Longitudinal Data Definition and Uses in Finance and Economics

Contents

Longitudinal Data: Definition and Uses in Finance and Economics

What Is Longitudinal Data?

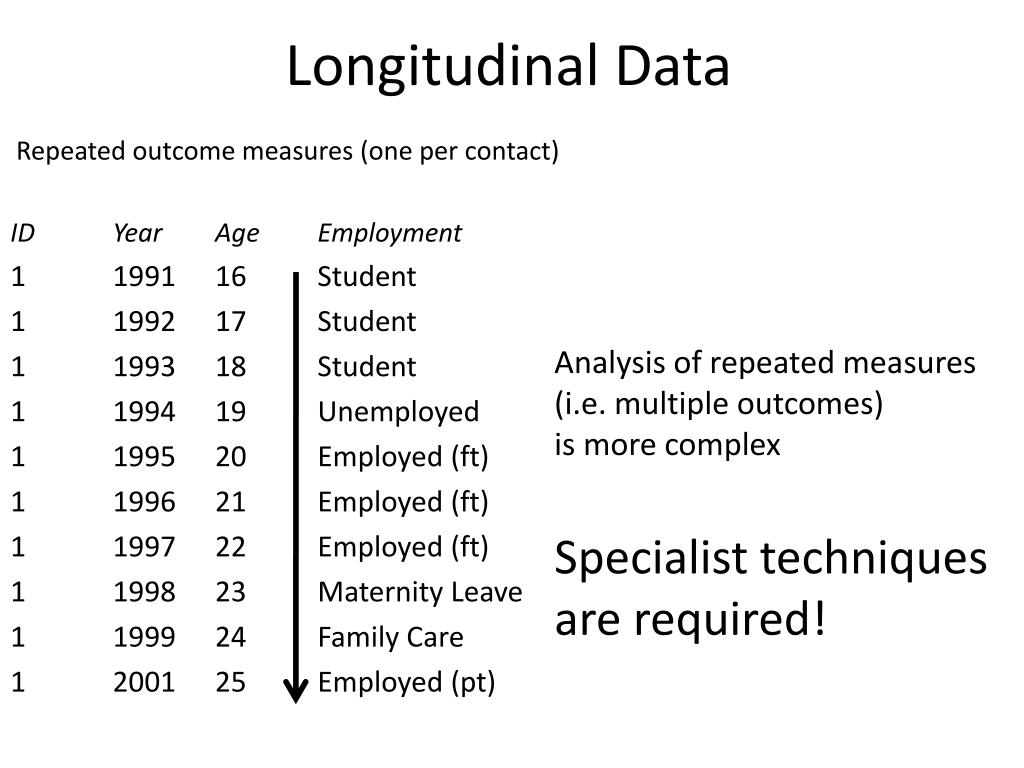

Longitudinal data, sometimes called panel data, is data collected through repeated observations of the same subjects over an extended time frame, measuring change. It follows the same sample over time, in contrast to cross-sectional data, which samples different subjects at each point in time.

Longitudinal data is commonly used in the social sciences, including economics, political science, and sociology.

Key Takeaways

- Longitudinal data is collected sequentially from the same respondents over time.

- It is valuable for tracking trends and changes by surveying the same respondents in multiple waves.

- Finance uses longitudinal data to monitor company performance, risk, and the impact of economic shocks.

Understanding Longitudinal Data

Analysts often focus on how things change over time. With cross-sectional data, measuring a variable today and a year from now would involve sampling different individuals each time. To better understand how things change for the same people over time, tracking and follow-up with the same individuals is necessary. This is where longitudinal data comes in.

Longitudinal data is frequently used in economic and financial studies due to its advantages over repeated cross-sectional data. For example, it can help identify factors influencing unemployment by determining if the same individuals remain unemployed during a recession or if different individuals experience job fluctuations.

Applications of Longitudinal Data

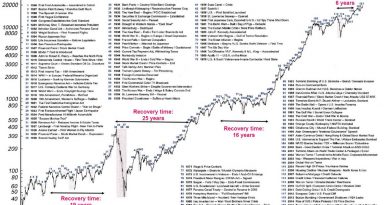

Longitudinal analysis aids in calculating a portfolio’s value at risk (VaR) through the historic simulation method. This simulates the portfolio’s value fluctuations over past periods based on the observed historical fluctuations of its assets. It provides an estimate of the maximum probable loss in the next period.

Furthermore, longitudinal data is utilized in event studies to analyze factors impacting abnormal stock returns over time, as well as how stock prices react to merger and earnings announcements. It is also valuable for measuring poverty and income inequality by tracking individual households. Additionally, standardized test scores in schools, which are longitudinal, can assess teacher effectiveness and other factors influencing student performance.

Social scientists also employ longitudinal data to understand the causal relationship between past events and observed outcomes in later waves of the data. For example, the impact of a new law on crime statistics or the long-term effects of a natural disaster on births and deaths.