Market Cycles Definition How They Work and Types

Market Cycles: Definition, How They Work, and Types

What Are Market Cycles?

Market cycles, also known as stock market cycles, refer to trends or patterns that emerge during different markets or business environments. During a cycle, some securities or asset classes outperform others because their business models align with growth conditions. Market cycles are the period between the two latest highs or lows of a common benchmark, such as the S&P 500, highlighting a fund’s performance through both an up and a down market.

Key Takeaways:

– A cycle refers to trends or patterns that emerge during different business environments.

– A cycle time frame often differs for each individual person depending on what trends they are looking for.

– A market cycle often has four distinct phases.

– It can be almost impossible to identify what phase of the cycle we are currently in.

– At different stages of a full market cycle, different securities will respond to market forces differently.

How Market Cycles Work

New market cycles form when trends within a particular sector or industry develop in response to innovation, new products, or regulations. These cycles or trends are often called secular. During these periods, revenue and net profits may exhibit similar growth patterns among many companies, which is cyclical in nature.

Market cycles are often hard to pinpoint until after the fact and rarely have a specific beginning or ending point. This can lead to confusion or controversy surrounding the assessment of policies and strategies. However, most market veterans believe they exist, and many investors pursue strategies to profit from them.

There are stock market anomalies that occur year after year.

Special Considerations

A market cycle can range from a few minutes to many years, depending on the market in question and the time horizon being analyzed. Different careers will look at different aspects of the range.

Types of Market Cycles

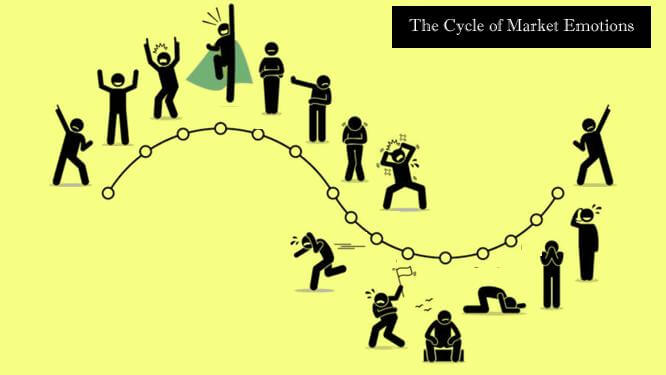

Market cycles generally exhibit four phases. At different stages of a full market cycle, different securities will respond to market forces differently. For example, luxury goods tend to outperform during a market upswing, while the consumer durables industry tends to outperform during a market downswing.

The four stages of a market cycle include the accumulation, mark-up, distribution, and downtrend phases.

Market cycles take both fundamental and technical indicators into account, using securities prices and other metrics as gauges of behavior.

Some examples include the business cycle, semiconductor/operating system cycles within technology, and the movement of interest-rate-sensitive financial stocks.

How Long Is a Market Cycle?

Cycles in the market tend to last 6-12 months on average. However, fiscal policy can have a widespread effect on the length of a market cycle. The average is 6 to 12 months, but if the Federal Reserve were to drastically cut interest rates, it could prolong a market trending upward for years.

What Are the 4 Market Cycles?

There are four phases of market cycles: accumulation, mark-up, distribution, and downturn. The first two phases could be considered mirror images of the others. Accumulation is when investors and businesses are scaling back into the market, whereas distribution is the opposite. Mark-up is an increase in price while a downturn is a decrease.

What Is Market Mid-Cycle?

A market mid-cycle occurs when an economy is strong but growth is moderating or slightly slowing. Corporate profits are delivering as expected and interest rates are low. This tends to be the longest part of the market cycle.

The Bottom Line

Markets generally follow the same cycle and although there is an average period of time for each cycle, political and fiscal policy can either extend or contract certain phases. Financial markets experience many mini-cycles in the short term, but large market cycles tend to occur in terms of months or years.