L-Shaped Recovery Meaning Examples FAQs

Contents

- 1 L-Shaped Recovery: Meaning, Examples, FAQs

L-Shaped Recovery: Meaning, Examples, FAQs

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant®, Chartered Life Underwriter®, Accredited Financial Counselor®, Retirement Income Certified Professional®, and Certified Retirement Counselor designations.

What Is an L-Shaped Recovery?

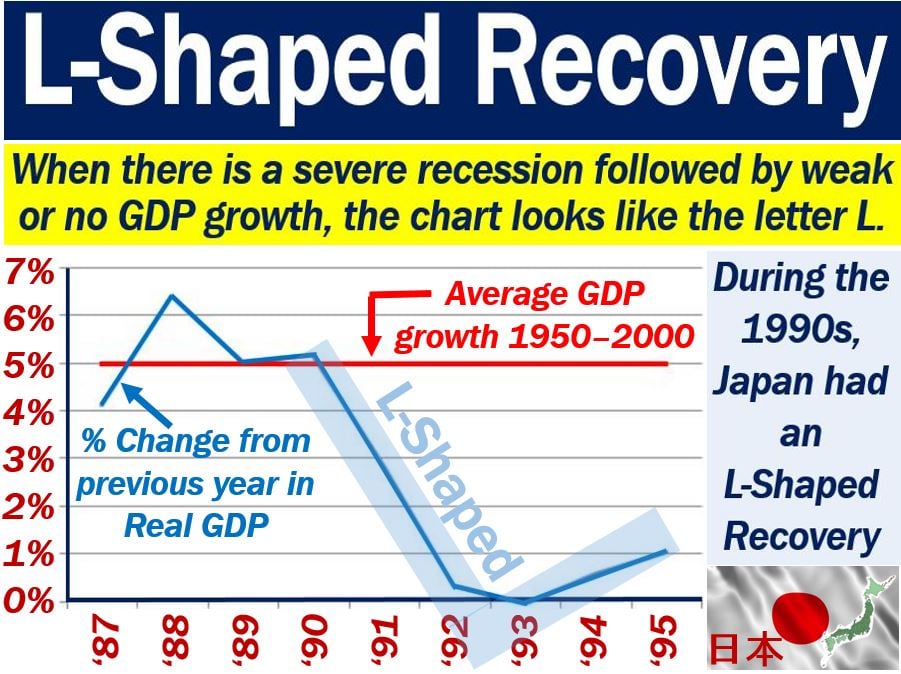

An L-shaped recovery is a type of recovery characterized by a slow rate of recovery, persistent unemployment, and stagnant economic growth. It occurs after an economic recession with a steep decline in the economy but without a correspondingly steep recovery. Graphs of major economic performance often visually resemble the shape of the letter “L” during this period.

Economists use indicators such as employment rates, GDP, and industrial output to determine the state of the economy. In an L-shaped recovery, there is a steep decline followed by a shallow upward slope indicating a long period of stagnant growth. Recovery from an L-shaped recession can take several years.

Key Takeaways

- An L-shaped recovery occurs when the economy experiences a slow rate of recovery after a steep recession.

- This type of recovery resembles the shape of the letter “L” when charted as a line graph.

- L-shaped recoveries are characterized by persistently high unemployment, slow return of business investment, and sluggish economic growth.

- They are associated with some of the worst economic episodes throughout history.

- A common thread in L-shaped recoveries is a massive fiscal and monetary policy response, which may slow the economy’s recovery process.

Understanding the L-Shaped Recovery

An L-shaped recovery is the most harmful type of recession and recovery.

The defining feature of an L-shaped recovery is the failure of the economy to progress back toward full employment after a recession. The economy does not quickly adjust and reallocate resources, leading to prolonged unemployment and underutilization of capital goods. An L-shaped recession is often referred to as a depression due to the extended period of economic decline.

Explanations for L-shaped recoveries include persistent pessimism, underconsumption, excessive saving, and active interventions that prevent the economy from adjusting and recovering. These interventions, such as fiscal and monetary policies, can protect the financial sector but slow the economy’s recovery process.

L-Shaped Recovery Examples

Three major examples of L-shaped recoveries stand out in the last century: the Great Depression of the 1930s, Japan’s Lost Decade, and the Great Recession following the 2008 financial crisis. These periods were marked by extensive fiscal and monetary policy campaigns.

The Great Depression

Following the stock market crash of 1929, the U.S. entered the Great Depression. Real GDP contracted sharply, and unemployment reached nearly 25%. Stagnant growth and high unemployment persisted for over a decade.

In response to the recession, President Herbert Hoover increased both spending and taxes, implementing federal lending subsidies, labor legislation, and funding for unemployment benefits. Expansionary monetary policy was also pursued. These measures failed to bring about a quick recovery, and the L-shaped recession extended throughout the entire decade of the 1930s.

Japan’s Lost Decade

The "Lost Decade" in Japan is another example of an L-shaped recovery. Following a period of remarkable growth, Japan experienced a stock market crash and a slowdown in economic growth. The government implemented multiple rounds of deficit spending and economic stimulus programs, but recovery was slow and prolonged.

The Great Recession

The Great Recession occurred in the U.S. after the 2008 financial crisis. Government interventions, such as bailouts and expansionary monetary policy, aimed to stabilize the economy. However, the recovery was slow, with high unemployment and sluggish GDP growth.

How Long Do Economic Recessions Last, on Average?

Historical data shows that recessions in the U.S. have had an average duration of 17 months. In recent times, recessions since 1980 have lasted less than 10 months, on average.

What Leads to an L-Shaped Recovery?

L-shaped recessions are characterized by a prolonged recovery period. They often occur in debt-based economies that experience a credit crisis. These economies rely on borrowing and spending, but when credit dries up, consumption and production decline. De-leveraging and restructuring are necessary before growth can resume.

Why Doesn’t Stimulus Work in an L-Shaped Recession?

Stimulus policies aimed at preventing economic contractions can create distortions that hinder quick recovery. These policies may prolong slow growth and high unemployment in debt-based economies. Excess debt needs to be liquidated for the financial system to recover and sustainable growth to resume. Stimulus measures can inadvertently increase debt, counterintuitively prolonging recessions.

The Bottom Line

Examples of L-shaped recoveries demonstrate how policy responses can impact recovery time. Long-lasting effects can persist even after policy interventions are withdrawn. These interventions may have severe long-term costs, as seen in Japan’s experience. Economic restructuring and deleveraging are crucial for a sustainable path back to growth.