Utilities and the Utilities Sector Pros and Cons for Investors

Utilities in the stock market are companies that provide services such as electricity, gas, and water. They are part of the public service infrastructure and are heavily regulated. Investors often choose utilities for long-term investments and income generation through dividends.

Key Takeaways:

– The utilities sector includes companies that provide electric, gas, and water utilities.

– Investors commonly buy utilities as long-term holdings.

– The sector is often used as an investment during economic downturns.

– Challenges for the sector include regulatory oversight and costly infrastructure updating and maintenance.

– Clean energy initiatives suggest strong growth for the utility industry in the 2020s.

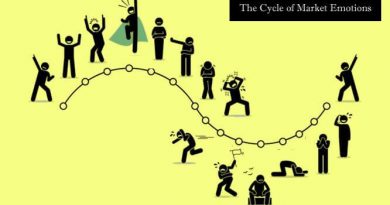

Utilities offer stable dividends and are less volatile than other equity markets, making them attractive during recessions. They require significant infrastructure and carry large amounts of debt, making them sensitive to market interest rates. Inflation also poses challenges for utilities. However, utilities that overcome these challenges are considered safe investments.

Investors prefer utility stocks for their reliable dividends, especially during times of economic downturns. Higher interest rates may prompt investors to seek higher-yielding alternatives. Aside from individual stocks, investors can also invest in regional utilities or utility ETFs.

The utilities sector has both pros and cons. It provides stable, long-term investments with regular dividends. It also serves as a safe investment during economic downturns. However, the sector faces intense regulatory oversight and requires expensive infrastructure updates and maintenance. It becomes less attractive during periods of high interest rates and low bond yields.

Public utility companies provide essential services like electricity, water, and sewage. These companies are privately owned but regulated by public utility commissions at the state level. Some notable utility companies in the United States include NRG Energy, OGE Energy Corp, and PG&E.

The utilities sector is changing due to clean energy initiatives and infrastructure upgrades. President Joe Biden’s goal of achieving a 100% clean energy economy by 2050 has prompted investments in grid modernization and clean energy projects. The utilities industry is also experiencing enhanced competition, infrastructure expansions, electrification of transportation, disaster readiness, and traditional energy players entering the renewable energy field.

Renewable energy resources are expected to grow from 12% to 39% of the US energy mix by 2030. Public utilities are regulated by the government or state and provide essential services like electricity, gas, or water to a region.

The largest utility company globally is NextEra Energy, which has a market capitalization of $158B as of July 2022. This company is engaged in the generation, transmission, distribution, and sale of electric energy.

In conclusion, the utilities sector consists of companies that provide basic amenities like natural gas, electricity, water, and power. Investors typically buy utilities stocks for long-term holdings and stable dividends. Clean energy initiatives and favorable legislation are expected to drive strong growth in the sector.