Market Value of Equity Definition and How to Calculate

Market Value of Equity: Definition and Calculation

What is Market Value Of Equity?

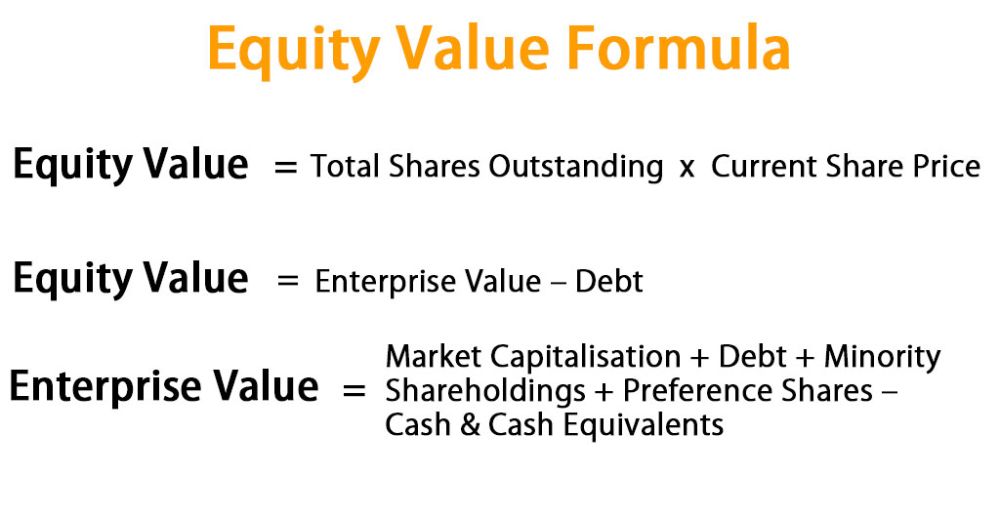

Market value of equity is the total dollar value of a company’s equity, also known as market capitalization. This measure of a company’s value is calculated by multiplying the current stock price by the total number of outstanding shares. A company’s market value of equity is always changing as these variables change. It is used to measure a company’s size and helps investors diversify their investments across companies of different sizes and risk levels.

Investors calculating market value of equity can find the total number of shares outstanding in the equity section of a company’s balance sheet.

Understanding Market Value Of Equity

A company’s market value of equity represents the total value of the company as determined by investors. It can shift significantly throughout a trading day, especially with significant news items like earnings. Large companies tend to have more stable market value of equity due to the number and diversity of investors. Conversely, small, thinly-traded companies can easily see double-digit shifts due to a relatively small number of transactions, making them targets for market manipulation.

Key Takeaways

– Market value of equity represents how much investors believe a company is worth today.

– Market value of equity is the same as market capitalization, calculated by multiplying the total shares outstanding by the current price per share.

– Market value of equity changes as the stock price fluctuates.

Calculating Market Value of Equity

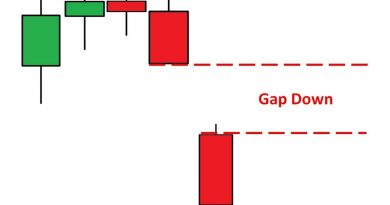

Market value of equity is calculated by multiplying the number of shares outstanding by the current share price. For example, on March 28, 2019, Apple stock was trading at $188.72 per share. As of this date, the company’s stock buyback program has reduced shares outstanding from over 6 billion to 4,715,280,000. So the market equity of capitalization is calculated as:

Stock Price ($188.72) x Shares Outstanding (4,715,280,000) = $889,867,641,600

For simplicity, people usually quote the market value of equity as $889.9 billion.

The Difference Between Market Value of Equity, Enterprise Value, and Book Value

Market value of equity can be compared to other valuations like book value and enterprise value. A company’s enterprise value includes its market value of equity plus total debt minus cash and cash equivalents, providing a rough idea of the company’s takeover valuation.

The market value of equity differs from the book value of equity, which is based on stockholders’ equity in the company’s balance sheet. The book value focuses on owned assets and owed liabilities. The market value of equity is believed to price in some of the company’s growth potential beyond its current balance sheet. If the book value is higher than the market value of equity, it may be a potential value buy due to market oversight.

Market Value of Equity and Market Profile

In general, there are three levels of market capitalization: small caps, mid-caps, and large caps. Small caps have a market capitalization of less than $2 billion, mid-caps range between $2 billion and $10 billion, and large caps exceed $10 billion.

Each level offers insights into the behavior of the company. Small caps are generally young, risky companies with high growth potential. Large caps are more stable, mature companies that may lack the same growth potential. Mid-caps provide a mix of the two. By owning stocks in each category, investors ensure diversification in assets, sales, maturity, management, growth rate, growth prospects, and market depth.