Loss Adjustment Expense LAE Definition How It Works and Types

Loss Adjustment Expense (LAE): Definition, How It Works, and Types

Loss Adjustment Expense

A loss adjustment expense (LAE) is a cost that insurance companies incur when investigating and settling an insurance claim.

Key Takeaways

– A loss adjustment expense is a cost that insurance companies shoulder to investigate and settle insurance claims.

– Although loss adjustment expenses cut into an insurance company’s bottom line, they’re incurred to avoid fraudulent claims.

– There are two types of loss adjustment expenses—allocated and unallocated.

– Allocated costs accumulate during active claim investigations; unallocated costs are part of the investigation overhead.

– Some loss adjustment expenses are recouped by insurance companies by requiring the policyholder to pay them.

How Loss Adjustment Expense Works

When an insurer receives a claim, it doesn’t open its checkbook immediately. It first does its due diligence to ensure that the damages claimed by a policyholder are accurate. This involves an investigation of an incident and claim. The absence of an investigation could lead to losses from fraudulent claims.

Loss adjustment expenses can include the costs of adjusters, investigators, attorneys, mediators, and more.

LAEs will vary widely depending upon how difficult a claim is to investigate. Even in cases where the LAE is high, insurance companies deem the expense worth it to avoid being bilked by fraudulent claims. The investigation of claims can be a deterrent to those who might file fraudulent claims for an easy payday.

Fraudulent insurance claims are believed to cost insurers billions of dollars. These claims drive up insurance premiums for the rest of the customers as insurance companies must count fraudulent claims in their cost of doing business.

Special Considerations

Some commercial liability policies contain endorsements that require policyholders to reimburse their insurance company for loss adjustment expenses.

It is important to carefully read the endorsement language, which may indicate that a loss adjustment expense doesn’t include the policyholder’s attorney fees and costs if an insurer denies coverage and a policyholder successfully sues the insurer.

Thus, when there’s no actual adjusting of the claim, the insurance company shouldn’t be allowed to use its deductible to cover policyholder expenses incurred when the policyholder defends the claim dismissed by the insurance company.

Using LAE to Calculate the Combined Ratio

The combined ratio (also known as the combined ratio after policyholder dividends ratio) is one of the key profitability measures in the insurance industry. It measures profits earned through daily underwriting activities and excludes investment-related income. The calculation includes the LAE.

Combined Ratio = (Incurred Losses + Loss Adjustment Expense (LAE) + Other Underwriting Expenses)/Earned Premiums

The combined ratio essentially compares expenses to revenue. A ratio below 100% means that the company is making an underwriting profit. A ratio above 100% indicates an underwriting loss. So when it comes to the combined ratio, the lower the result, the better.

Example

As you can see from the above formula, loss adjustment expense is one of the components used in the combined ratio formula. All things being equal, the higher the loss adjustment expense, the higher the company’s combined ratio, and vice-versa.

Let’s say, for example, insurance company ABC incurred underwriting losses of $5 million, loss adjustment expenses of $3 million, and $2 million in underwriting expenses in Q1 (for a total of $10 million dollars). In the same period, the company earned $11 million in premiums. Thus, ABC’s combined ratio for the quarter is .91, or 91% ($10 million/$11 million). It’s making a profit, as the $11 million in earned premiums outpaced the underwriting costs.

Generally speaking, a combined ratio in the range of 75%-90% over the long run is considered healthy.

Types of Loss Adjustment Expense

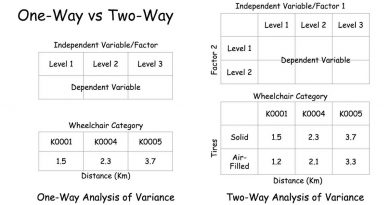

Loss-adjusted expenses that are allocated to a specific claim are called allocated loss adjustment expenses (ALAE), while expenses not allocated to a specific claim are called unallocated loss adjustment expenses (ULAE).

Allocated loss adjustment expenses occur when the insurance company pays for an investigator to survey claims made on a specific policy. Or, a driver with an automobile insurance policy may be required to take a damaged vehicle to an authorized third-party shop so that a mechanic can assess the damage.

In the case of a third-party review, the cost associated with hiring that professional is an allocated loss adjustment expense. Other allocated expenses include the cost of obtaining police reports, and the cost required to evaluate whether an injured driver is really injured.

Insurance companies can also incur unallocated loss adjustment expenses. Unallocated expenses could be related to the salaries of the home office personnel, maintenance costs of the fleet of vehicles used by in-house investigators, and other expenses incurred in the regular course of operations.

An insurance company that maintains a staff to evaluate claims but is fortunate enough to never have a claim filed will have salary and overhead as unallocated loss adjustment expenses but will not have any allocated loss adjustment expenses.

How Is a Loss Ratio Different From the Combined Ratio?

The loss ratio is calculated by dividing the total incurred losses by the total collected insurance premiums. It does not include underwriting and loss adjustment expenses, as is the case with the combined ratio.

What Does It Mean If a Company’s LAE Increases Each Year?

If a company’s LAE increases each year, it could mean that management is overly aggressive in its financial reporting. Specifically, it might be habitually under-reserving for losses and overstating income.

What Is the Difference Between an Incurred Loss and an LAE?

Incurred loss is simply the amount of money an insurance company paid out in claims. Loss adjusted expense, meanwhile, is the expense associated with investigating and settling those claims.

The Bottom Line

Loss adjustment expenses are the expenses that insurance companies incur during the investigation and handling of claims. Examples of loss adjustment expenses include costs for adjusters, investigators, attorneys, and mediators.

The combined ratio, the formula for which includes loss adjustment expenses, compares expenses to earned premiums and is used as a metric for profitability by the insurance industry.