Transfer Pricing What It Is and How It Works With Examples

Transfer Pricing: What It Is and How It Works, With Examples

What Is Transfer Pricing?

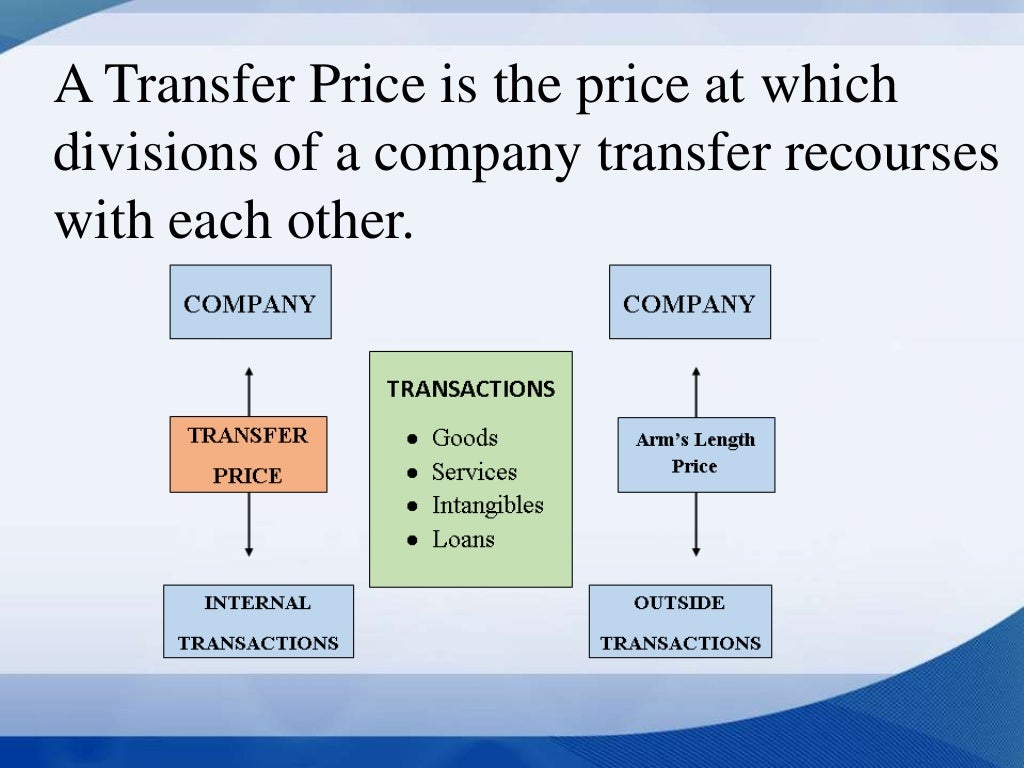

Transfer pricing is an accounting practice that represents the price that one division charges another for goods and services provided.

Transfer pricing allows for the establishment of prices for goods and services exchanged between subsidiaries, affiliates, or commonly controlled companies within the same enterprise. It can lead to tax savings, though tax authorities may contest it.

Key Takeaways

– Transfer pricing occurs when goods or services are exchanged between divisions of the same company.

– A transfer price is based on market prices for services rendered.

– Companies use transfer pricing to reduce the overall tax burden.

– Higher prices are charged in high-tax countries, while lower prices increase profits in low-tax countries.

– The IRS states that transfer pricing should be the same between intercompany transactions as it would be outside the company.

How Transfer Pricing Works

Transfer pricing is an accounting and taxation practice that allows pricing transactions internally within and between subsidiaries under common control or ownership. It extends to cross-border as well as domestic transactions.

A transfer price determines the cost charged for services rendered between divisions, subsidiaries, or holding companies. Typically, transfer prices reflect market prices for the goods or services. Intellectual property, such as research, patents, and royalties, can also be subject to transfer pricing.

Multinational corporations (MNCs) can allocate earnings among their subsidiaries and affiliates through transfer pricing. However, companies can potentially misuse this practice to alter their taxable income and reduce taxes. Transfer pricing allows companies to shift tax liabilities to low-tax jurisdictions.

Transfer Pricing and Taxes

To understand how transfer pricing affects a company’s taxes, consider the following scenario: an automobile manufacturer with two divisions, Division A and Division B. Division A manufactures software and sells it to other carmakers, including its parent company. Division B pays Division A for the software based on the market price charged to other carmakers.

If Division A decides to charge a lower price to Division B instead of the market price, Division A’s revenues decrease while Division B’s costs of goods sold (COGS) and profits increase. Therefore, the overall corporation’s finances remain unaffected.

However, if Division A is in a higher-tax country than Division B, the overall company can save on taxes. By reducing Division A’s profitability and increasing Division B’s, the company can shift tax liabilities to a lower-tax jurisdiction.

In summary, transfer pricing allows companies to transfer profits and costs internally, using prices above or below market value, to reduce their tax burden.

Transfer Pricing and the IRS

The IRS requires transfer pricing to be the same in intercompany transactions as it would be with external parties. According to the IRS, transfer pricing regulations state:

"The regulations under section 482 generally provide that prices charged by one affiliate to another, in an intercompany transaction involving the transfer of goods, services, or intangibles, yield results that are consistent with the results that would have been realized if uncontrolled taxpayers had engaged in the same transaction under the same circumstances."

Therefore, transfer pricing is closely monitored and regulated to ensure compliance. Auditors and regulators often require extensive documentation. Incorrect or inappropriate transfer pricing may require restating financial statements and may result in fees or penalties.

However, there is ongoing debate and ambiguity regarding how transfer pricing should be accounted for and which division should bear the tax burden.

Examples of Transfer Pricing

Some prominent cases remain contentious between tax authorities and companies:

Coca-Cola: The company defends its $3.3 billion transfer pricing of a royalty agreement related to the production, marketing, and sales of Coca-Cola products in various overseas markets.

Medtronic:

Commonly Used Methods of Transfer Pricing

The Comparable Uncontrolled Price Method is a frequently used transfer pricing method.

Disadvantages of Transfer Pricing

One key disadvantage is that the seller risks selling for less, resulting in lower revenue. Additionally, transfer pricing provides a tax loophole for multinational corporations.

The Purpose of Transfer Pricing

Transfer pricing is used to distribute earnings within organizations but primarily aims to reduce tax burdens for multinational companies.

The Bottom Line

Transfer pricing is a legal technique used by large businesses to distribute profits. While it ensures funds are evenly distributed, many multinational corporations exploit it to lower their tax burdens. Consequently, they often engage in legal battles with the IRS.