United States Treasury Money Mutual Fund Meaning How It Works

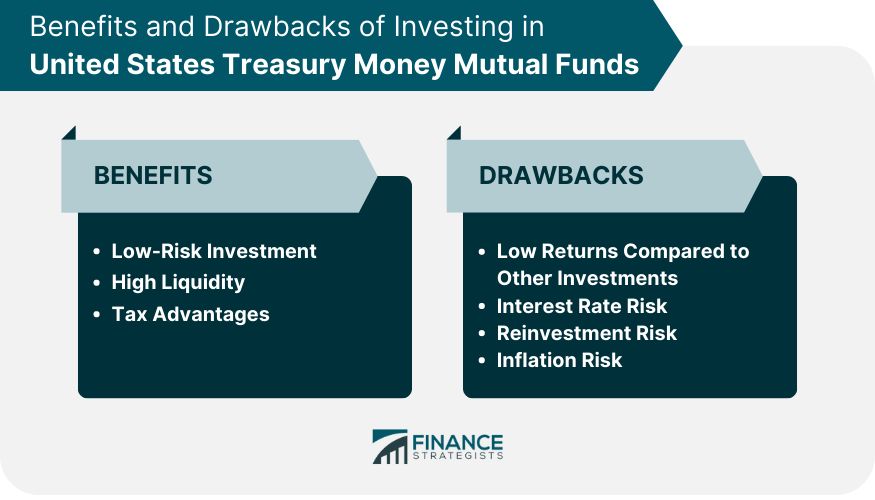

A United States Treasury money mutual fund pools investor money to purchase low-risk government securities. It primarily invests in U.S. government debt like Treasury bills and repurchase agreements. These funds are ideal for investors looking to preserve principal or invest cash temporarily.

Key Takeaways:

– A U.S. Treasury money mutual fund invests in low-risk, highly liquid investments like Treasury bills.

– These funds are stable and preserve invested principal.

– Money mutual funds are regulated by the SEC, which sets rules for maturity, credit quality, and liquidity.

U.S. Treasury money mutual funds are one of the best low-risk investments. They invest in Treasury bills and are stable and liquid. Treasury bills are secured by the full faith and credit of the U.S. Treasury, making them reliable sources of low-risk returns due to the country’s developed economy and political stability.

Money managers offer money market mutual funds that fully invest in U.S. Treasuries. These funds follow standard accounting principles to keep their net asset value at $1 per share at amortized cost. They are governed primarily by Rule 2a-7 of the Investment Company Act of 1940, which stipulates the type of quality, maturity, credit, and liquidity of the securities they can invest in. Rules have been revised to provide greater security for investors since the 2008 financial crisis.

U.S. government money market funds can be offered as cash sweep options or no-transaction-fee funds. Popular options include the Vanguard Treasury Money Market Fund (VUSXX), Fidelity Treasury Only Money Market Fund (FDLXX), and American Century Capital Preservation Fund (CPFXX).

Apart from money market funds, there are U.S. government mutual funds that offer similar benefits but are not characterized as money market funds. These funds can provide slightly higher returns with the same risk. They can have short, intermediate, or long-term durations, with longer-term durations potentially offering enhanced returns. Popular options include the Eaton Vance Short Duration Government Income Fund (EALDX), Commerce Short Term Government Fund (CFSTX), Federated Hermes Total Return Government Bond Fund (FTRGX), Fidelity Intermediate Treasury Bond Index Fund (FUAMX), Vanguard Extended Duration Treasury Index Fund (VEDTX), and Fidelity Long-Term Treasury Bond Index Fund (FNBGX).