Margin of Safety Examples Meaning and FAQ

Contents

- 1 Margin of Safety: Examples, Meaning, and FAQ

- 1.1 What Is Margin of Safety?

- 1.2 Understanding Margin of Safety

- 1.3 Example of Investing and Margin of Safety

- 1.4 Margin of Safety in Accounting

- 1.5 How Do You Calculate the Margin of Safety in Accounting?

- 1.6 What Is the Margin of Safety in Dollars?

- 1.7 Is the Margin of Safety the Same as the Degree of Operating Leverage?

Margin of Safety: Examples, Meaning, and FAQ

What Is Margin of Safety?

Margin of safety is an investing principle where an investor only purchases securities when their market price is significantly below their intrinsic value. In other words, when a security’s market price is significantly below its intrinsic value, the difference is the margin of safety. By buying securities with this difference, investors can minimize downside risk.

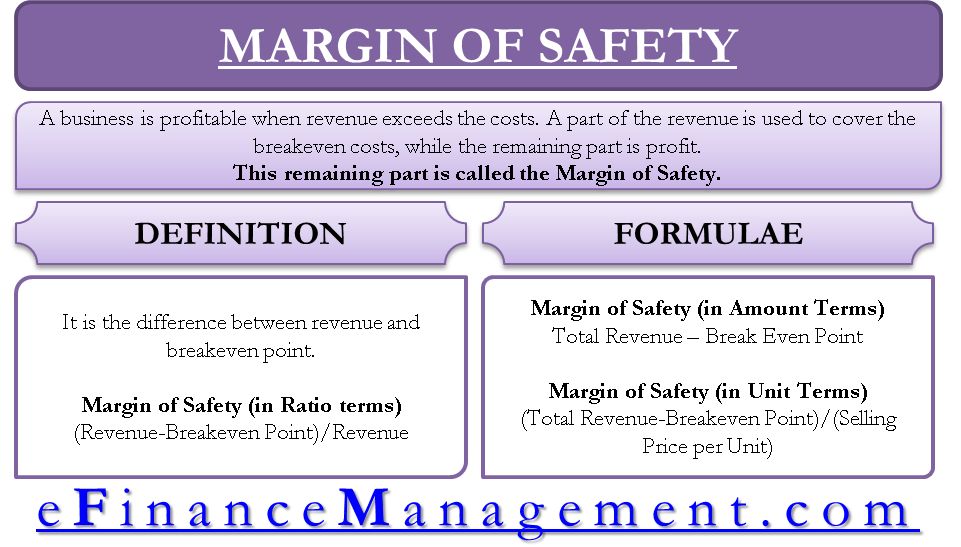

In accounting, the margin of safety, or safety margin, refers to the difference between actual sales and break-even sales. It helps managers understand how much sales can decrease before the company or a project becomes unprofitable.

Key Takeaways

- A margin of safety provides a cushion for potential losses without major negative effects.

- Investors use quantitative and qualitative factors to determine a security’s intrinsic value and then set a safety margin based on that value.

- Purchasing stocks at prices below their target price builds in a margin of safety in case estimates are incorrect.

- In accounting, the safety margin is built into break-even forecasts to allow for some leeway in those estimates.

Understanding Margin of Safety

The margin of safety principle was popularized by Benjamin Graham, a British-born American investor known as the father of value investing, and his followers, including Warren Buffett. Investors consider qualitative and quantitative factors to determine a security’s intrinsic value, and then compare it to the market price to calculate the margin of safety. Buffett, a staunch supporter of the margin of safety, often applies a 50% discount to a stock’s intrinsic value as his price target.

Considering a margin of safety when investing helps protect against errors in judgment or calculation. However, it doesn’t guarantee a successful investment because determining a company’s intrinsic value is highly subjective. Additionally, predicting a company’s earnings or revenue is notoriously difficult.

Example of Investing and Margin of Safety

Benjamin Graham’s principle was based on simple truths. He understood that a stock priced at $1 today could be valued at 50 cents or $1.50 in the future. Recognizing that the current valuation might be off, he concluded that buying a stock at a discount to its intrinsic value would limit his losses substantially. While there’s no guarantee that the stock’s price would increase, the discount provided the margin of safety needed to minimize losses.

For example, if Graham determined that XYZ’s intrinsic value is $162, below its share price of $192, he might apply a 20% discount and set a target purchase price of $130. This means he believes XYZ is fairly valued at $192, but he wouldn’t consider buying it above its $162 intrinsic value. To limit downside risk, he sets the purchase price at $130. Using this model, he might not be able to purchase XYZ stock in the foreseeable future. However, if the stock price declines to $130 for reasons other than a collapse in XYZ’s earnings outlook, he can buy it with confidence.

Margin of Safety in Accounting

As a financial metric, the margin of safety is the difference between current or forecasted sales and the break-even point. It’s sometimes expressed as a percentage value by dividing the aforementioned formula by current or forecasted sales. This figure informs a firm’s management about the cushion in actual or budgeted sales before incurring a loss.

How Do You Calculate the Margin of Safety in Accounting?

To calculate the margin of safety, subtract the break-even point from the actual or budgeted sales and then divide by the sales. The result is expressed as a percentage.

What Is the Margin of Safety in Dollars?

The margin of safety in dollars is calculated as current sales minus break-even sales.

Is the Margin of Safety the Same as the Degree of Operating Leverage?

The margin of safety is the difference between actual sales and break-even sales, while the degree of operating leverage (DOL) shows how a company’s operating income changes after a percentage change in sales.