What Is a Central Counterparty Clearing House CCP in Trading

What Is a Central Counterparty Clearing House (CCP) in Trading?

Andrew Bloomenthal has 20+ years of editorial experience as a financial journalist and services marketing writer.

What Is a Central Counterparty Clearing House (CCP)?

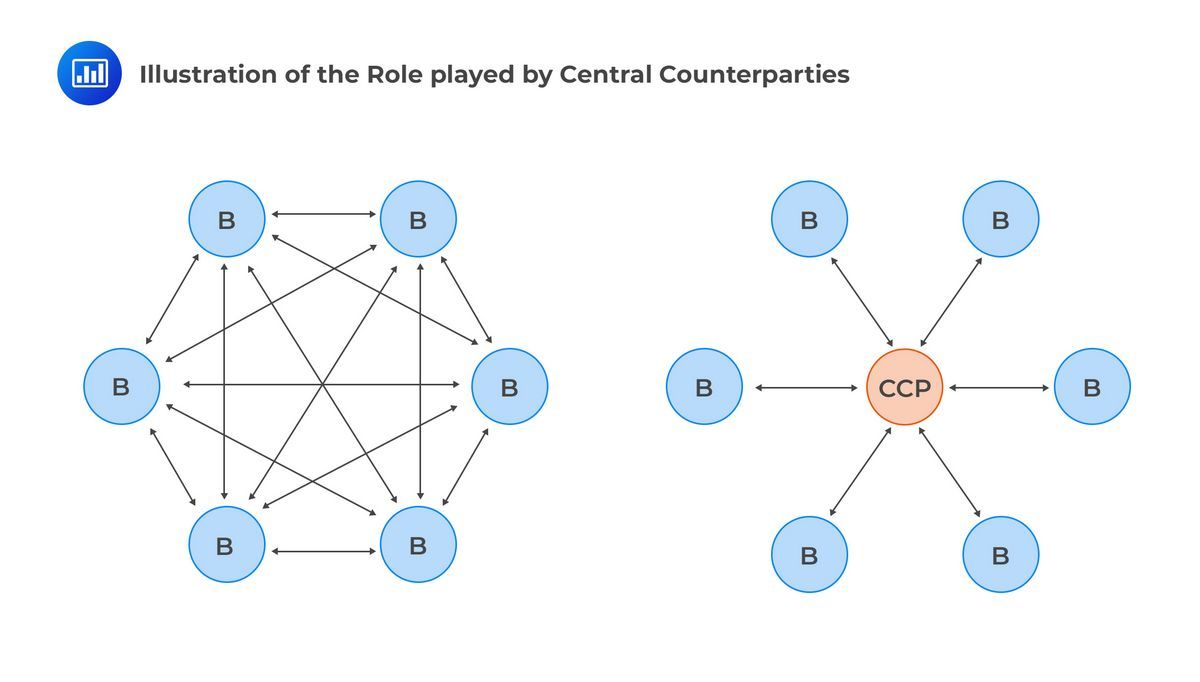

A central counterparty clearing house (CCP) facilitates trading in European derivatives and equities markets. Operated by major banks, CCPs introduce efficiency and stability into financial markets by reducing counterparty, operational, settlement, market, legal, and default risk for traders.

Understanding a Central Counterparty Clearing House (CCP)

Central counterparty clearing houses (CCPs) serves as intermediaries in transactions, performing two primary functions: clearing and settlement. As counterparties to buyers and sellers, CCPs guarantee trade terms, even in the event of default. CCPs assume most of the credit risk for buyers and sellers during clearing and settlement.

CCPs collect sufficient funds from each buyer and seller to cover potential losses resulting from failed agreements. In such cases, the CCP replaces the trade at the current market price. Monetary requirements depend on each trader’s exposure and obligations.

Key Takeaways

- A central counterparty clearing house (CCP) facilitates derivatives and equities trading and is operated by major banks.

- CCPs serve as intermediaries in transactions, performing clearing and settlement functions.

- A CCP acts as a counterparty to both sellers and buyers, collecting funds from each to guarantee trade terms.

Functions of a Central Counterparty Clearing House (CCP)

CCPs protect traders’ privacy by shielding their identities from each other. They also protect trading firms against default from buyers and sellers. Additionally, CCPs reduce the number of settled transactions, improving operational efficiency and facilitating efficient movement of money among traders.

In the U.S., the equivalent of a CCP is known as a derivatives clearing organization (DCO) and is regulated by the Commodity Futures Trading Commission (CFTC).

Moody’s Rating Methods for Central Counterparty Clearing Houses

In January 2016, Moody’s Investors Service introduced a new methodology for rating CCPs worldwide. In its Clearing Counterparty Rating (CCR) report, Moody’s evaluates a CCP’s ability to fulfill clearing and settlement obligations efficiently. The report takes into account management capabilities, business and financial basics, operating environment, and quantitative and qualitative measurements when determining a CCP’s creditworthiness.

Blockchain Technology and CCPs

Blockchain technology offers a new frontier for CCPs. Clearinghouses from multiple nations formed the Post Trade Distributed Ledger Group in 2015 to explore the impact of blockchain technology on clearing, settlement, and recording of trades. The group, now collaborating with the Global Blockchain Business Council, includes around 40 financial institutions worldwide.

The PTDL Group believes that blockchain technology can reduce risk and margin requirements, save on operational costs, increase settlement cycle efficiency, and enable greater regulatory oversight. With a comprehensive understanding of the securities settlement process, the group members recognize how blockchain technology can assist in settlement, clearing, and reporting.