Martingale System What It Is and How It Works in Investing

Contents

- 1 Martingale System: What It Is and How It Works in Investing

- 1.1 What Is the Martingale System?

- 1.2 Understanding the Martingale System

- 1.3 Basic Example of the Martingale System

- 1.4 Drawbacks of the Martingale System

- 1.5 The Martingale System In Forex Markets

- 1.6 Is the Martingale System Profitable?

- 1.7 Can You Use the Martingale System in Casinos?

- 1.8 What Causes the Martingale Strategy to Fail?

- 1.9 The Bottom Line

Martingale System: What It Is and How It Works in Investing

What Is the Martingale System?

The Martingale system of investing increases the dollar value of investments after losses. It was introduced by French mathematician Paul Pierre Levy in the 18th century. The strategy is based on the idea that one good bet or trade can turn your fortunes around.

This technique can be contrasted with the anti-martingale system, which involves halving a bet after a trade loss and doubling it after a gain.

Key Takeaways

- The Martingale system amplifies the chance of recovering from losing streaks.

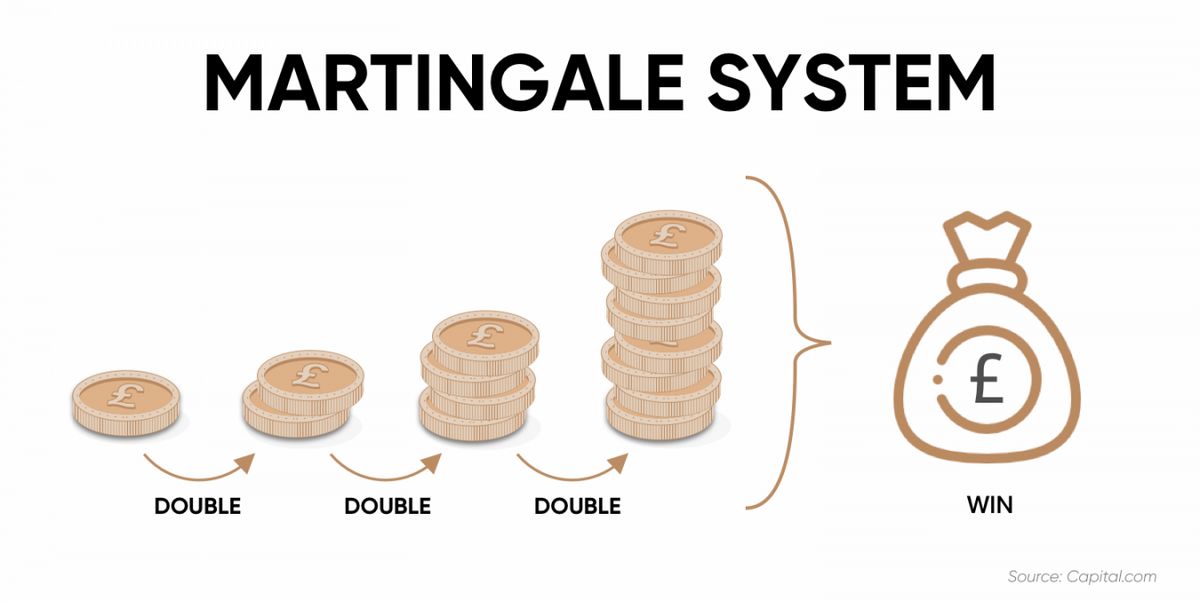

- The strategy involves doubling up on losing bets and reducing winning bets by half.

- It promotes a loss-averse mentality to improve the odds of breaking even, but also increases the chances of severe losses.

- The strategy is more suited to forex trading than stocks trading or casino gambling.

Understanding the Martingale System

The Martingale System (or Martingale Strategy) is a risk-seeking method of investing. The main idea is that statistically, you cannot lose all the time, so the amount allocated in investments should be increased even if they are declining in value, in anticipation of a future increase.

Martingale strategies rely on the theory of mean reversion. Without enough money to obtain positive results, missed trades can bankrupt an entire account. It’s important to note that the amount risked on the trade is far higher than the potential gain. Despite these drawbacks, there are ways to improve the Martingale Strategy and boost your chances of success.

The Martingale System is commonly compared to betting in a casino to break even. When using this method, a loss prompts doubling the size of the next bet with the hope of eventually winning.

This assumes an unlimited supply of money to bet or at least enough to make it to the winning payoff. If not, a few successive losses under this system could lead to losing everything.

Basic Example of the Martingale System

A basic example illustrates the strategy. Suppose you have a coin and engage in a betting game of either heads or tails with a starting wager of $1. Each flip is independent, so as long as you stick with the same call, you’ll eventually see the coin land on that side and recoup all your losses plus $1.

Drawbacks of the Martingale System

The Martingale System does not guarantee success for several reasons. For example, most exchanges limit trade size. At some point, you won’t be able to keep doubling your investment because of this limit. There are other drawbacks as well.

- The amount spent on trading increases rapidly with each successive trade.

- Each trade comes with transaction costs, which add to the money spent.

- The stock may stop trading or the company may go out of business.

- The risk is much higher than the reward, as you spend more with each loss, but the profit will only be equal to your initial investment.

- You can lose everything if you run out of money to invest.

Using the Martingale Strategy relies on mean reversion. However, the timeline for reversion is not reliable, and external factors can impact the market and the value of your investment. Like any investment strategy, the Martingale System carries risks and is not suitable for every investor.

The Martingale System In Forex Markets

Martingale trading is popular in the forex markets for several reasons. Currencies rarely drop to zero, unlike stocks. Even in cases of a sharp decline, currency value rarely reaches zero.

The FX market also allows traders to earn interest, so forex investors following the Martingale Strategy can offset some losses with interest income. For example, a Martingale trader can use the strategy on currency pairs in the direction of positive carry, borrowing from a low-interest-rate currency to buy one with a higher rate.

Is the Martingale System Profitable?

If you have the funds available to continue using the Martingale System until it works, you can make a profit. However, the risk to reward is not equal. You may have to invest large sums as you double your investment with each loss, resulting in a much lower eventual profit.

Can You Use the Martingale System in Casinos?

The Martingale System works best when there is an equal probability of two results occurring. If the outcome you are betting on does not have the same probability as all other outcomes, you are more likely to lose your bets than recover your losses.

What Causes the Martingale Strategy to Fail?

Successfully using the Martingale Strategy depends on having enough funds to continue investing (or betting) until you recover your losses. If you run out of money before that happens, or if you aren’t investing in an asset that can offset losses with interest income, the strategy will fail. The Martingale Strategy requires adequate capital to see it through until your investments experience a reversal.

The Bottom Line

The Martingale system amplifies the chance of recovering from losing streaks in investing or gambling. It involves doubling up on losing bets and reducing winning bets by half. The strategy assumes that a single investment cannot lose every time, so by increasing the investment, you’ll eventually earn back your money plus a profit.

The Martingale System promotes a loss-averse mentality to improve the odds of breaking even, but it also increases the chances of severe losses. The strategy is more well-suited to forex trading than stock trading or gambling in a casino.