Up-and-Out Option What it is How it Works Example

Contents

Up-and-Out Option: Overview and Example

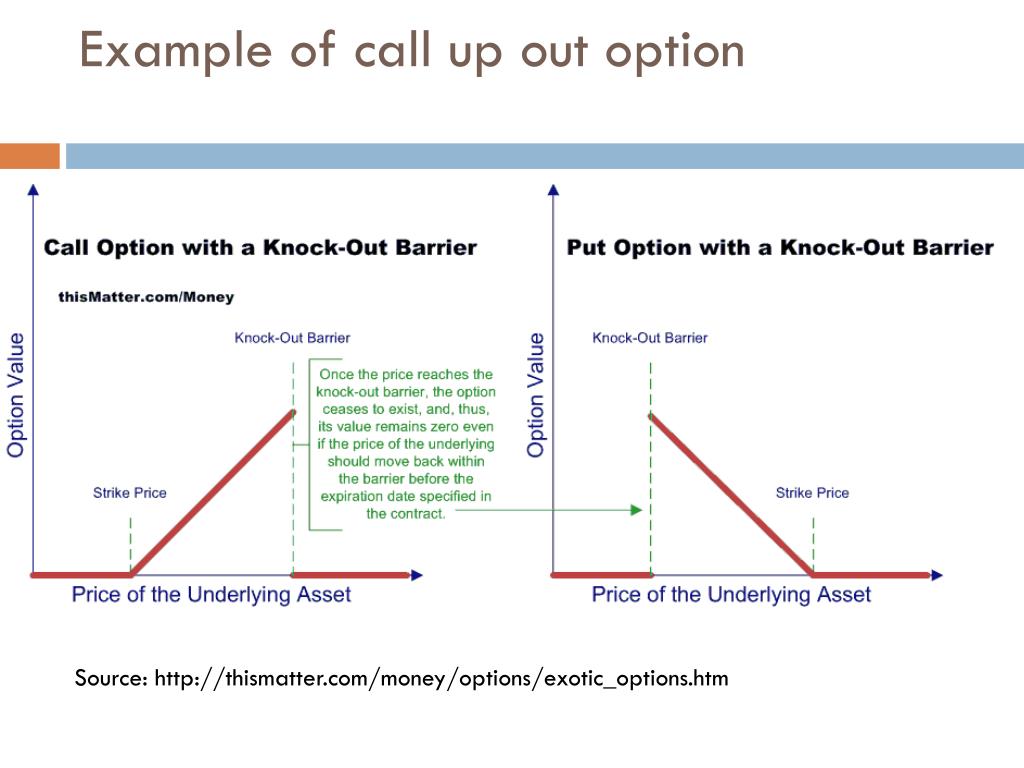

An up-and-out option is a knock-out barrier option that becomes nullified when the price of the underlying security exceeds a specific barrier price.

If the price doesn’t surpass the barrier level, the option functions like any other option, giving the holder the right but not the obligation to exercise their call or put option at the specified strike price before the contract’s expiration.

Key Takeaways

- An up-and-out option ceases to exist when the underlying asset exceeds a defined barrier.

- A down-and-out option is similar, vanishing when the underlying drops below the barrier price.

- Up-and-out options are generally cheaper than vanilla options due to the possibility of being knocked out (rendering them worthless).

Understanding Up-and-Out Options

Up-and-out options and down-and-out options are two types of knock-out barrier options. They come as put or call varieties and are considered exotic options. In a barrier option, the payoff and existence of the option rely on whether the underlying asset reaches a predetermined price or not.

If the underlying touches the barrier at any point during the option’s life, the knock-out nullifies the option, even if the underlying subsequently returns below the pre-knock-out levels.

For instance, if an up-and-out option with a strike price of $80 and a knock-out price of $100 reaches $100 before becoming exercisable, it becomes worthless. Its fate is sealed by exceeding or reaching the barrier level, irrespective of the underlying’s subsequent trading.

Barriers can also serve as knock-in options, which gain value only when the underlying reaches a specified price.

Down-and-out options, like up-and-outs, vanish if the underlying slips below the barrier price. Both types of options can be calls or puts.

Applications of Up-and-Out Options

Institutions and market makers create up-and-out options through direct agreements with clients. Portfolio managers, for example, might employ these options as a cost-effective hedge against losses on short positions. However, they provide imperfect protection if the security price rises above the barrier.

Pricing depends on standard option metrics, with the knock-out feature introducing an extra dimension. Limited liquidity is typically present for these over-the-counter traded instruments. Buyers must accept the premium offered or attempt to negotiate a better price with the seller. Generally, up-and-out call options have lower premiums compared to vanilla call options with identical strike and expiration.

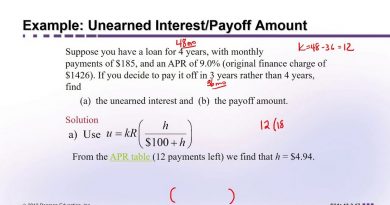

Example of an Up-and-Out Option

Suppose an institutional investor wants to buy calls on Apple Inc. (AAPL), believing the price will rise. They require 100 contracts but aim to minimize costs. They consider purchasing an up-and-out option, which tends to be cheaper than similar vanilla calls.

If Apple trades at $200, and the investor expects the price to rise above that but likely not exceed $240 in the next three months, they might opt for an at-the-money up-and-out option with a $200 strike, three-month expiration, and $240 knock-out level.

A three-month vanilla option with a $200 strike trades at $11.80 ($1,180 per contract). Buying 100 contracts totals $118,000.

The investor receives an offer from an investment bank for an up-and-out option at $8.80, amounting to $88,000 ($8.80 x 100 shares x 100 contracts). This saves $30,000 on premiums.

The investor breaks even at $208.80 ($200 + $8.80). Apple’s price must exceed this level within the next three months for the investor to recover their option costs, profiting if the price remains below $240.

If Apple reaches $240 before expiration, the options vanish, causing the investor to lose the $88,000 premium paid.