Underwriting Fees in Insurance Meaning and Examples

Contents

Underwriting Fees in Insurance: Meaning and Examples

What Are Underwriting Fees?

Underwriting fees are collected by underwriters for performing underwriting services in various markets including investments, mortgages, and insurance.

Key Takeaways

- An underwriter is a financial firm that takes on risks, such as loans, insurance, or investments, in exchange for a fee.

- An underwriting fee is a payment that a firm receives for taking on the risk.

- With securities underwriting, a firm earns a fee for underwriting a public offering or placing an issue in the market.

- In addition to securities, underwriters are commonly used in the mortgage and insurance industries.

How Underwriting Fees Work

In capital markets, underwriting fees are collected by underwriters who administer the issuing and distributing of financial instruments. For example, when a company issues stock, bonds, or publicly traded securities, it hires an underwriter.

The issuing company and the underwriter work closely together to determine the offering price. After determining the offer structure, underwriters assemble a group of investment banks and brokerage firms that commit to selling a certain percentage of the offering. After an underwriting agreement is struck, the underwriter bears the risk of being unable to sell the underlying securities and the cost of holding them on its books. Once the underwriter ensures the sale of all shares in the offering, it closes the offering by purchasing all the shares from the company (if it is a guaranteed offering), and the issuer receives the proceeds minus the underwriting fees, usually 3.5 to 7 percent of the capital raised.

Underwriters or underwriter syndicates earn fees for negotiating and managing the offering, assuming the risk of buying the securities when no one else will, and managing the sale of the shares.

Underwriting Fees for Mortgage Underwriters

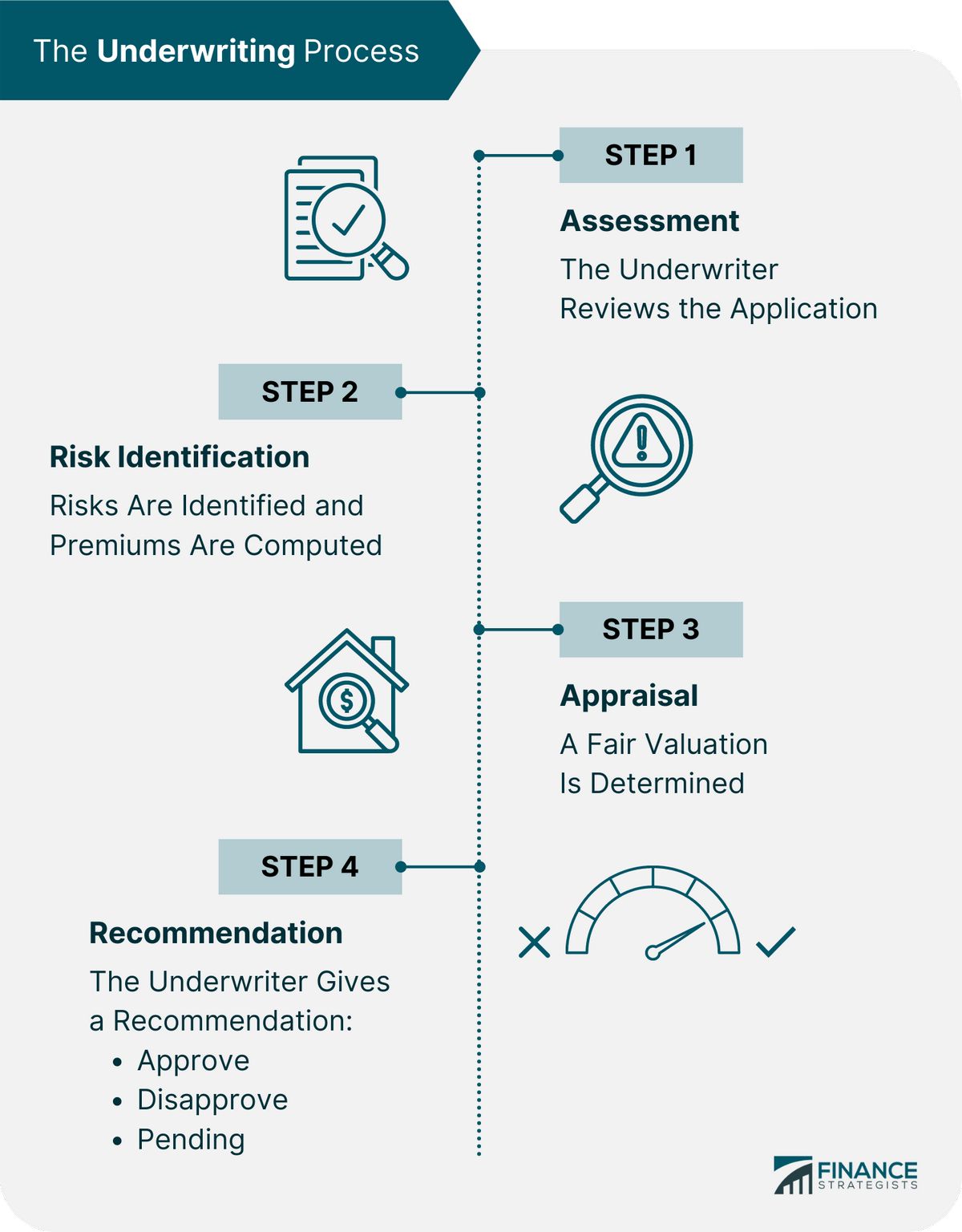

A mortgage underwriter earns fees by evaluating and verifying mortgage loan applications and either approving or denying the loan.

An underwriting fee for evaluating the loan application is a nonrecurring fee that the lender may charge in lieu of or in addition to an origination fee. Origination fees cover costs associated with obtaining a loan and may include administrative services like loan processing and mortgage broker fees. Other loan fees can include an appraisal, a credit report, flood certification, and a tax service fee. When charged separately from origination, underwriting costs range from $400 to $900, depending on the lender and loan type.

Underwriting Fees for Insurance Underwriters

Insurance underwriters collect fees for identifying and calculating a policyholder’s risk of loss and writing policies to cover these risks. Their job is to protect the company’s book of business from potential losses and issue insurance policies at an appropriate premium.