Understanding Notional Value and How It Works

Contents

- 1 Understanding Notional Value and How It Works

- 1.1 What Is Notional Value?

- 1.2 Understanding Notional Value

- 1.3 Uses in Swaps, Options, and Foreign Currencies

- 1.4 Example of Notional Value

- 1.5 Why Is Notional Value Important?

- 1.6 Difference Between Notional and Market Value

- 1.7 Notional Value vs. Face Value

- 1.8 Value to Hedge Against an Asset Exposure

- 1.9 Effective Notional Amount of an Investment

- 1.10 The Bottom Line

Understanding Notional Value and How It Works

What Is Notional Value?

Notional value is often used by derivatives traders to refer to the total value of the underlying asset in a contract. It can be the total value of a position, how much value a position controls, or an agreed-upon amount in a contract. Put simply, it is the face value used to determine payments on a financial asset. This term is used when describing derivative contracts in the options, futures, forwards, and currency markets.

Key Takeaways

- Notional value refers to the total value of the underlying asset in a contract.

- Notional value is the same as face value, used to determine payments on a financial asset.

- Derivative contracts have a higher notional value than market value due to leverage.

- Notional value is important in assessing portfolio risk and determining hedge ratios.

- Notional value is applicable to interest rate swaps, total return swaps, equity options, and foreign currency derivatives.

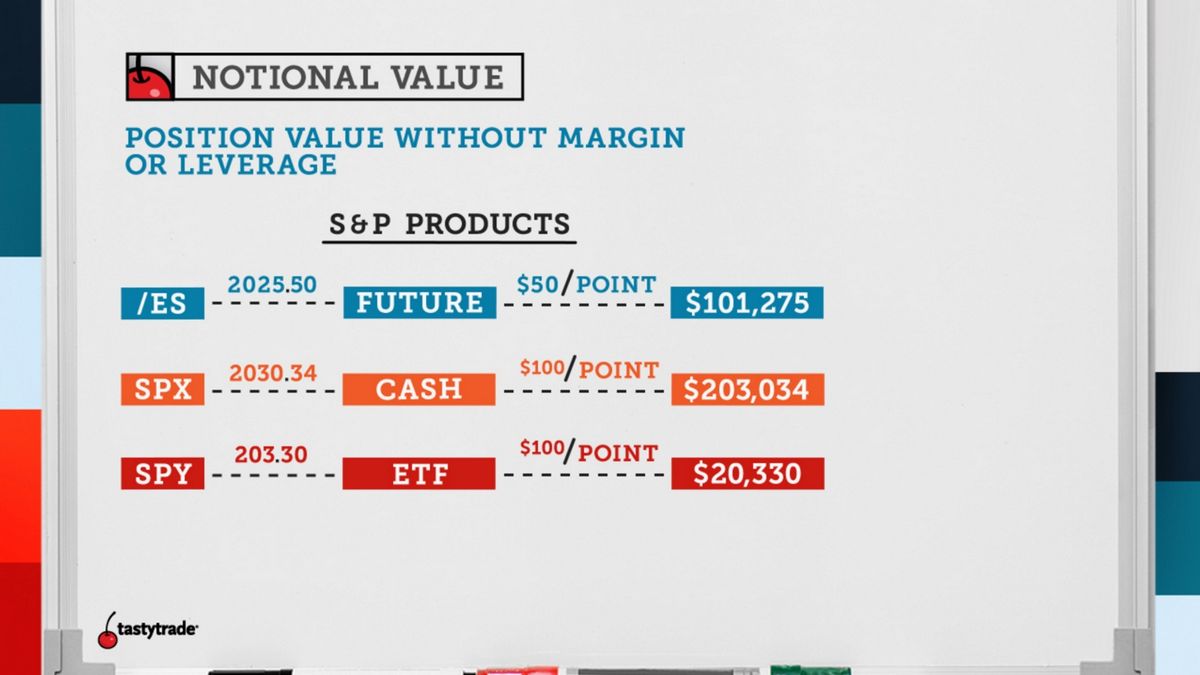

Understanding Notional Value

Notional value is the total value of a position in a financial instrument, such as a derivatives trade. It distinguishes the total value of a trade from the market value or cost of taking the trade.

There is a clear distinction between the two: notional value accounts for the total value of the position, while the market value is the price at which that position can be bought or sold.

Calculating Notional Value

Notional value can be calculated as NV = CS × UP, where NV = Notional Value, CS = Contract Size, and UP = Underlying Price.

The notional value of derivative contracts is higher than the market value due to leverage. Leverage allows someone to control a larger amount with a small investment. The amount of leverage used can be calculated by dividing notional value by market value, L = NV ÷ MV, where L = Leverage, NV = Notional Value, and MV = Market Value.

Notional value is integral in assessing portfolio risk and determining hedge ratios. For example, if a fund has a $1 million exposure to U.S. equity markets and wants to offset the risk using E-mini S&P 500 futures contracts with a notional value of $140,000 each, the hedge ratio would be HR = CER ÷ NVRUA, where HR = Hedge Ratio, CER = Cash Exposure Risk, and NVRUA = Notional Value of Related Underlying Asset. In this case, the hedge ratio would be 7.14.

Uses in Swaps, Options, and Foreign Currencies

Notional value applies to interest rate swaps, total return swaps, equity options, and foreign currency derivatives.

Swaps

In interest rate swaps, the notional value is the specified value upon which interest rate payments will be exchanged. The notional value is used to calculate the amount of interest due. Typically, the notional value is fixed during the contract’s life.

Total return swaps involve payments based on a floating or fixed rate multiplied by a notional value amount plus the decrease or appreciation in notional value.

Equity Options

Notional value in an option refers to the value that the option controls. For example, if ABC trades for $20 and a particular call option costs $1.50, the notional value of the option would be $2,000.

Foreign Currency Exchange and Derivatives

In foreign exchange derivatives, the notional value depends on the common quoting convention of the currency pair. For example, trading in GBP/USD would have a notional value of £10,000,000, while trading in USD/JPY would have a notional value of $10,000,000. Counterparties may choose to use the secondary currency as the notional amount instead.

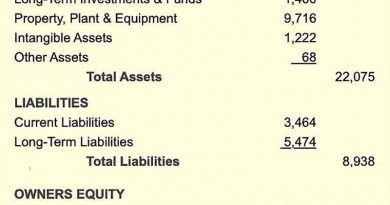

Example of Notional Value

A single COMEX Gold futures contract (GC) has a notional value of 100 times the market price of gold, while an E-mini S&P 500 Index futures contract has a notional value of 50 times the market price of the S&P 500 Index.

If someone buys an E-mini S&P 500 contract at 2,800, the notional value would be $140,000 ($50 × 2,800). However, the trader is only required to put up an initial margin, which is a fraction of the notional amount. The leverage used would be the notional amount divided by the price of buying the contract.

Why Is Notional Value Important?

Notional value is important in hedging against exposure to an underlying asset. It provides a baseline for measuring investments and determining hedge ratios.

Difference Between Notional and Market Value

Notional value refers to the value of the underlying asset, while market value is the current worth in the open market.

Notional Value vs. Face Value

Notional value and face value are the same and represent the full value of the underlying asset.

Value to Hedge Against an Asset Exposure

Investors should target the notional or face value to hedge against exposure to an asset. The cost of the hedge is typically a small fraction of the notional value.

Effective Notional Amount of an Investment

The effective notional amount is the face value minus the cost of any hedges. For example, if a long stock position worth $10,000 is hedged with an out-of-the-money put costing $250, the effective notional amount would be $9,750.

The Bottom Line

Notional value, or face value, represents the value of the underlying asset in a derivatives trade. It serves as a baseline for measuring investments and determining the effectiveness of hedges.