Fully Amortizing Payment Definition Example Vs Interest-Only

Contents

- 1 Fully Amortizing Payment: Definition, Example, Vs. Interest-Only

- 1.1 What Is a Fully Amortizing Payment?

- 1.2 Understanding a Fully Amortizing Payment

- 1.3 Fully Amortized Loan Payment Example

- 1.4 Pros and Cons of Fully Amortized Loans

- 1.5 Other Types of Loan Payments

- 1.6 FAQs

- 1.7 What Is a Fully Amortizing Loan?

- 1.8 What Is an Amortization Schedule?

- 1.9 Can You Pay Off a Fully Amortizing Loan Early?

Fully Amortizing Payment: Definition, Example, Vs. Interest-Only

What Is a Fully Amortizing Payment?

A fully amortizing payment is a periodic repayment on a debt that ensures the debt is fully paid off by the end of its set term. For fixed-rate loans, each fully amortizing payment is an equal dollar amount. For adjustable-rate loans, the payment changes with the interest rate.

Key Takeaways

- A fully amortizing payment ensures the debt is fully paid by the end of the loan term.

- Fully amortizing payments are typical for self-amortizing loans.

- Traditional fixed-rate mortgages usually have fully amortizing payments.

- Interest-only payments are the opposite of fully amortizing payments.

Understanding a Fully Amortizing Payment

Self-amortizing loans, like mortgages, have fully amortizing payments. Homebuyers can use an amortization schedule provided by their lender to see how much they’ll pay in interest over the loan’s life.

Fully amortizing payments vs. interest-only payments

Interest-only payments are the opposite of fully amortizing payments. If a loan allows for interest-only payments early in the loan term, the fully amortizing payments later in the term will be higher. This is typical for adjustable-rate mortgages. For example, a borrower who only pays interest on a $250,000 mortgage for the first five years will have higher fully amortizing payments later on.

Here’s an example: A borrower takes out a $250,000 adjustable-rate mortgage with a 30-year term and a 4.5% interest rate. For the first five years, they pay only interest, which results in a monthly payment of $937.50. After the initial period, the monthly payment increases to $1,949.04 to cover both principal and interest.

Important

Refinancing an interest-only adjustable-rate mortgage before the rate adjusts can help avoid a significant increase in monthly payments.

Fully Amortized Loan Payment Example

For example, a borrower takes out a 30-year fixed-rate mortgage of $250,000 with a 4.5% interest rate. Their monthly payment is $1,266.71. At the beginning of the loan, most of the payment goes towards interest, but near the end, most of it goes towards the principal. By making the required monthly payments, the loan will be fully paid off by the end of the term.

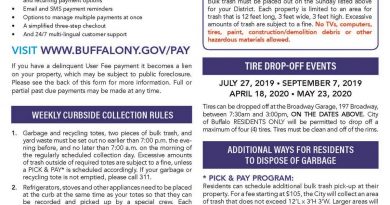

Below is an example of an amortization schedule for the first and last five years of the loan:

First 5 Years:

| Nov 2021 | $1,266.71 | $329.21 | $937.50 | $937.50 | $249,670.79 |

| Dec 2021 | $1,266.71 | $330.45 | $936.27 | $1,873.77 | $249,340.34 |

| Jan 2022 | $1,266.71 | $331.69 | $935.03 | $2,808.79 | $249,008.65 |

Last 5 Years:

| Oct 2046 | $1,266.71 | $1,008.14 | $258.58 | $197,959.70 | $67,945.72 |

| Nov 2046 | $1,266.71 | $1,011.92 | $254.80 | $198,214.49 | $66,933.80 |

| Dec 2046 | $1,266.71 | $1,015.71 | $251.00 | $198,465.50 | $65,918.09 |

As the loan term progresses, more of the monthly payments go towards principal, resulting in a decrease in the loan balance over time.

Note

Your amortization schedule may also show payments for homeowners’ insurance or property taxes if they are included in your loan payments.

Pros and Cons of Fully Amortized Loans

The main advantage of fully amortized loans is the ability to see how your payment is divided each month. This makes budgeting easier, especially with fixed-rate loans.

The chief disadvantage is that most of your initial payments go towards interest, resulting in slower equity building in the early years of the loan.

If you’re considering refinancing, it’s important to calculate the breakeven point with a fully amortizing loan to determine if it’s the right choice.

Other Types of Loan Payments

Borrowers may have the option to make other types of payments on their loans. For example, payment option ARMs offer different payment options, including fully amortizing payments, interest-only payments, and minimum payments. While minimum payments could result in a larger loan balance, fully amortizing payments keep you on track to pay off the loan in the desired term.

Warning

Using only the minimum payment option could result in negative amortization and a larger loan balance.

FAQs

What Is a Fully Amortizing Loan?

A fully amortizing loan is a loan that is repaid in full, including principal and interest, within the specified term. Borrowers make periodic payments that ensure the loan’s full repayment by the end of the term.

What Is an Amortization Schedule?

An amortization schedule shows how payments are applied to the principal and interest on a loan over time. For fully amortized loans, interest payments are higher in the early years, while more of the payment goes towards the principal as the loan term progresses.

Can You Pay Off a Fully Amortizing Loan Early?

Yes, if your lender allows it. Paying off a fully amortized loan before the term ends can save money on interest. However, some lenders may charge a prepayment penalty to compensate for lost interest.