Marubuzo What it Means How it Works Why it s Used

Contents

Marubozu: Meaning, Function, and Benefits

What is a Marubozu?

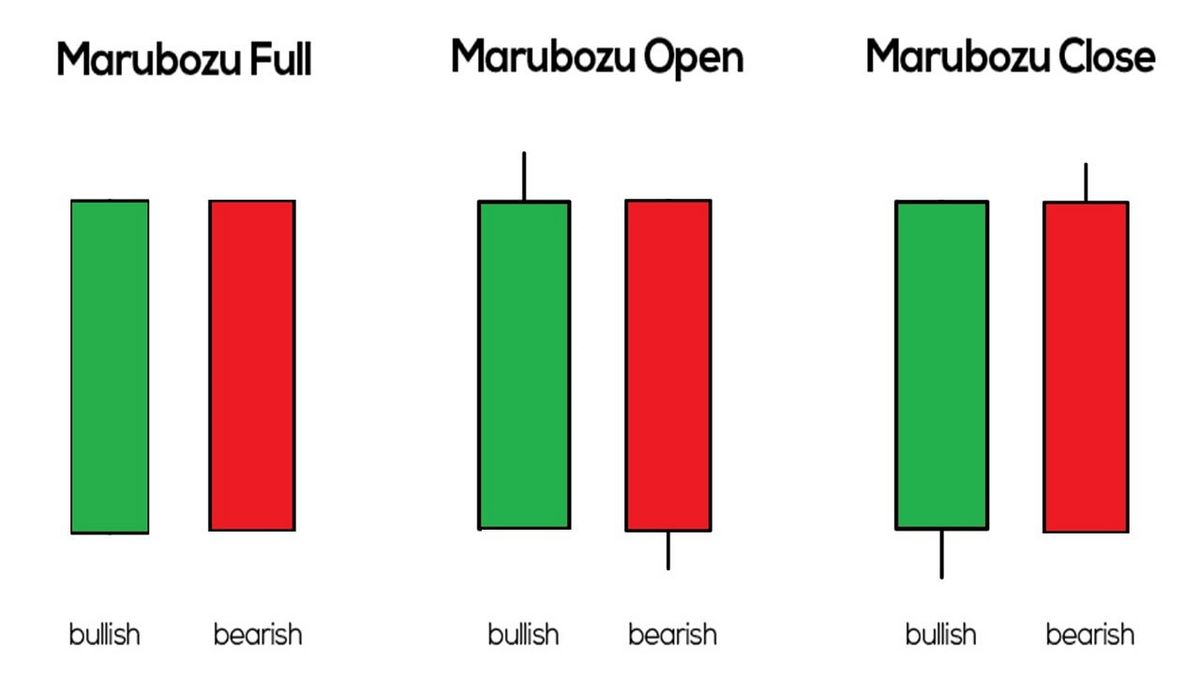

A Marubozu is a candlestick charting pattern that indicates a security’s price did not trade beyond the opening and closing price range. It is a candlestick pattern with no shadow.

Key Takeaways

- A Marubozu is a long-bodied candlestick with no shadow, derived from the Japanese word "close-cropped".

- Candlestick charts analyze the opening and closing price on a single day and are used by technical traders.

- A candlestick with no shadow is a strong signal of conviction, depending on the direction of the candle.

Understanding the Marubozu

The term Marubozu derives from the Japanese word "close-cropped," indicating a candlestick with no shadow. Its defining characteristic is the absence of upper or lower shadows, limiting the chart within the opening day price range. On an up day, the opening price and the day’s low are equal, while the closing price equals the day’s high. In cases where the stock gains, it suggests a bull market, while losses indicate a bear market.

Gaining days strongly imply higher demand for the stock than supply, while losing days suggest the opposite.

Candlestick charting has been popular among Japanese rice merchants and traders. The wider part of the candlestick, known as the real body, was used to determine whether the closing price exceeded or fell below the opening price.

A Marubozu candle found in an uptrend signals aggressive buying and suggests upward momentum. A bullish Marubozu candle found at the end of a downtrend signifies a reversal and changing sentiment toward continuation. Conversely, a bearish Marubozu found in a downtrend implies further selling pressure, particularly at the top of an uptrend.

Benefits of Using Charts to Track Stocks

Charting stock market activity is not a novel concept. Analysts have been using charts since before the creation of the New York Stock Exchange (NYSE), albeit in a rudimentary form. Charts provide a visual representation of stock market activity and track changes over time, excluding the reasons behind growth or decline.

Even casual investors can decipher charts once they understand the fundamentals. This information gives investors insights into market activity, enabling them to make informed decisions. By analyzing charts, investors can identify excessively bought or sold assets, decide whether to follow trends, or take advantage of less popular assets.

It is important to note that charts can track various features, so pay close attention to the information presented. Some charts depict daily activity, while others cover longer periods. Investors seeking a comprehensive perspective may review multiple charts to observe changes within short and long-term periods before making decisions.