Understanding Financial Risk Plus Tools to Control It

Contents

- 1 Understanding Financial Risk and Tools to Control It

- 1.1 What Is Financial Risk?

- 1.2 Understanding Financial Risks for Businesses

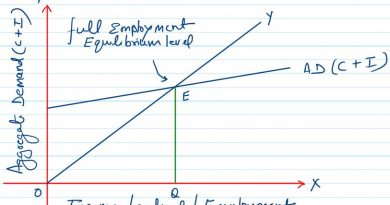

- 1.3 How Governments Offset Financial Risk

- 1.4 The Impact of Financial Risks on Markets

- 1.5 How Financial Risks Impact Individuals

- 1.6 Pros and Cons of Financial Risk

- 1.7 Tools to Control Financial Risk

- 1.8 Real-World Example of Financial Risk

- 1.9 How Do You Identify Financial Risks?

- 1.10 How Do You Handle Financial Risk?

- 1.11 Why Is Financial Risk Important?

- 1.12 Is Financial Risk Systematic or Unsystematic?

- 1.13 The Bottom Line

Understanding Financial Risk and Tools to Control It

What Is Financial Risk?

Financial risk is the possibility of losing money on an investment or business venture. Common financial risks include credit risk, liquidity risk, and operational risk.

Financial risk can result in the loss of capital for interested parties. For governments, it can lead to a lack of control over monetary policy and default on debt. Corporations can face default on debt and financial burdens.

Key Takeaways

- Financial risk relates to losing money.

- The most commonly referred financial risk is inadequate cash flow to meet obligations.

- Financial risk can apply to governments that default on bonds.

- Credit risk, liquidity risk, asset-backed risk, foreign investment risk, equity risk, and currency risk are common forms of financial risk.

- Financial risk ratios can help assess a company’s prospects.

Understanding Financial Risks for Businesses

Financial markets face risk due to macroeconomic forces, market interest rate changes, and the possibility of default. Individuals face risk when they jeopardize their income or ability to pay debt.

Financial risks are prevalent and come in many forms, affecting nearly everyone. Being aware of financial risks can help mitigate harm and reduce negative outcomes.

Building a business is expensive, and seeking funding creates risk for the business and investors or stakeholders.

Credit risk, or default risk, is the danger associated with borrowing money. Defaults can lead to decreased income and increased costs for creditors.

Specific risk occurs when a company or small group of companies face issues related to capital structure and exposure to default.

Operational risk occurs when a business has poor management or flawed financial reasoning.

There are at least five types of financial risk: market risk, credit risk, liquidity risk, operational risk, and legal risk.

How Governments Offset Financial Risk

Financial risk for governments refers to losing control of monetary policy and defaulting on debt.

Governments issue debt in the form of bonds and notes to fund operations and infrastructure projects. Defaulting on debt leads to financial risk for investors and stakeholders.

The Impact of Financial Risks on Markets

Financial risks are tied to financial markets. They can impact overall market wellbeing and cause businesses to close, investors to lose money, and governments to rethink monetary policy.

Volatility creates uncertainty about market asset values. Changes in market interest rates and defaults can also pose financial risk.

Asset-backed risk involves volatility in asset-backed securities due to changes in the underlying securities’ value.

In 2021, the U.S. high yield default rate finished at a record low of 0.5%.

How Financial Risks Impact Individuals

Individuals face financial risk when they make poor decisions. Liquidity risk and speculative risk are two common risks faced by individuals.

Liquidity risk involves securities that cannot be quickly bought or sold. It can affect market liquidity and funding liquidity.

Speculative risk occurs when there is uncertainty about the chance of profit or gain.

Currency risk and foreign investment risk also impact individuals who hold foreign currencies and invest in foreign markets.

Pros and Cons of Financial Risk

Financial risk is neither inherently good nor bad but exists to different degrees. Understanding financial risk can lead to better decisions. It can be identified and assessed using analysis tools.

However, financial risks can stem from uncontrollable outside forces and are difficult to overcome.

Tools to Control Financial Risk

There are tools available to calculate financial risk. Investment professionals use fundamental, technical, and quantitative analysis methods.

Hedging techniques can help reduce exposure to various risks. Statistical and numerical analysis are useful for identifying potential risk.

Real-World Example of Financial Risk

The closure of Toys "R" Us in 2018 exemplifies the financial risk associated with debt-heavy buyouts. The company’s bankruptcy stemmed from a leveraged buyout and high levels of debt.

How Do You Identify Financial Risks?

Identifying financial risks involves reviewing corporate balance sheets and comparing metrics to other companies. Statistical analysis techniques can be used.

How Do You Handle Financial Risk?

Financial risk can be mitigated by holding insurance, diversifying investments, maintaining emergency funds, and having different income streams.

Why Is Financial Risk Important?

Understanding and mitigating financial risk is crucial for long-term success. It allows companies to accomplish finance-related objectives and yield better returns.

Is Financial Risk Systematic or Unsystematic?

Financial risk impacts every company, but its severity depends on the operations and capital structure. Therefore, financial risk is an example of unsystematic risk.

The Bottom Line

Financial risk occurs across businesses, markets, governments, and individual finance. Fundamental, technical, and quantitative analysis can help forecast and mitigate risk.