Treynor Ratio What It Is What It Shows Formula To Calculate It

Treynor Ratio: What It Is and How to Calculate It

What Is the Treynor Ratio?

The Treynor ratio, also known as the reward-to-volatility ratio, measures the excess return generated for each unit of risk taken by a portfolio.

Excess return refers to the return earned above the return that could have been earned in a risk-free investment. Treasury bills are often used to represent the risk-free return in the Treynor ratio.

Risk in the Treynor ratio refers to systematic risk, measured by a portfolio’s beta. Beta measures the tendency of a portfolio’s return to change in response to changes in the overall market.

Key Takeaways

- The Treynor ratio adjusts a portfolio’s returns for systematic risk.

- A higher Treynor ratio means a more suitable investment.

- The Treynor ratio is similar to the Sharpe ratio, but uses beta to adjust returns.

The Treynor ratio was developed by Jack Treynor, an American economist and co-inventor of the Capital Asset Pricing Model (CAPM).

Understanding the Treynor Ratio

The Formula for the Treynor Ratio

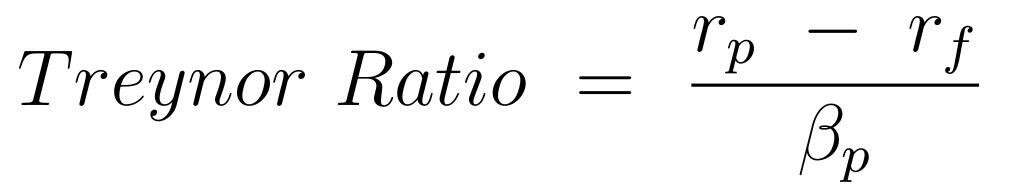

Treynor Ratio = rp – rf / βp where: rp = Portfolio return, rf = Risk-free rate, βp = Beta of the portfolio

What Does the Treynor Ratio Reveal?

The Treynor ratio is a risk-adjusted measurement of return based on systematic risk. It shows how much return an investment earned for the amount of risk assumed.

A negative beta renders the ratio result meaningless. A higher ratio result indicates a more suitable investment. However, the ratio is based on historical data and does not guarantee future performance, so other factors should also be considered for investing decisions.

How the Treynor Ratio Works

The Treynor ratio measures an investment’s success in compensating investors for taking on risk. It relies on a portfolio’s beta, which measures the sensitivity of its returns to market movements.

Diversification does not eliminate risk, so investors should be compensated for it.

Difference Between the Treynor Ratio and Sharpe Ratio

The Treynor ratio and Sharpe ratio both measure risk and return, but they differ in the way they calculate volatility. The Treynor ratio uses beta to measure volatility, while the Sharpe ratio uses the standard deviation of the portfolio returns.

Limitations of the Treynor Ratio

The main weakness of the Treynor ratio is its backward-looking nature. Future performance may differ from past performance. The accuracy of the ratio relies on appropriate benchmarks to measure beta.

Comparing investments using the Treynor ratio does not provide a clear ranking. A higher ratio is better, but there are no defined degrees of superiority.