U-Shaped Recovery What It Means How It Works and Examples

Contents

U-Shaped Recovery: Understanding the Concept and Examples

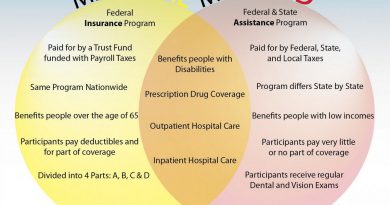

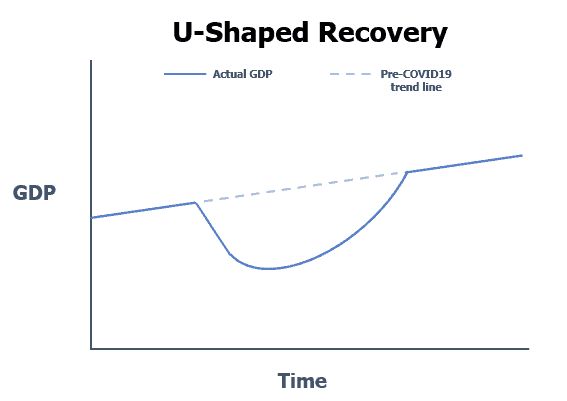

A U-shaped recovery is an economic recession and recovery that forms a U shape on a chart. This recovery is characterized by a sharp decline in economic measures such as employment, GDP, and industrial output, followed by a period of stagnation and then a gradual rise back to its previous peak. It is similar to a V-shaped recovery but takes longer to bounce back.

Key Takeaways

- A U-shaped recovery gets its name from the shape it takes on a chart during periods of economic decline and recovery.

- It occurs when a recession lasts longer and shows a more prolonged period of stagnation before the economy starts to recover.

- Examples of U-shaped recoveries include the 1973–75 Nixon recession and the 1990–91 recession following the S&L crisis.

Understanding U-Shaped Recovery

U-shaped recovery describes an economic recession and recovery that follows a U shape on a chart. It involves a significant decline in economic output, a longer period of stagnation compared to a V-shaped recovery, and a slower recovery out of the trough.

In the early stages of a U-shaped recovery, economists may mistakenly believe that the worst is over and the economy has bottomed out. However, the longer the recovery takes, the more severe the setback could be. Companies may struggle to meet their financial obligations and some may even have to declare bankruptcy.

During the recovery period, banks are usually hesitant to lend more money to businesses, and consumers hold off on spending until they see signs of economic improvement. This cautious behavior prolongs the recovery process, leading to higher unemployment rates.

In contrast, a V-shaped recovery quickly bounces back within a matter of weeks or months.

Other Common Recession Shapes

Economists use various shapes to describe different types of recessions. The most common recession shapes include U-shaped, V-shaped, W-shaped, and L-shaped.

- A V-shaped recession shows a steep decline followed by a swift recovery, considered the best-case scenario.

- W-shaped recessions initially recover, then experience another downturn before a full recovery, also known as double-dip recessions.

- L-shaped recessions fail to recover and remain in a prolonged downturn.

- K-shaped recessions demonstrate an uneven recovery, with some sectors bouncing back quickly while others lag behind.

Examples of U-Shaped Recessions

About half of the U.S. recessions since 1945 have been U-shaped, including the 1973–75 recession and the 1990–91 recession.

1973–1975: Nixonomics, the Gold Window, and Stagflation

The 1973–75 recession was a notable U-shaped recession in U.S. history. It began in early 1973 and lasted for two years, with the GDP dipping 3% at its lowest point before recovering in 1975.

This recession was caused by inflationary policies, including financing the Vietnam War and the Great Society welfare state expansion. Additionally, the abandonment of the gold standard led to economic instability.

The recession was marked by the following events:

- The 1973 oil crisis and increased oil prices

- The 1973–74 stock market crash

Although the economy recovered, unemployment remained high, and inflation persisted throughout the 1970s.

1990–1991: The Jobless Recovery

The 1990–91 recession, also referred to as the Jobless Recovery, resulted from the S&L crisis. Real estate lending boomed in the early 1980s, leading to a debt bubble that burst in the late 1980s.

The recession caused significant losses, debt deflation, and bank failures. While GDP experienced mild growth the following year, unemployment continued to rise until mid-1992, and total employment didn’t return to pre-recession levels until 1993.

Was the COVID Recession U-Shaped?

Economists have described the economic downturn caused by the COVID-19 pandemic as a K-shaped recovery. Some industries, like travel and hospitality, suffered greatly, while others, such as internet communications and online streaming, experienced positive growth.

U-Shaped vs. V-Shaped Recession

Both U- and V-shaped recessions feature a sharp decline followed by a recovery. The difference lies in the length of time the economy remains depressed at its lowest point. A V-shaped recession quickly rebounds, while a U-shaped recession stays at the trough for a longer period before recovery.

Duration of Recessions

In the United States, recessions have varied in length from as short as two months to over five years. Since 1980, the average recession lasted less than 10 months.

The Bottom Line

A U-shaped recession and recovery follow a pattern of initial decline, a prolonged period of stagnation, and a slower but eventual economic expansion. Identifying the bottom or anticipating further decline during the recovery can be challenging. Economists categorize U shapes into three stages: the recessionary part, the trough, and the slower but lasting recovery.

Economists categorize U shapes into three stages: the recessionary part, the trough, and the slower but more lasting recovery.