Understanding a Special Needs Trust and Its Benefits

Understanding a Special Needs Trust and Its Benefits

What Is a Special Needs Trust?

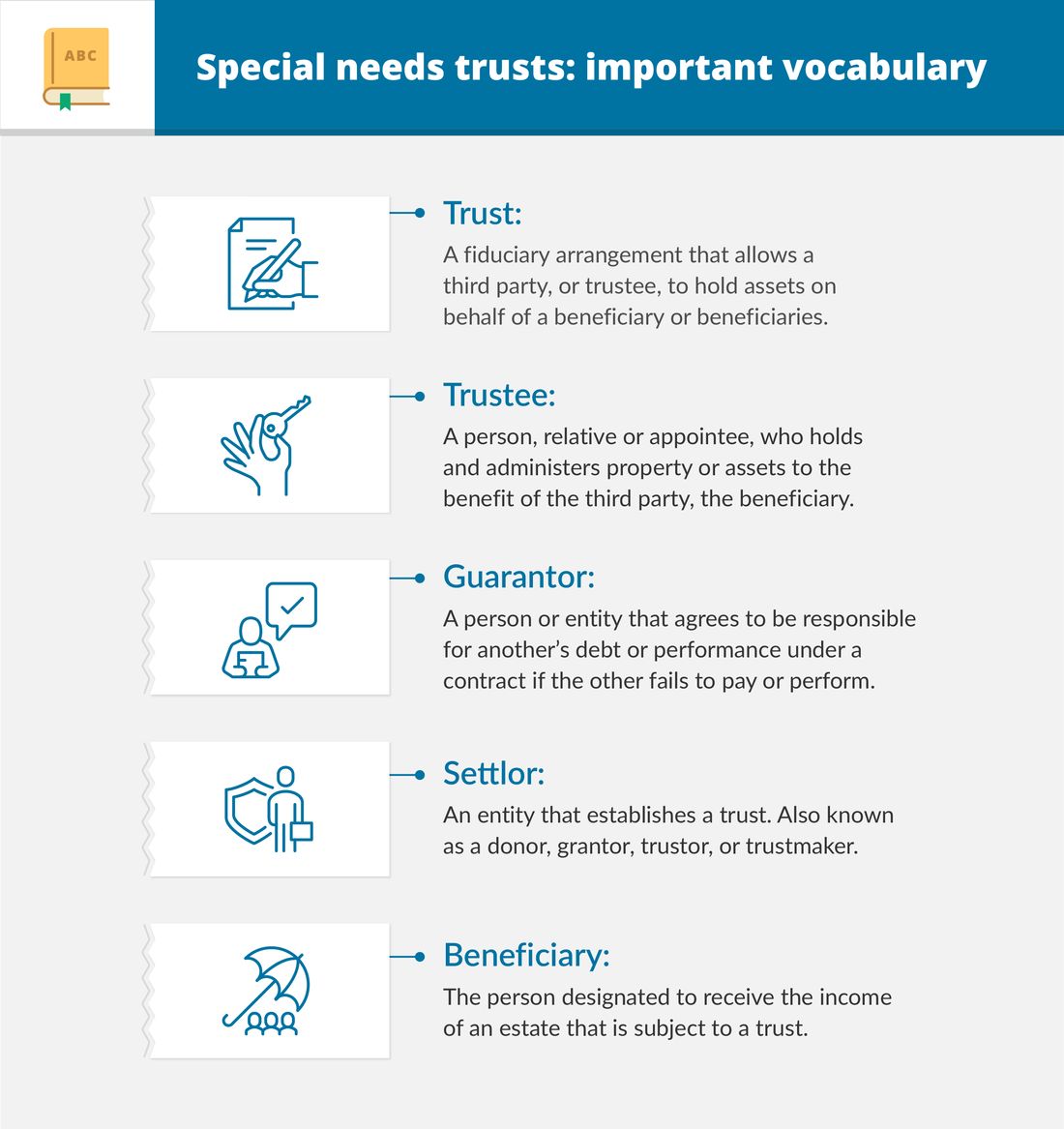

A special needs trust is a legal arrangement and fiduciary relationship that allows a physically or mentally disabled or chronically ill person to receive income without reducing their eligibility for public assistance disability benefits provided by Social Security, Supplemental Security Income (SSI), or Medicaid.

A grantor creates a trust and a trustee oversees the disbursement of assets. The trust will supplement the beneficiary’s government benefits but not replace them.

A special needs trust is a popular strategy for helping someone in need without risking their eligibility for programs that require their income or assets to remain below a certain limit.

Key Takeaways

– A special needs trust is a legal arrangement that provides funding to a physically or mentally disabled or chronically ill person.

– This trust allows for additional financial support without jeopardizing public assistance benefits.

– Public assistance programs like Social Security and Medicaid have income and asset restrictions, but trust funding does not count toward these qualifications.

How a Special Needs Trust Works

A special needs trust helps cover a person’s financial needs not covered by public assistance payments. Assets held in the trust do not count toward qualifying for public assistance.

Proceeds from this trust are commonly used for medical expenses, caretaker payments, and transportation costs. The grantor designates a trustee to control and manage the trust, including the disbursement of funds.

A third-party special needs trust, also known as a supplemental needs trust, is funded with assets belonging to someone other than the beneficiary. Funds belonging to the beneficiary cannot be used to fund the trust. Funding may come from gifts, inheritances, or life insurance proceeds.

A self-funded or first-person special needs trust allows individuals with disabilities to place their own money into the trust and still be eligible for certain benefits under SSI and Medicaid. These trusts only hold assets that belonged to the beneficiary before the funds were placed into the trust.

Assets originally belonging to the disabled individual placed into the trust may be subject to Medicaid’s repayment rules, but assets provided by third parties are not.

Special needs trusts are irrevocable, and funds designated for the beneficiary cannot be accessed by creditors or winners of lawsuits.

Benefits of a Special Needs Trust

Establishing a special needs trust benefits both parties. The beneficiary receives financial support without risking eligibility for income-restricted programs or services, while the contributor is reassured that the proceeds will go to specified expenses.

The trust’s terms must be defined carefully by the creator or their legal representative to ensure validity and clarity of directives and purpose.

The special needs trust must be established before the beneficiary turns 65. It is irrevocable, and its assets cannot be seized by creditors or winners of lawsuits.

When Do the Benefits of a Special Needs Trust End?

The trust ends upon the beneficiary’s death, and remaining assets go to the designated remainder beneficiaries. In self-funded trusts, the state’s Medicaid division is reimbursed for services provided, and any remaining assets usually pass to the beneficiary’s estate. In third-party trusts, the grantor decides who the remainder beneficiaries are.

What Kind of Assistance Does a Special Needs Trust Provide?

A special needs trust’s money will not jeopardize a recipient’s eligibility for public assistance if it only covers financial needs not provided by government funds. The trust money cannot be used for food or housing but can be used for caretakers, medical expenses, and transportation.

Is a Special Needs Trust Revocable?

No, a special needs trust is an irrevocable trust, meaning it cannot be modified, amended, or terminated without permission from the grantor’s beneficiaries. The trust’s assets are protected from seizure by creditors or winners of lawsuits.