Macro Accounting What It is How it Works

Contents

Macro Accounting: What It is, How it Works

What Is Macro Accounting?

Macro accounting is the compilation of economic data for a nation. Also known as national accounting, the data form the basis for tracking and forecasting the nation’s economic performance and development and is used to form government policy.

Key Takeaways

- Macro accounting is the compilation and tracking of economic statistics for a nation.

- The statistics as a whole reveal the state of a nation’s economy and influence government policy moving forward.

- Many investors watch macroeconomic data for signs of the direction of sectors particularly sensitive to economic swings.

Understanding Macro Accounting

In macro accounting, the vital components of an entire economy rather than a single company or sector are calculated.

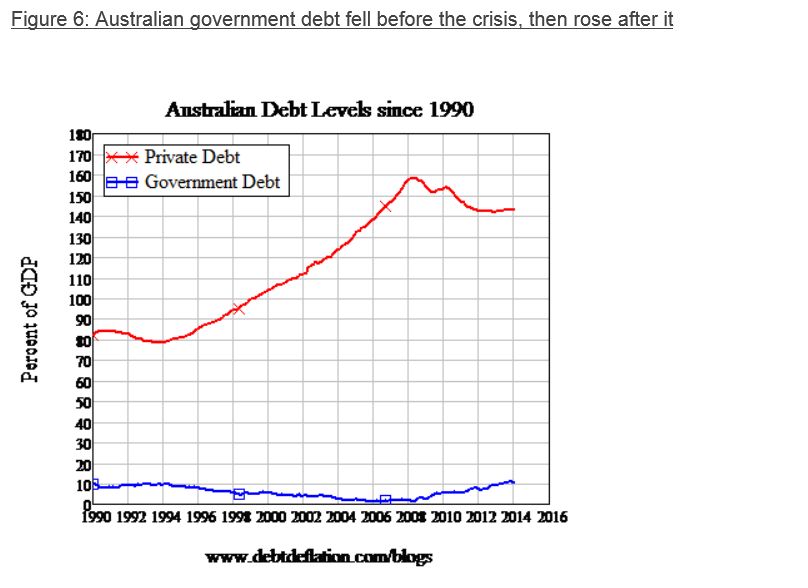

Economic health is gauged by aggregating and organizing national statistics and economic indicators including gross domestic product (GDP), external debt, imports and exports, employment, personal income, inflation, nonfarm payrolls, durable goods orders, and retail sales.

All of these are components of the macroeconomic data of a nation. The figures are released periodically, usually monthly or quarterly, by government departments charged with tracking the data.

U.S. Macro Economics

In the U.S., the Bureau of Economic Analysis (BEA) of the Department of Commerce conducts macro accounting, as do the Federal Reserve Bank, Department of Treasury, and Office of Management and Budget (OMB).

All of these departments release statistics closely watched by financial market participants and company decision-makers. The state of the economy is an inescapable factor in the performance of every company that is a part of it.

Macro accounting is also vital to economic policymakers who depend on reliable data to adjust the levers on a country’s economy and keep it moving forward.

International macro accounting standards were first established by the United Nations (UN) in 1953 with the publication of its System of National Accounts (SNA) guidebook.

Macro Accounting vs. Micro Accounting

As its name suggests, micro accounting focuses on the smaller picture. Rather than calculating the economic activity of an entire country, micro accounting is concerned with accounting at a personal or corporate level.

Microeconomics is typically used by companies and organizations to assess their individual economic health and helps them determine production levels and pricing, among other factors.

Pros and Cons of Macroeconomic Accounting

Investing legend Warren Buffett has mentioned on numerous occasions that macroeconomic forecasts have little bearing on the stocks he buys and sells. Several other high-profile investors have made similar comments. They prefer to focus on company-specific data rather than the general economy.

Completely ignoring the macroeconomic environment can be a bad move, though. The fate of many businesses and business sectors is closely tied to the health of the overall economy. Cyclical industries, such as luxury goods and travel, are particularly susceptible to shifts in the overall economy because consumers tend to use them only when they have sufficient disposable income. That is why macroeconomic data on disposable income are a key indicator of a flourishing economy.

Sectors highly dependent on credit to finance purchases and business investments are also at the mercy of macroeconomics as interest rate movements, often influenced by macro accounting, impact their borrowing costs.

The macro-environment tends to directly affect consumers’ ability and willingness to spend, meaning it can have a big bearing on the fate of more cyclical companies.

Ignoring the Numbers

Data from macro accounting are mostly used responsibly by those who formulate and implement fiscal and monetary policies.

However, there are times when data of far-reaching significance can be influenced by a political agenda. The OMB of the Executive Office of the President, for example, painted a much rosier picture of the growth of the national debt under the Tax Cuts and Jobs Act of 2017 than the non-partisan Congressional Budget Office and other authoritative voices in economics. In this case, the pessimistic views were dismissed and the Act passed.

However, there are times when data of far-reaching significance can be influenced by a political agenda. The OMB of the Executive Office of the President, for example, painted a much rosier picture of the growth of the national debt under the Tax Cuts and Jobs Act of 2017 than the non-partisan Congressional Budget Office and other authoritative voices in economics. In this case, the pessimistic views were dismissed and the Act passed.