Mississippi Company What It is History

Contents

Mississippi Company: What It is, History

What Is the Mississippi Company?

The Mississippi Company is a company that experienced rapid growth and decline in 18th-century France. It is commonly used as a cautionary tale when discussing speculative bubbles.

Key Takeaways

- In the 18th century, the Mississippi Company successfully developed U.S. French territories in the Mississippi River valley.

- The Mississippi Company is a cautionary tale of what can happen to an entire economy when a speculative bubble bursts.

- The company’s impact on the French economy following its demise is a prime example of how speculation in the market may cause rapid growth followed by severe decline.

- A speculative bubble occurs when there is an expected growth or value increase across a specific group. That speculation of growth intensifies both demands of the commodity and increased activity in that sector, resulting in applying an over-inflated value to an asset.

Understanding the Mississippi Company

The Mississippi Company is often used as an anecdote when discussing speculative bubbles and the impact their bursting can have on an economy. The company is an example of how speculation can cause rapid growth and decline across an economy.

History of the Mississippi Company

France had been struggling with unstable currency and a volatile treasury status when a Scottish adventurer named John Law introduced a plan to settle the nation’s debts. Law had acquired the Mississippi Company, a company developing a strong foothold in the United States. Law proposed to the Duke d’Orleans that selling off shares of the company could help pay off some of France’s debts.

The Mississippi Company had been developing the U.S. French territories in the Mississippi River valley and had monopolized the French tobacco and African slave trades in the region.

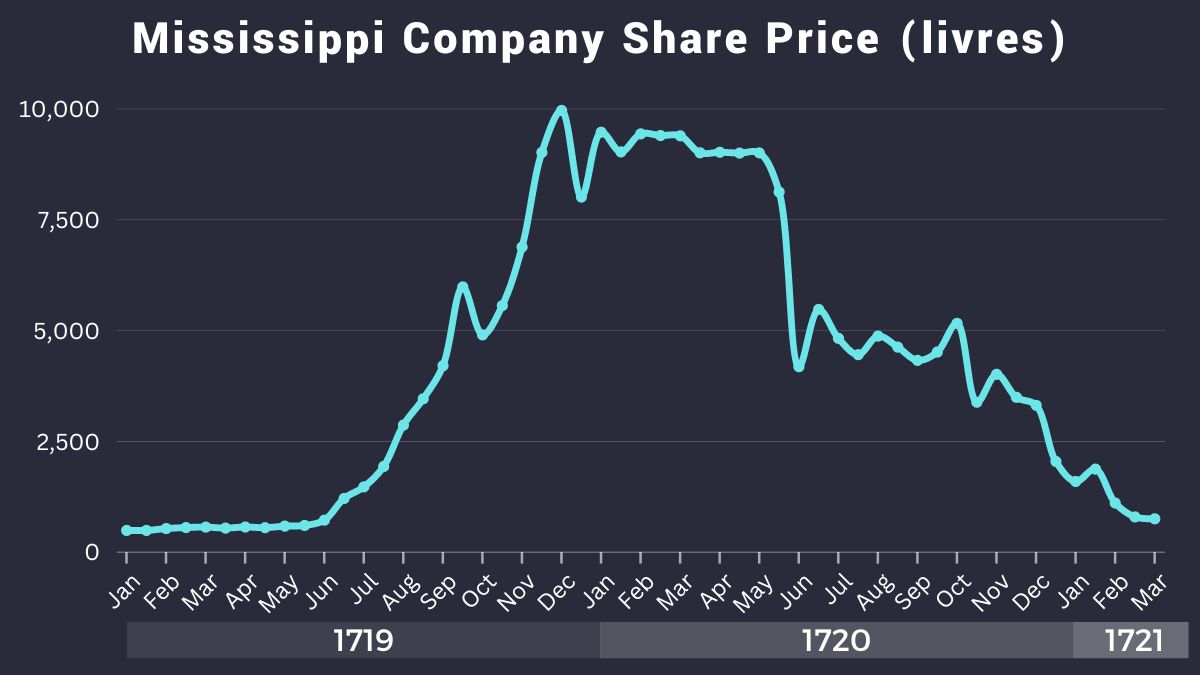

Just two years after Law acquired it, the company held a monopoly on French colonial trading, thanks to support from France. Speculation of continued growth spread, and public interest in purchasing shares increased.

Law theorized that he could sell the shares at a high price and use the profit to pay off most of France’s national debt. He intended to sell these shares in exchange for billets d’etat, the nation’s public securities, which had also experienced a rapid rise in value. These activities led to economic growth throughout Europe. France responded by increasing the production of its paper money.

Inevitably, inflation caught up with France, and both the currency and the billets d’etat began to decline in value. This economic boom resulted in a global stock market crash. While Law was not solely responsible for this sudden economic downturn, he was primarily blamed for the rapid rise and fall of the market. In 1720, Law left behind both France and the once profitable Mississippi Company. France absorbed the company and its large debts and was left with no choice but to raise taxes to compensate for its losses.

Special Considerations

A speculative bubble occurs when there is an expected growth or value increase across a specific group, referring to an industry, commodity, or asset. Speculation of growth intensifies both demand and activity in that sector, resulting in an over-inflated value that exceeds the asset’s intrinsic value.

These bubbles, or periods of rapid growth, either end in deflation or bursting. Deflation occurs when prices and demand adjust back down to the fair-market value. Bursting happens when rapid growth is followed immediately by a period of rapid decline, and many investors attempt to unload their investments quickly with little regard to their current worth.