flag suspicious transactions before they are completed.

Majority of card companies place these transactions on hold until the customer verifies their status. If the customer denies the charge, the company can void it. If the customer cannot be reached for verification, many card companies automatically void suspicious transactions before settling them.

Refunds, on the other hand, are issued after the money has already passed through the customer’s account to the merchant. Thus, the refund process can be longer than a void transaction.

Void Transactions vs. Refunds

Void transactions differ from refunds. With void transactions, the payment process stops before any money is transferred from the customer’s account to the merchant. Refunds, however, are issued after a transaction has been settled, and the merchant has received payment.

Some merchants and credit card processing systems settle transactions immediately. In such cases, the merchant can only issue a refund instead of voiding the transaction.

Compared to void transactions, refunds can take significantly longer to complete. While some refunds may be reflected in the cardholder’s account within 48 hours, others may take up to 30 days.

What Is a Chargeback or Reverse Transaction?

A chargeback, also known as a reverse transaction, is similar to a refund. In this case, the customer has their money credited back to their credit or debit card account. These transactions can be initiated by the merchant or forced upon them by the cardholder or card issuer.

For example, if a customer claims that a product was defective and the merchant refuses to accept its return, the customer can request that the charge be reversed by their card issuer. Merchants can also dispute chargebacks.

What Does "Posting" Mean With a Credit or Debit Card?

Posting refers to the completion of a credit or debit card transaction, where the money moves into or out of the cardholder’s account. The date that appears on the statement is known as the post date or settlement date, usually later than the actual transaction date.

Why Are Credit or Debit Card Transactions Declined?

There are numerous reasons why credit or debit card transactions may be declined. For instance, a credit card may lack the necessary credit to cover the charge, or a customer’s debit card may have insufficient funds in the linked checking account. Transactions can also be declined due to card expiration, incorrect PIN or information, suspected fraud, and other factors.

The Bottom Line

Void transactions halt the payment process for credit or debit cards before the merchant receives any payment. However, voiding is only possible within a relatively short time window. After that, the cardholder may need to request a refund to recover their money.