Mezzanine Financing What Mezzanine Debt Is and How It s Used

Contents

Mezzanine Financing: What It Is and How It’s Used

What Is Mezzanine Financing?

Mezzanine financing is a hybrid of debt and equity financing that allows the lender to convert the debt to equity in the company in case of default, after senior lenders are paid. It exists between senior debt and equity in terms of risk.

Mezzanine debt often includes warrants, which increase the value of the debt and provide flexibility when dealing with bondholders. It is commonly used in acquisitions and buyouts to prioritize new owners in case of bankruptcy.

Key Takeaways

– Mezzanine financing combines debt and equity financing for specific projects or acquisitions.

– Mezzanine lending is used in mezzanine funds, which offer financing to qualified businesses.

– Mezzanine financing provides higher returns compared to corporate debt.

– It is commonly used for established company expansion, not start-ups.

– Mezzanine financing and preferred equity may be replaced with lower interest financing if market rates drop.

How Mezzanine Financing Works

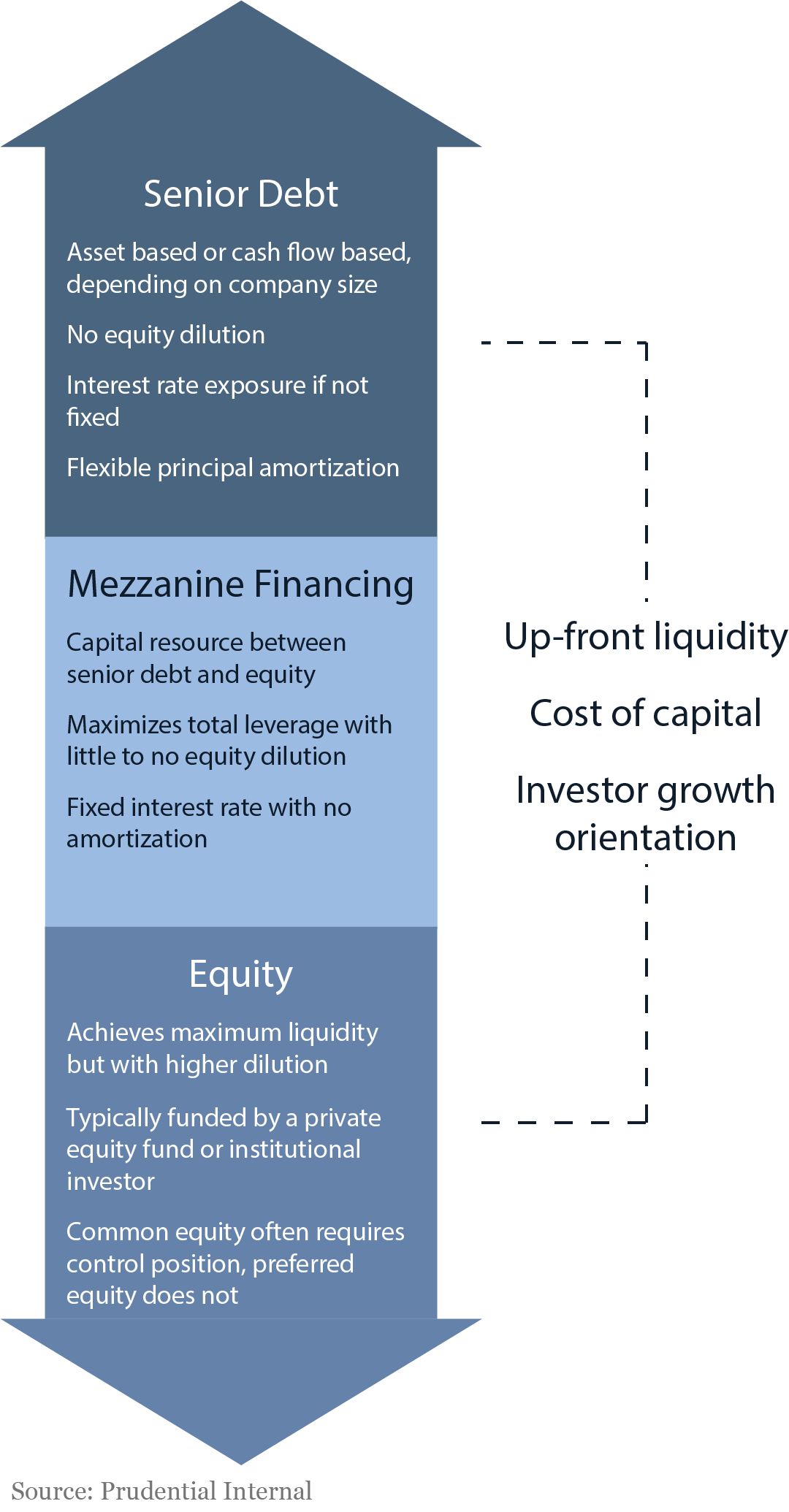

Mezzanine financing bridges the gap between debt and equity financing and offers high returns to investors. It is senior to equity but subordinate to debt. Mezzanine financing can be considered expensive debt or cheaper equity, as it carries a higher interest rate but is less dilutive to the company’s share value.

Companies use mezzanine financing for specific growth projects or acquisitions with short- to medium-term time horizons. The loans are often funded by long-term investors and existing funders, providing more liquid capital for the business without mandatory repayments.

Common characteristics of mezzanine loans include subordination to senior debt, higher yields, unsecured status, no principal amortization, and partially fixed or variable interest rates.

Mezzanine Financing Structure

Mezzanine financing falls between senior debt and common stock in a company’s capital structure. It can be subordinated debt, preferred equity, or a combination of the two. Unsecured subordinated debt is the most common structure.

Subordinated debt ranks below senior debt and is paid after senior debt holders in case of default. Preferred equity is an equity investment in a property-owning entity, subordinate to mortgage and mezzanine loans but senior to common equity. It offers priority distributions and sometimes additional profit participation.

Maturity, redemption, and transferability of mezzanine financing depend on existing debt and equity maturities. Lenders have the right to transfer the loan, while preferred equity may have restrictions on transferring ownership.

Advantages and Disadvantages of Mezzanine Financing

Mezzanine financing has advantages and disadvantages for lenders and borrowers.

Advantages

– Lenders gain equity or warrants, increasing returns.

– Borrower interest payments are tax-deductible.

– Mezzanine financing is more manageable than other debt structures.

– Companies can restructure mezzanine financing into lower interest senior loans.

– Lenders receive additional equity interest and higher returns.

Disadvantages

– Owners sacrifice control and pay more interest with longer financing.

– Loan agreements often include restrictions and financial ratios.

– Mezzanine lenders risk losing investments in case of borrower bankruptcy.

– Negotiating mezzanine loan debt and equity can be tedious and time-consuming.

Example of Mezzanine Financing

In a mezzanine financing example, Bank XYZ provides Company ABC with $15 million in a mezzanine loan financing. The funding replaces a higher interest credit line, giving Company ABC more working capital. Bank XYZ collects 10% interest and can convert the debt to equity in case of default.

Frequently Asked Questions

What Is a Mezzanine Type Loan?

A mezzanine loan is a capital source between senior debt and equity, with features of both. It is more expensive but allows businesses to grow and carry more senior debt.

What Is Mezzanine Financing in Real Estate?

Real estate mezzanine loans are used for acquisitions or projects and are subordinate to senior debt but receive priority over equity. They may be secured or unsecured.

How Do Mezzanine Funds Make Money?

Mezzanine funds make money through interest received on pooled investments and profits from buying and selling mezzanine financing instruments.

Who Provides Mezzanine Financing?

Mezzanine debt is provided by lenders specializing in such loans, offering a positive track record and customized structures.

Are Mezzanine Loans Secured?

Mezzanine loans can be secured or unsecured, with real estate mezzanine loans indirectly secured by real estate interests. However, collateral value may be limited due to lower repayment priority.