Uniform Prudent Investor Act UPIA Meaning Updates

Uniform Prudent Investor Act (UPIA): Meaning, Updates

Cierra Murry is an expert in banking, credit cards, investing, loans, mortgages, and real estate. She is a banking consultant, loan signing agent, and arbitrator with over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management.

What Is the Uniform Prudent Investor Act (UPIA)?

The Uniform Prudent Investor Act sets guidelines for trustees when investing trust assets on behalf of a trustor. It also applies to financial professionals who make recommendations or place trades for clients. It updates the "Prudent Man" standard to reflect changes in investment practices since the late 1960s.

Specifically, the Uniform Prudent Investor Act adopts modern portfolio theory (MPT) and a total return approach to fiduciary investment and discretion.

Key Takeaways

– The Uniform Prudent Investor Act (UPIA) sets guidelines for trustees making investments for others, updating the Prudent Man Rule.

– The Prudent Man Rule required trust fiduciaries to invest trust assets like a prudent individual would invest their own assets.

– The UPIA requires trustees to consider a diversified portfolio approach based on modern portfolio theory and total return.

Understanding the Uniform Prudent Investor Act (UPIA)

The Uniform Prudent Investor Act was adopted in 1992 by the American Law Institute’s Third Restatement of the Law of Trusts, updating the Prudent Man Rule.

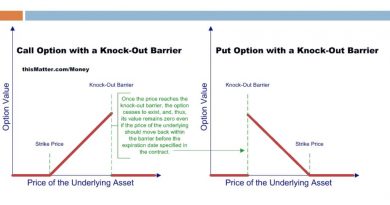

By adopting a total portfolio approach and removing category restrictions on investments, the UPIA allows for increased diversification in portfolios. It also allows trustees to include investments such as derivatives, commodities, and futures. While these investments have higher risk individually, they can potentially reduce overall portfolio risk and increase returns in a total portfolio context.

The Prudent Man Rule

The Prudent Man Rule, based on Massachusetts common law, was written in 1830 and revised in 1959. It required trust fiduciaries to invest trust assets prudently, considering the needs of beneficiaries, the preservation of the estate, and the need for income.

A prudent investment may not always be highly profitable, and no one can predict investment outcomes with certainty.

The Uniform Prudent Investor Act’s Updates to the Rule

The Uniform Prudent Investor Act made four main changes to the previous Prudent Man Rule:

– The prudence of an individual investment is determined by considering the entire investment portfolio. As long as an investment aligns with the portfolio or investment objectives, the fiduciary is not liable for individual investment losses.

– Diversification is explicitly required for prudent fiduciary investing.

– No investment category or type is inherently imprudent. Suitability to the portfolio’s needs is considered. Junior lien loans, limited partnerships, derivatives, futures, and similar investment vehicles are now possible. However, speculation and excessive risk-taking are not sanctioned and may result in liability.

– A fiduciary can delegate investment management and other functions to qualified third parties.

The most significant change of the Uniform Prudent Investor Act is applying the standard of prudence to any investment in the context of the total portfolio, rather than individual investments.