Low Volume Pullback Definition as Indicator and How It Works

TITLE: Low Volume Pullback: Definition and How It Works

INTRODUCTION:

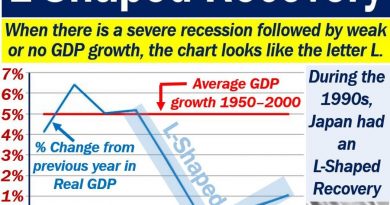

A low volume pullback is a technical correction towards support on below-average volume. Traders attribute this pullback to weak longs locking in profits rather than a reversal.

KEY TAKEAWAYS:

– Low volume pullbacks occur when the price moves towards support levels on below-average volume.

– They suggest weak longs taking profit but the long-term uptrend remains intact.

– High volume pullbacks suggest a near-term reversal.

UNDERSTANDING LOW VOLUME PULLBACKS:

Moves in the opposite direction of a trend with low volume are insignificant fluctuations. On the other hand, a spike in volume in the opposite direction could signal a reversal, known as a high volume pullback.

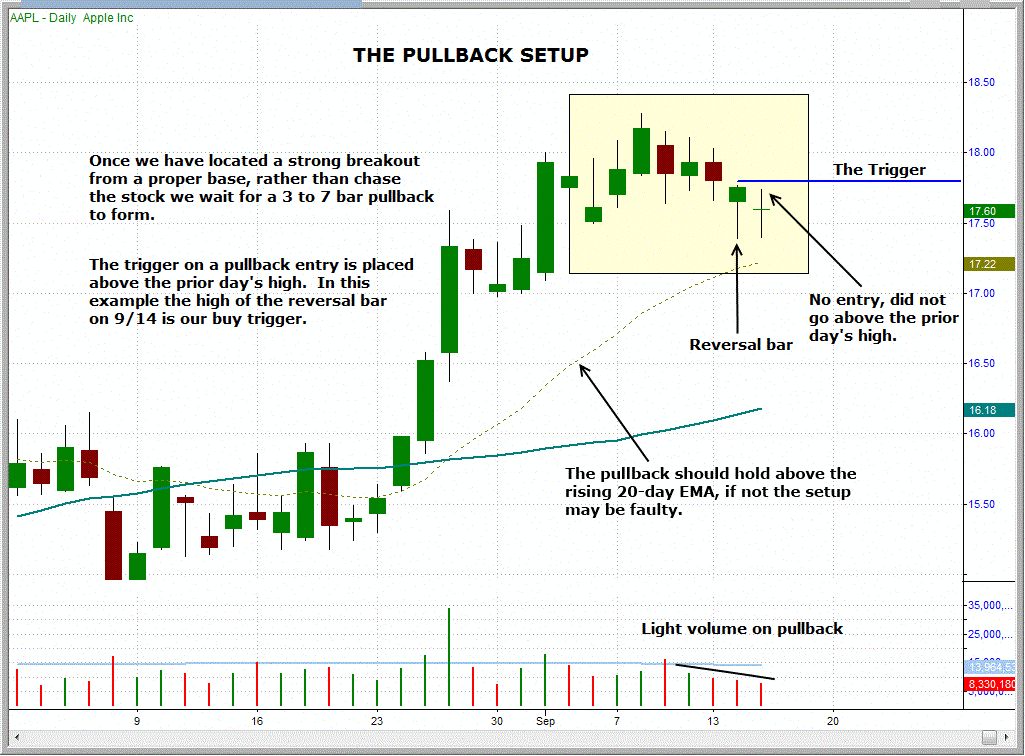

TRADING LOW VOLUME PULLBACKS:

Technical traders enter positions on short-term weakness in low volume pullbacks, increasing the risk/reward ratio. Long-term investors may add to positions at a lower price, decreasing the cost basis and creating potential upside. Indicators like the on-balance volume (OBV) can help spot diverging trend and volume. High volume pullbacks indicate a possible reversal, prompting traders and long-term investors to adjust positions.

CONCLUSION:

While volume is a reliable indicator, it’s essential to consider other factors like chart patterns, support/resistance levels, and technical indicators (RSI, MACD) to confirm sentiments.

REAL-WORLD EXAMPLE:

In the SPDR S&P 500 ETF (SPY), there were three low volume pullbacks within an uptrend before a high volume pullback indicating a prolonged reversal. The low volume pullbacks were followed by a resumption of the trend, while the high volume pullback resulted in increased volatility as the long-term trend was questioned.