UPREIT Benefits and Qualifications in Real Estate Investing

UPREIT: Benefits and Qualifications in Real Estate Investing

What Is an UPREIT?

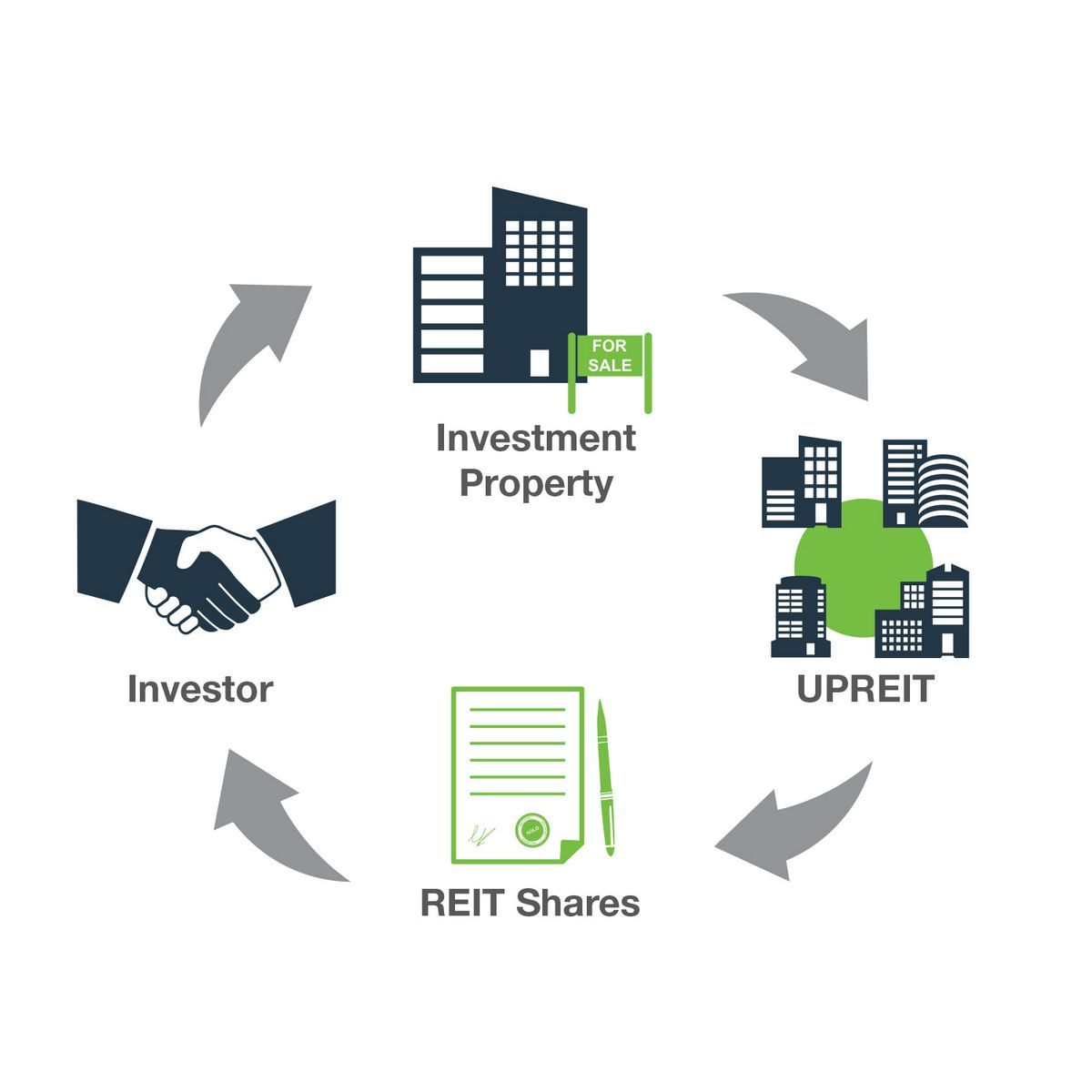

UPREITs, or umbrella partnership real estate investment trusts, are unique REIT structures that allow property owners to exchange their property for share ownership in the UPREIT. These exchanges fall under Section 721 of the Internal Revenue Code.

Key Takeaways:

– UPREITs allow property owners to exchange their property for share ownership.

– Property-for-share exchanges in an UPREIT are generally allowed under Section 721 of the Internal Revenue Code.

– UPREIT property contributors can defer taxes on the sale of property in exchange for UPREIT units, though capital gains taxes on UPREIT units are subject to standard REIT taxation.

Understanding UPREITs

Real estate investment trusts (REITs) were introduced by Dwight D. Eisenhower as a type of alternative real estate mutual fund. They serve as real estate portfolios that include both properties and financing capital. Investors can contribute to REITs in exchange for equity units or shares.

As REITs have evolved, alternative structures like UPREITs, DownREITs, and others have emerged to accommodate different types of investors. UPREITs are known for accepting property contributions in exchange for share ownership. The structure of a REIT can vary; publicly traded REITs are typically structured as corporations, while private REITs can be structured as trusts or associations.

Regardless of their structure, all REITs must meet the requirements outlined in IRC Title 26, Sections 856-859. These requirements enable a REIT to pass its income to shareholders, resulting in minimal taxes. The key requirement is that more than 90% of the business involves real estate assets.

Special Considerations

Instead of selling property, owners can contribute it to an UPREIT in exchange for units. With the value of the contributed property largely equivalent to the share units received, this transaction qualifies under IRC Section 721 and is not taxable.

UPREITs may offer special provisions for property-to-share conversions. These provisions can include immediate conversion of units to REIT shares or options to hold shares for a minimum period before receiving cash.

After an investor sells property to an UPREIT, the UPREIT assumes responsibility for its management. UPREIT managers face additional complexity due to the Section 721 exchange option and associated provisions for new unitholders. Their main responsibility is generating returns by managing the REIT portfolio.

The value of UPREIT shares can fluctuate based on various factors, such as management activities, property valuations, financing deals, and other transactions. This can create volatility for shareholders. However, UPREIT shareholders typically enjoy flexible liquidity and can easily convert their shares to cash.

Benefits of UPREITs

UPREITs offer a viable option for property owners looking to sell. Whether they own residential or commercial properties, individuals can make Section 721 exchanges into an UPREIT and receive the property’s value in the form of UPREIT units.

These exchanges do not trigger taxable events. Instead, unitholders are taxed based on general REIT standards. Some property owners may find UPREITs beneficial for estate planning, as they can potentially avoid taxes altogether.

Requirements for UPREITs

UPREITs are considered REITs under accounting and tax guidelines. They were created specifically to accept property contributions in exchange for ownership shares. Their structuring is guided by IRC Section 721, which outlines tax shields for property-to-share exchanges. Any REIT that allows Section 721 exchanges within the REIT framework can be classified as an UPREIT.

While most REITs focus on specific real estate market segments, there are no strict guidelines regarding the types of properties they can invest in. However, more than 90% of the business must pertain to real estate assets. UPREITs typically follow a targeted real estate investment strategy.

Section 721 provides standards for the release of shareholder units in exchange for property. Unlike Section 1031 exchanges, which allow like-kind exchanges and disallow property-to-share ownership exchanges, Section 721 exchanges into UPREITs can be attractive. Both Section 721 and 1031 exchanges allow property owners to defer taxes.

UPREIT vs. DownREIT

UPREITs, DownREITs, and other special REIT entities are fundamentally REITs with additional provisions that offer flexibility. DownREITs enable property investors to enter joint ventures with REITs. In a DownREIT, the exchange of units is primarily based on the value of the joint venture property, potentially leading to better returns for the joint venture unitholder.