Risk Parity Definition Strategies Example

Risk parity is a portfolio allocation strategy that determines allocations across various components of an investment portfolio based on risk. This strategy modifies the modern portfolio theory (MPT) approach by using leverage. The goal is to optimize diversification for different objectives and investor preferences.

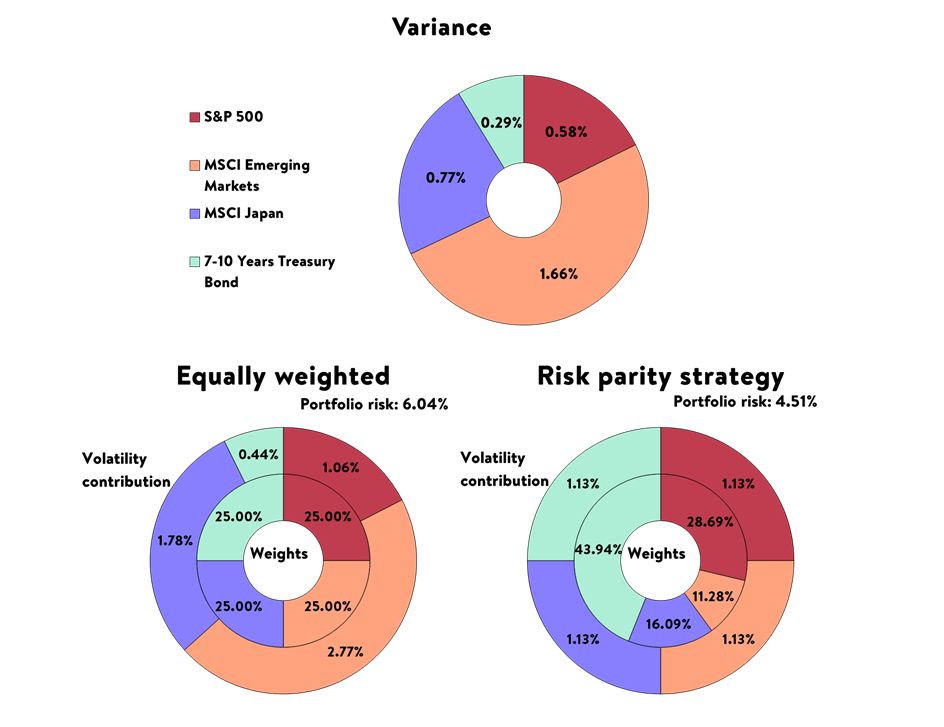

The risk parity approach to portfolio construction optimally diversifies investments by allocating capital on a risk-weighted basis. It builds off of MPT and allows for the use of leverage and short selling. This approach involves quantitative calculations, making it more advanced than simplified allocation strategies.

Risk parity is an advanced portfolio technique used by hedge funds and sophisticated investors. It aims to earn the optimal level of return at the targeted risk level. Simplified allocation strategies, such as the 60%/40% stocks-bonds portfolio, make use of MPT. These strategies allocate more heavily towards equities for investors seeking higher risk and towards bonds for risk-averse investors.

Risk parity strategies allow for leverage, alternative diversification, and short selling. Portfolio managers have the flexibility to choose any mix of assets. However, instead of generating allocations to different asset classes to reach an optimal risk target, risk parity strategies use the optimal risk target level as their basis for investing. This is typically achieved by using leverage to weight risk equally across different asset classes.

With a risk parity strategy, investment portfolios often include stocks and bonds. However, the proportions of different asset classes are determined by targeted risk and return levels, rather than predetermined proportions. The goal is to achieve optimized portfolio diversification.

The risk parity approach also involves the use of the security market line (SML), which represents the relationship between risk and return of an asset. The slope of the line is determined by the market beta. The assumption of a constant slope may not be realistic, especially for traditional allocations like 60/40. Risk parity addresses this issue by using leverage to equalize volatility and risk across different assets in the portfolio.

Real-world examples of risk parity include the AQR Risk Parity Fund and Horizon’s Global Risk Parity ETF. These funds invest globally across various asset classes and employ risk parity strategies to achieve optimal returns through balanced risk participation.