Transfer Price What It Is How It s Used and Examples

Contents

Transfer Price: What It Is, How It’s Used, and Examples

What Is Transfer Price?

Transfer price, also known as transfer cost, is the price at which related parties transact, such as during the trade of supplies or labor between departments. Transfer prices may be used in transactions between a company and its subsidiaries, or between divisions of the same company in different countries.

Key Takeaways

- Transfer prices that differ from market value will be advantageous for one entity, while lowering the profits of the other.

- Multinational companies can manipulate transfer prices to shift profits to low tax regions.

- Regulations enforce an arm’s length transaction rule that requires pricing to be based on similar transactions between unrelated parties.

Understanding Transfer Price

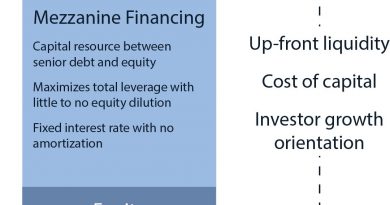

Transfer prices are used when individual entities of a larger multi-entity firm are treated and measured separately. It is common for multi-entity corporations to be consolidated on a financial reporting basis; however, they may report each entity separately for tax purposes.

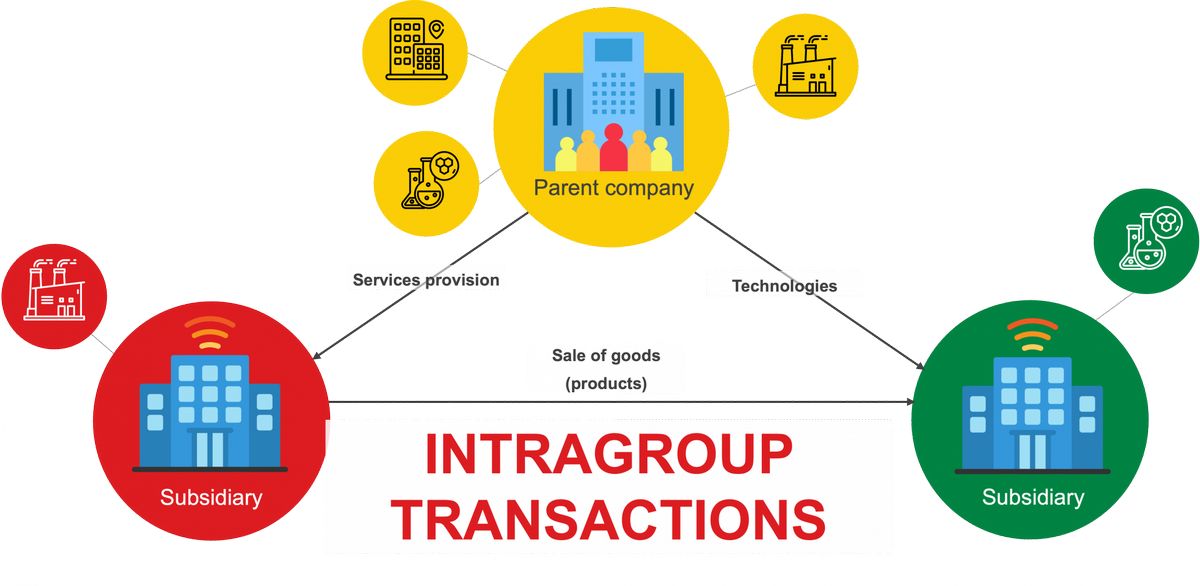

A transfer price arises for accounting purposes when related parties, such as divisions within a company or a company and its subsidiary, report their own profits. When these related parties are required to transact, a transfer price is used to determine costs. Transfer prices generally do not differ much from the market price. If the price does differ, then one of the entities is at a disadvantage and would start buying from the market to get a better price.

For example, assume entity A and entity B are two unique segments of Company ABC. Entity A builds and sells wheels, and entity B assembles and sells bicycles. Entity A may also sell wheels to entity B through an intracompany transaction. If entity A offers entity B a rate lower than market value, entity B will have a lower cost of goods sold (COGS) and higher earnings. However, doing so would also hurt entity A’s sales revenue.

If, on the other hand, entity A offers entity B a rate higher than market value, then entity A would have higher sales revenue than if it sold to an external customer. Entity B would have higher COGS and lower profits. In either situation, one entity benefits while the other is hurt by a transfer price that varies from market value.

Regulations on transfer pricing ensure the fairness and accuracy of transfer pricing among related entities. Regulations enforce an arm’s length transaction rule that states companies must establish pricing based on similar transactions done between unrelated parties. It is closely monitored within a company’s financial reporting.

Transfer pricing requires strict documentation included in the footnotes to the financial statements for review by auditors, regulators, and investors. This documentation is closely scrutinized. If inappropriately documented, it can burden the company with added taxation or restatement fees. These prices are closely checked for accuracy to ensure that profits are booked appropriately within arm’s length pricing methods and associated taxes are paid accordingly.

Transfer prices are used when divisions sell goods in intracompany transactions to divisions in other international jurisdictions. A large part of international commerce is done within companies as opposed to between unrelated companies. Intercompany transfers done internationally have tax advantages, which has led regulatory authorities to frown upon using transfer pricing for tax avoidance.

When transfer pricing occurs, companies can manipulate profits of goods and services to book higher profits in another country with a lower tax rate. In some cases, the transfer of goods and services from one country to another within an intracompany transaction can also allow a company to avoid tariffs on goods and services exchanged internationally. The international tax laws are regulated by the Organisation for Economic Cooperation and Development (OECD), and auditing firms within each international location audit the financial statements accordingly.

Transfer Price Example

To better understand the effect of transfer pricing on taxation, let’s take the example above with entity A and entity B. Assume entity A is in a high tax country, while entity B is in a low tax country. It would benefit the organization as a whole for more of Company ABC’s profits to appear in entity B’s division, where the company will pay lower taxes.

In that case, Company ABC may attempt to have entity A offer a transfer price lower than market value to entity B when selling them the wheels needed to build the bicycles. As explained above, entity B would then have a lower cost of goods sold (COGS) and higher earnings, and entity A would have reduced sales revenue and lower total earnings.

Companies will attempt to shift a major part of such economic activity to low-cost destinations to save on taxes. This practice continues to be a major point of discord between multinational companies and tax authorities like the Internal Revenue Service (IRS). The various tax authorities each have the goal to increase taxes paid in their region, while the company has the goal to reduce overall taxes.

Why Is Transfer Price Used?

Transfer prices are used when individual entities of a larger multi-entity firm are treated and measured separately. While multi-entity corporations are usually consolidated on a financial reporting basis, they may report each entity separately for tax purposes. When these entities report their own profits, a transfer price may be necessary for accounting purposes to determine the costs of the transactions.

What Are the Benefits of Transfer Pricing?

Transfer prices will usually be equal to or lower than market prices, resulting in cost savings for the entity buying the product or service. It increases transparency in intra-entity transactions and ensures the desired product is readily available to mitigate supply chain issues.

What Are the Disadvantages of Transfer Pricing?

Since transfer prices are usually equal to or lower than market prices, the entity selling the product gets less revenue. It is also a complicated process. Market prices are based on supply-demand relationships, whereas transfer prices may be subject to other organizational forces. Additionally, intra-entity animosity might arise, especially if the transfer price is appreciably higher or lower than the market price as one of the parties will feel cheated.