Fully Convertible Debenture Meaning Benefits Criticism

Cierra Murry, an expert in banking, credit cards, investing, loans, mortgages, and real estate, has over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management.

A fully convertible debenture (FCD) is a debt security that can be converted into equity shares at the issuer’s notice. The conversion ratio is determined when the debenture is issued, and upon conversion, investors are given the same status as ordinary shareholders.

Key takeaways:

– FCDs allow the entire value of the debenture to be converted into equity shares at the issuer’s notice.

– Unlike other convertible debentures, FCDs can be forced to convert into equity by the issuing company.

– FCDs provide investors with the opportunity to participate in a company’s growth while reducing short-term risk.

– However, firms may choose to force conversion when it benefits existing shareholders rather than FCD investors.

Debentures are medium to long-term debt instruments used by large companies to borrow money at a fixed interest rate. They are unsecured and backed by the issuer’s credit rather than collateral. If the company defaults or goes bankrupt, debenture holders are paid after secured creditors.

Fully convertible debenture holders may receive nothing if the issuer goes bankrupt.

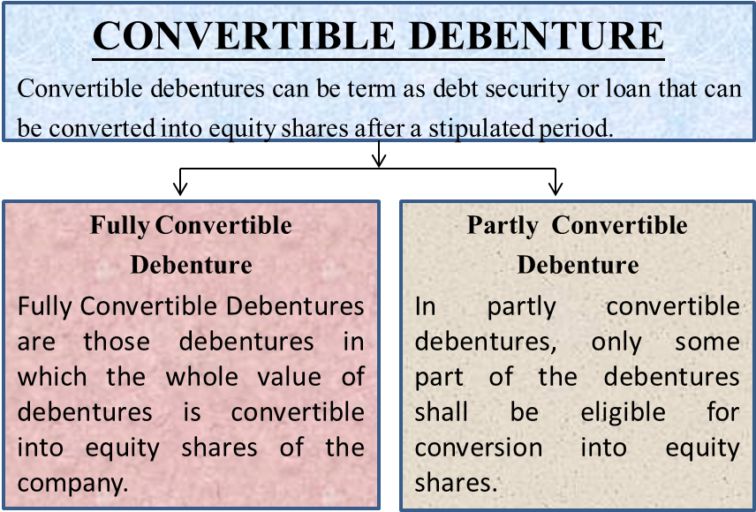

Debentures can be nonconvertible or convertible. Nonconvertible debentures have higher interest rates because they cannot be converted into equity. Convertible debentures can be converted into common shares after a predetermined time, allowing holders to benefit from share price appreciation. Convertibles are issued with lower interest rates than nonconvertible debentures.

The trust indenture specifies the conversion time, conversion ratio, and conversion price at the time of issuance. The conversion time is the period from the debenture’s allotment date, and the issuer can exercise its option to convert after that time. The conversion ratio determines the number of shares each debenture converts into. The conversion price is typically higher than the current market price of the stock.

The main difference between FCDs and other convertible debentures is that the issuing company can force conversion into equity. This eliminates credit risk for the issuing company since FCDs eventually convert to equity.

Partially convertible debentures involve converting a fraction of the security into cash and the rest into equity. Fully convertible debentures involve a complete conversion into equity. This method is used to pay off debt with equity, eliminating the need for cash repayment.

Benefits of fully convertible debentures:

– Investors can participate in a company’s growth while reducing short-term risk.

– There are lower interest rates compared to nonconvertible debentures.

– FCD owners receive interest payments before any dividends to shareholders, even if the firm is not profitable.

– FCDs can help the issuing firm during difficult financial situations by avoiding the need for principal repayment and interest payments.

Criticism of fully convertible debentures:

– The issuing company can force conversion at times that benefit existing shareholders rather than FCD investors.

– If share prices fall, FCD investors may be forced to convert at a substantial loss.

– If share prices rise significantly, the company may delay conversion to avoid dilution of equity, limiting the gains of FCD holders.