Risk Control What It Is How It Works Example

Risk control is a method by which firms evaluate potential losses and take action to reduce or eliminate threats. It utilizes findings from risk assessments to identify risk factors in a company’s operations, including technical and non-technical aspects, financial policies, and other issues that may affect the firm. Risk control implements proactive changes to reduce risk and is a key component of enterprise risk management.

Risk control works by identifying, assessing, and preparing for potential dangers that may interfere with an organization’s operations and objectives. It includes techniques such as avoidance, loss prevention, loss reduction, separation, duplication, and diversification. These methods help companies limit loss and minimize the impact of threats.

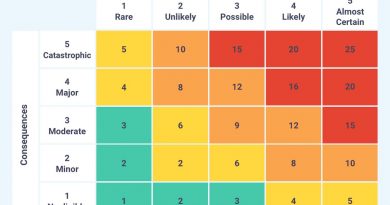

A Risk and Control Matrix (RACM) is a valuable tool used by organizations to understand and optimize their risk profiles. It helps companies identify, assess, and manage risks by mapping the relationships between potential risks and the corresponding control measures. The RACM includes components such as risk identification, risk assessment, control measures, control effectiveness, and action plans.

Examples of risk control in practice include Sumitomo Electric’s business continuity plans, British Petroleum’s post-oil spill risk management approach, and Starbucks’ supply chain strategies. These companies implement measures to minimize risk and protect their operations and stakeholders.

While risk control is an important aspect of risk management, it cannot eliminate all risks completely. Some risks are inherent in the business environment, and others may arise unexpectedly. The goal of risk control is to reduce the likelihood and potential impact of risks, build resilience, and maintain stability.

To identify emerging risks, companies can stay updated on industry trends, engage in scenario planning, utilize data analytics, promote open communication, and establish dedicated risk management teams. These strategies help anticipate and address potential risks on the horizon.

Risk control is closely related to corporate social responsibility (CSR). By implementing risk control measures, companies can minimize harm to stakeholders and align with ethical and sustainable business practices. Effective risk control also protects a company’s reputation and maintains public trust.

In conclusion, risk control is an essential part of modern business management. By implementing various techniques and strategies, companies can minimize exposure to risks, enhance resilience, and ensure long-term success and sustainability in an evolving business environment.