Treynor Index What it Means How it Works Example

Contents

Treynor Index: What it Means, How it Works, Example

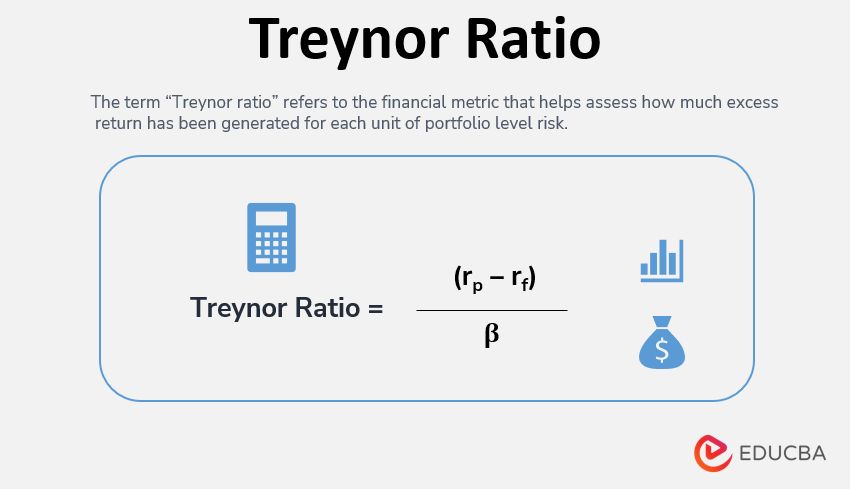

What Is the Treynor Index?

The Treynor Index measures the risk-adjusted performance of an investment portfolio by analyzing excess return per unit of risk. Excess return refers to the return earned above the return that could have been earned in a risk-free investment (although there are no true risk-free investments).

For the Treynor Index, market risk is measured using beta, which is a measure of overall market risk or systematic risk. Beta measures the tendency of a portfolio’s return to change in response to changes in return for the overall market. The higher the Treynor Index, the greater the excess return being generated by the portfolio per unit of overall market risk.

The Treynor Index is also known as the Treynor Ratio or the reward-to-volatility ratio.

Key Takeaways

- The Treynor Index measures the risk-adjusted performance of an investment portfolio by analyzing excess return per unit of risk.

- Excess return refers to the return earned above the return that could have been earned in a risk-free investment.

- For the Treynor Index, market risk is measured using beta, which is a measure of overall market risk or systematic risk.

Formula and Calculation of the Treynor Index

The formula for the Treynor Index/Ratio is:

Treynor Ratio = PR − RFR / PB where: PR = Portfolio return RFR = Risk free rate

What the Treynor Index Can Tell You

The Traynor Index indicates the return earned for the amount of risk assumed by an investment, such as a portfolio of stocks, a mutual fund, or exchange-traded fund. A higher Treynor Index means a more suitable investment. The index essentially expresses how many units of reward an investor is given for each unit of volatility experienced.

Like the Sharpe ratio which uses standard deviation rather than beta as the risk measure, the Treynor Index adjusts investment performance for risk to convey an accurate picture of performance. The Traynor Index was developed by economist Jack Treynor, one of the inventors of the Capital Asset Pricing Model (CAPM).

While a higher Treynor Index may indicate a suitable investment, investors must remember that it should not be the sole factor considered for investing decisions. Additionally, since the Treynor Index is based on historical data, it does not necessarily predict future performance.

Example of the Treynor Index

For example, assume Portfolio Manager A achieves an 8% portfolio return in a given year, when the risk-free rate of return is 5%, and the portfolio has a beta of 1.5. In the same year, Portfolio Manager B achieves a 7% portfolio return with a portfolio beta of 0.8.

The Treynor Index is therefore 2.0 for Portfolio Manager A and 2.5 for Portfolio Manager B. While Portfolio Manager A exceeded Portfolio Manager B’s performance by a percentage point, Portfolio Manager B actually had better risk-adjusted performance.

The Treynor Index is therefore 2.0 for Portfolio Manager A and 2.5 for Portfolio Manager B. While Portfolio Manager A exceeded Portfolio Manager B’s performance by a percentage point, Portfolio Manager B actually had better risk-adjusted performance.