Long-Term Assets Definition Depreciation Examples

Contents

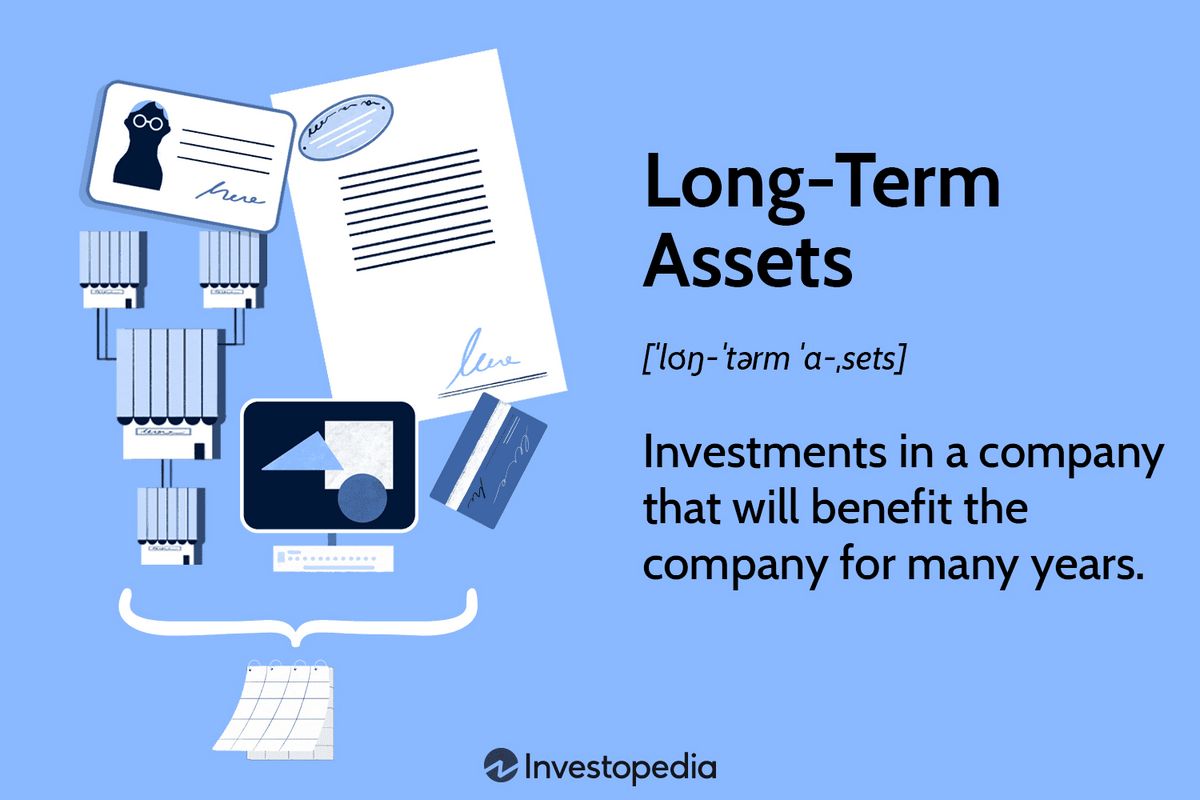

Long-Term Assets: Definition, Depreciation, Examples

What Are Long-Term Assets?

Long-term assets are assets, whether tangible or non-tangible, that will benefit the company for more than one year. Also known as non-current assets, long-term assets can include fixed assets such as property, plant, and equipment, as well as other assets like long-term investments, patents, copyright, franchises, goodwill, trademarks, trade names, and software.

Long-term assets are reported on the balance sheet and are usually recorded at their purchase price, so they may not reflect the current value of the asset. Long-term assets are different from current assets, which can be sold, consumed, used, or exhausted within a year.

Key Takeaways

- Long-term assets are investments that benefit the company for many years.

- Long-term assets can include fixed assets such as property, plant, and equipment, as well as intangible assets like long-term investments or a company’s trademark.

- Changes in long-term assets can indicate capital investment or liquidation.

Understanding Long-Term Assets

Long-term assets are held on a company’s balance sheet for many years. They can be tangible assets, like property, plant, and equipment, or intangible assets, like a company’s trademark or patent.

There is no standardized accounting formula that defines a long-term asset, but it is commonly understood that such an asset must have a useful life of more than one year.

Some examples of long-term assets include:

- Fixed assets like property, plant, and equipment, including land, machinery, buildings, fixtures, and vehicles

- Long-term investments, such as stocks, bonds, real estate, or investments in other companies

- Trademarks, client lists, patents

- Goodwill acquired in a merger or acquisition, considered an intangible long-term asset

Changes in long-term assets on a company’s balance sheet can indicate capital investment or liquidation. If a company is investing in long-term growth, it will use revenues to purchase more assets to drive future earnings. However, selling long-term assets can be a warning sign of financial difficulty, as it may be done to raise cash for short-term operational costs or debt payments.

Current vs. Long-Term Assets

The two main types of assets on a balance sheet are current and non-current assets. Current assets are assets likely to be converted into cash within one year. These assets fund ongoing operations and current expenses, such as accounts payable. Examples of current assets include cash, inventories, and accounts receivables.

Non-current assets are long-term assets with a useful life of more than one year, often lasting several years. These assets are less liquid and cannot be easily converted into cash.

Depreciation of Long-Term Assets

Depreciation is an accounting convention that allows companies to expense a portion of long-term operating assets used in the current year. It is a non-cash expense that increases net income and helps match revenues with expenses in the period they are incurred.

Long-term assets, like property, plant, and equipment, are included in a company’s long-term assets. However, a portion of these assets designated for depreciation (expensing) in the current year is excluded. Long-term assets may be depreciated using a linear or accelerated schedule and can provide a tax deduction for the company. Analysts often consider a company’s earnings before asset depreciation (e.g., EBITDA) to understand their financial situation, as depreciation can obscure the true value and impact of long-term assets on profitability.

Limitations of Long-Term Assets

Long-term assets can be expensive, requiring significant capital that can drain a company’s cash or increase its debt. Analyzing a company’s long-term assets can be limited because their benefits may not be seen for a long time, possibly years. Investors must trust the management team to plan the company’s future and allocate capital effectively.

Not all long-term assets drive earnings. For example, drug companies invest billions of dollars in research and development for new drugs, but only a few become profitable and reach the market.

When analyzing any financial metric, investors should take a holistic view of the company’s long-term assets. Utilizing multiple financial ratios and metrics is best for understanding a company’s financial situation.

Real World Example

Below is a portion of Exxon Mobil Corporation’s (XOM) balance sheet as of September 30, 2018.

- Exxon’s long-term assets are highlighted in green.

- The long-term assets are below the total of current assets, highlighted in blue.

- Exxon’s long-term assets include investments and long-term receivables totaling $40.427 billion for the period.

- Property, plant, and equipment totaled $249.153 billion, including the company’s oil rigs and drilling machinery.

- Other assets, including intangible assets, totaled $11.073 billion.

- Exxon’s total long-term assets for the period equaled $300.653 billion ($40.427 + $249.153 + $11.073).