Funds Management Definition Responsibilities and Industries

Contents

Funds Management: Definition, Responsibilities, and Industries

What Is Funds Management?

Funds management oversees and handles a financial institution’s cash flow. The fund manager ensures that deposit maturity schedules align with loan demand by considering both liabilities and assets that affect the bank’s credit issuance.

Funds Management in Action

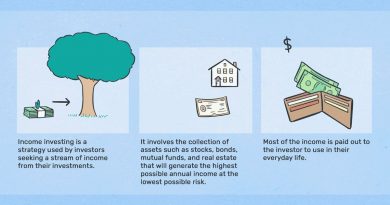

Funds management, also known as asset management, maintains the value of an entity. It applies to intangible assets (e.g., intellectual property and goodwill) and tangible assets (e.g., equipment and real estate). This systematic process operates, deploys, maintains, disposes, and upgrades assets in the most cost-efficient and profit-yielding way.

A fund manager pays attention to cost and risk to capitalize on cash flow opportunities. Ensuring proper fund liquidity is crucial. Funds management can also involve managing fund assets.

In the financial world, "fund management" refers to people and institutions that manage investments on behalf of investors, such as investment managers responsible for pension fund assets.

Divisions of Use

Fund management may be divided into four industries:

- Financial investment industry

- Infrastructure industry

- Business and enterprise industry

- The public sector

The most common use of "fund management" refers to investment or financial management, within the financial sector responsible for managing investment funds for clients. The fund manager studies client needs and financial goals, creates an investment plan, and executes the strategy.

Classifying Fund Management

Fund management can be classified by client type, management method, or investment type.

When classifying fund management by client type, fund managers are either business, corporate, or personal fund managers. Personal fund managers handle smaller investment portfolios compared to business fund managers. Funds may be controlled by one manager or a team.

Some funds are managed by hedge fund managers who earn from an upfront fee and a percentage of the fund’s performance, incentivizing them to perform well.