Uninsured Certificate of Deposit What It is How it Works FAQs

Maya Dollarhide, a financial journalist with over 10 years of experience, helps people understand complex financial topics such as student loans, home-buying, and retirement savings.

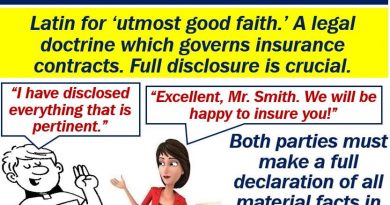

An uninsured certificate of deposit (CD) is not insured against losses, and therefore carries a higher interest rate as the purchaser assumes all the risks. If the issuing financial institution goes bankrupt, the investor loses their investment.

Key Takeaways:

– Uninsured CDs are not insured by the Federal Deposit Insurance Corp. (FDIC) or the National Credit Union Administration (NCUA).

– Uninsured CDs have higher interest rates as the purchaser takes on all the risk.

– Examples of uninsured CDs include Yankee CDs, bull CDs, and bear CDs.

– Most CDs are insured by the FDIC or the NCUA.

– CDs, savings accounts, and money market accounts are savings vehicles available at local banks and credit unions.

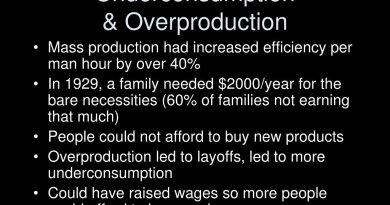

Understanding Uninsured CDs:

– The majority of CDs are insured by the FDIC or the NCUA, but there are uninsured options such as offshore CDs and brokered CDs.

– Offshore CDs place money in a foreign bank and offer higher interest rates. However, they carry the risk of relying on the safety of a foreign bank and being exposed to currency risk.

– An FDIC-insured account includes checking, savings, money market deposit accounts, and CDs. The maximum amount insured is $250,000 per depositor, per institution.

– Exotic CDs may not be government-guaranteed and can have various features like teaser rates, long lock-up periods, variable rates tied to market indexes, or assets with undisclosed prices.

– Some brokered CDs may be partially uninsured. Bull CDs, bear CDs, and Yankee CDs are other forms of CDs with specific features and interest rates tied to underlying market indexes.

Is it safe to invest in an uninsured CD?

– Uninsured CDs, like other investment options such as mutual funds, annuities, life insurance policies, stocks, and bonds, carry risks. Investors must evaluate whether the higher interest rates outweigh the risks.

What are the benefits of an uninsured CD?

– While uninsured CDs carry risk, they offer the benefit of potentially higher earnings over time. If an investor is confident in the market, an uninsured CD may be a suitable option.

Are CDs insured by the FDIC?

– Most CDs provided by banks or credit unions are insured by the FDIC for up to $250,000. The NCUA provides similar protection for credit union options. Uninsured options, typically offered through brokerages, include offshore CDs, bull CDs, bear CDs, and Yankee CDs.