Medicare and Medicaid Fraud Meaning Examples

Contents

- 1 Medicare and Medicaid Fraud: Meaning, Examples

- 1.1 What Is Medicare and Medicaid Fraud?

- 1.2 Understanding Medicare and Medicaid Fraud

- 1.3 The Challenges of Fighting Medicare and Medicaid Fraud

- 1.4 The CARES Act of 2020

- 1.5 Examples of Medicare and Medicaid Fraud

- 1.6 How Do You Report Medicare or Medicaid Fraud?

- 1.7 Who Investigates Medicaid Fraud?

- 1.8 What Are the Penalties for Medicare and Medicaid Fraud?

- 1.9 The Bottom Line

Medicare and Medicaid Fraud: Meaning, Examples

What Is Medicare and Medicaid Fraud?

Medicare and Medicaid fraud refer to illegal practices aimed at getting unfairly high payouts from government-funded healthcare programs. Fraud involves deceit with the intention to gain illegally or unethically from government-sponsored healthcare programs.

Key Takeaways

- Medicare and Medicaid fraud can be committed by medical professionals, healthcare facilities, patients, and others.

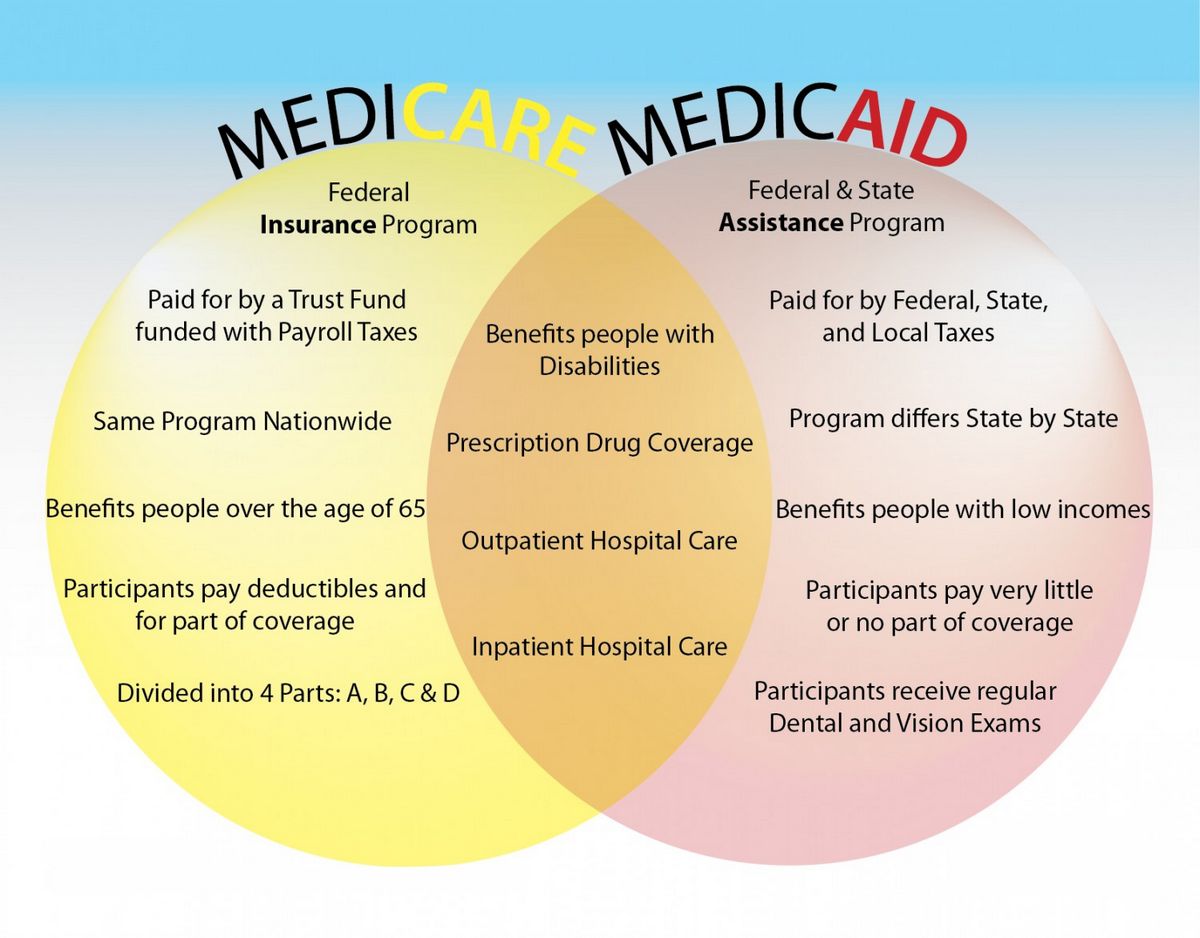

- Medicare and Medicaid are government programs to provide affordable healthcare to certain populations.

- Common examples of Medicare or Medicaid fraud include billing for services that weren’t provided, performing unnecessary tests, and receiving benefits when not eligible.

- The Medicaid Fraud Control Units, or MFCUs, operate in 49 states and the District of Columbia to investigate and oversee potential fraud.

- Combined, Medicare and Medicare fraud cost taxpayers over $146.5 billion per year.

Understanding Medicare and Medicaid Fraud

Medicare and Medicaid fraud can be committed by medical professionals, healthcare facilities, patients, or program participants, and outside parties pretending to be one of these parties.

There are many types of Medicare and Medicaid fraud, including:

- Billing for services that weren’t provided, through phantom billing and upcoding.

- Performing unnecessary tests or giving unnecessary referrals, known as ping-ponging.

- Charging separately for services that are usually charged at a package rate, called unbundling.

- Abusing or mistreating patients.

- Providing benefits to ineligible patients or participants through fraud or deception, or by not reporting financial information accurately.

- Filing claims for reimbursement to which the claimant is not entitled.

- Committing identity theft to receive services pretending to be an eligible person.

$60+ billion

Medicare fraud costs U.S. taxpayers over $60 billion annually.

The Challenges of Fighting Medicare and Medicaid Fraud

Medicare and Medicaid fraud are multibillion-dollar drains on an already expensive system. The overseeing departments have internal staff members and external auditors monitoring activities for fraud signs. Investigation and oversight related to fraud are conducted by Medicaid Fraud Control Units (MFCUs), operating in 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. Most MFCUs operate independently from the state’s Medicaid office.

In spring 2018, Medicare implemented a program to prevent fraud related to identity theft by issuing new ID cards with a Medicare Number instead of a Social Security number.

Detecting and preventing fraud is a top priority for those overseeing the programs. The funds lost to fraud and illegal tactics could be used to support participants genuinely in need.

$86.5 billion

Medicaid fraud is estimated to cost taxpayers around $86.5 billion in 2020.

The CARES Act of 2020

On March 27, 2020, President Trump signed the $2 trillion CARES (Coronavirus Aid, Relief, and Economic Security) Act. It expands Medicare’s coverage for COVID-19 treatment and services. The act also:

- Increases Medicare’s flexibility for covering telehealth services.

- Authorizes Medicare certification for home health services provided by physician assistants, nurse practitioners, and certified nurse specialists.

- Increases Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the CARES Act allows non-expansion states to use the program to cover COVID-19-related services for uninsured adults who would have qualified if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Examples of Medicare and Medicaid Fraud

One example of healthcare fraud is charging the government for medically unnecessary drugs, procedures, or tests to profit. In 2022, a Florida man who owned telemedicine platforms was sentenced to 14 years in prison for fraud costing Medicare over $20 million. He prescribed unnecessary genetic tests to Medicare beneficiaries in exchange for kickbacks, knowing that the genetic laboratories involved would bill Medicare for unnecessary goods and services.

Impersonating a licensed provider is another way of committing fraud. In 2022, a Texas woman used her ex-husband’s provider number to submit fraudulent claims to Medicaid for counseling services never provided, receiving over $600,000 in fraudulent claims.

How Do You Report Medicare or Medicaid Fraud?

If you witness or suspect Medicare or Medicaid fraud, report it anonymously by contacting the federal government’s tip line at 1-800-HHS-TIPS or online. State governments may also have their own Medicaid fraud tip lines.

Who Investigates Medicaid Fraud?

State Medicaid Fraud Control Units (MFCUs) investigate and prosecute Medicaid provider fraud, as well as abuse or neglect in healthcare facilities.

What Are the Penalties for Medicare and Medicaid Fraud?

Depending on the severity of the case, those found guilty of Medicare or Medicaid fraud can face prison time, fines, and become ineligible for future benefits. Medical professionals may also face further sanctions, such as license suspension.

The Bottom Line

Medicare and Medicaid fraud can be committed by medical professionals, healthcare facilities, patients, and others. Examples include billing for services not provided, performing unnecessary tests, and receiving benefits when not eligible. Combined, Medicare and Medicare fraud cost taxpayers over $146.5 billion per year.

Investigation and oversight of potential fraud are conducted by the Medicaid Fraud Control Units (MFCUs) operating in 49 states and the District of Columbia.