Triple Exponential Average TRIX Overview Calculations

Contents

Triple Exponential Average (TRIX): Overview, Calculations

What Is Triple Exponential Average (TRIX)?

The triple exponential average (TRIX) is a momentum indicator used by technical traders to show the percentage change in a moving average smoothed exponentially three times. TRIX filters out insignificant or unimportant price movements and is similar to the moving average convergence divergence (MACD).

Key Takeaways

- TRIX is used to identify oversold and overbought markets and is a momentum indicator.

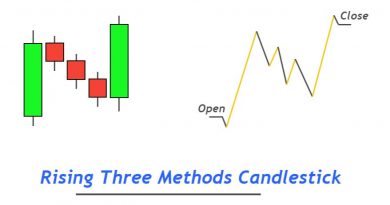

- Moving averages are smoothed three times to filter out insignificant price movements.

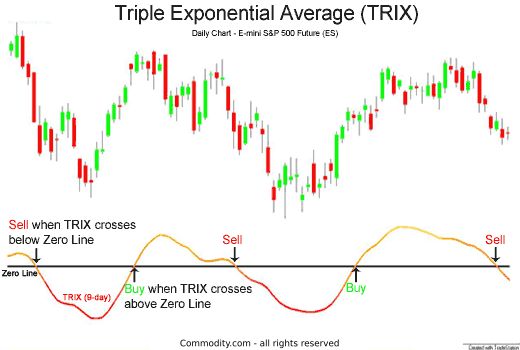

- When TRIX crosses above the zero line, it gives a buy signal, and when it closes below the zero line, it gives a sell signal.

Understanding Triple Exponential Average (TRIX)

Developed by Jack Hutson in the early 1980s, TRIX helps chartists spot diversions and directional cues in stock trading patterns. TRIX is similar to MACD but provides smoother outputs due to triple smoothing of the exponential moving average (EMA).

TRIX can be used to identify oversold and overbought markets and as a momentum indicator. It oscillates around a zero line, with extreme positive values indicating an overbought market and extreme negative values indicating an oversold market.

As a momentum indicator, positive TRIX values suggest increasing momentum, while negative values suggest decreasing momentum. When TRIX crosses above the zero line, it gives a buy signal, and when it closes below the zero line, it gives a sell signal. Divergence between price and TRIX can indicate significant turning points in the market.

Calculating TRIX

The exponential moving average of a price is derived from the expression:

EMA1(i) = EMA(Price, N, 1) where: Price(i) = Current price, EMA1(i) = The current value of the Exponential Moving Average

Next, the second smoothing of the average is executed:

EMA2(i) = EMA(EMA1, N, i)

The double exponential moving average is smoothed exponentially again to obtain the triple exponential average:

EMA3(i) = EMA(EMA2, N, i)

The TRIX indicator is found with:

TRIX(i) = (EMA3(i) – EMA3(i – 1)) / EMA3(i – 1)

TRIX(i) = (EMA3(i) – EMA3(i – 1)) / EMA3(i – 1)